世界一のアートディーラー、New York City ラリー・ガゴシアンを巡って World's No.1 Art Dealer, Larry Gagosian from New York City

This is an extension of my past articles, which I, as a Japanese artist, published here on ART+CULTURE, see the links. It can be art-re-contextualized also as a body of work, still in progress. This text on this page has to be understood as part of my artistic practice, in this context called “appropriation art”. No commercial interests are involved. Creative Commons Attribution Noncommercial-NoDerivative Works. Photographs have to be understood under the terms of courtesy creative common sense.

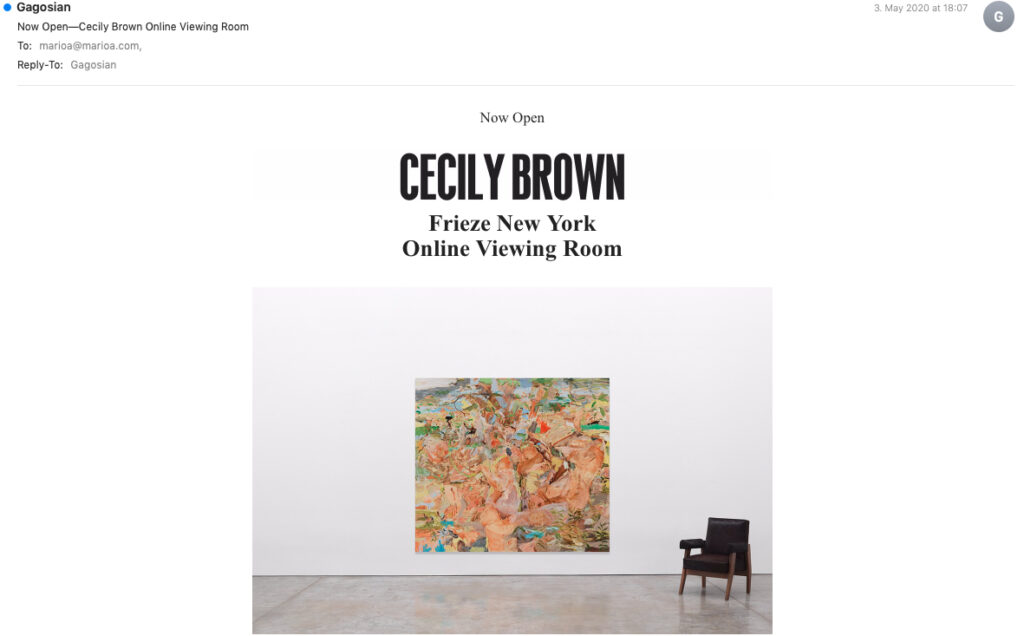

一週間前、ラリー・ガゴシアンに関する長いレポートが掲載されました。その文章はウェブサイト上で無料公開されたので、アート界全体が知っています。

本音としてやりたくない、ガゴシアン氏について改めて書く気にはならないが、日本のART+CULTURE読者には、世界のアートシーンの最新情報を得るために、全文を知る権利があると思っています。仕方がありません。

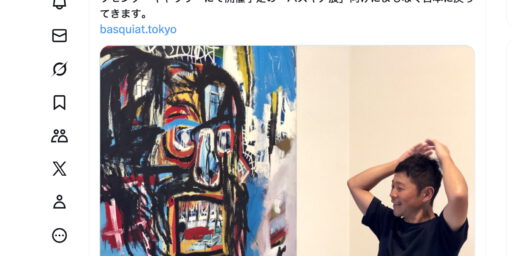

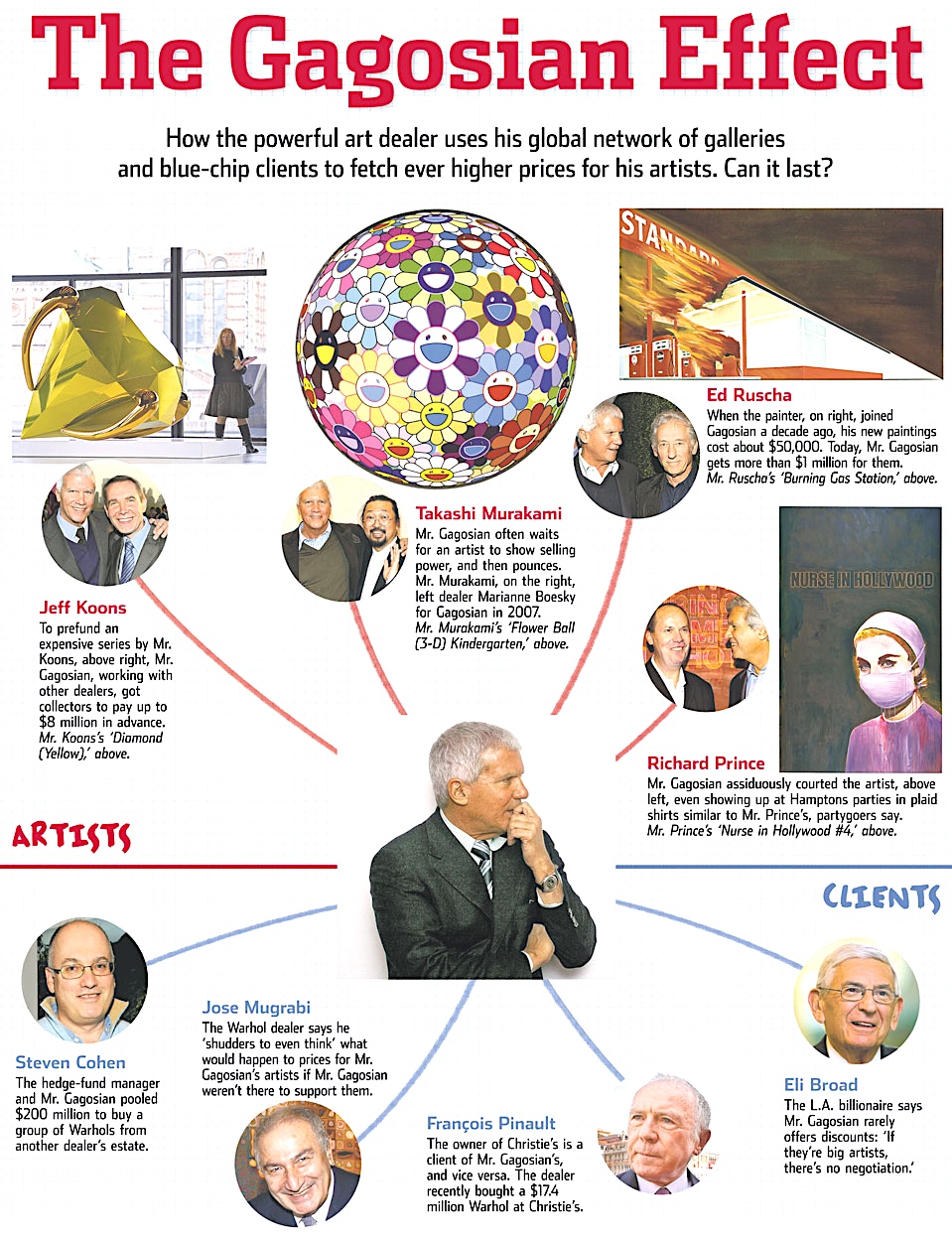

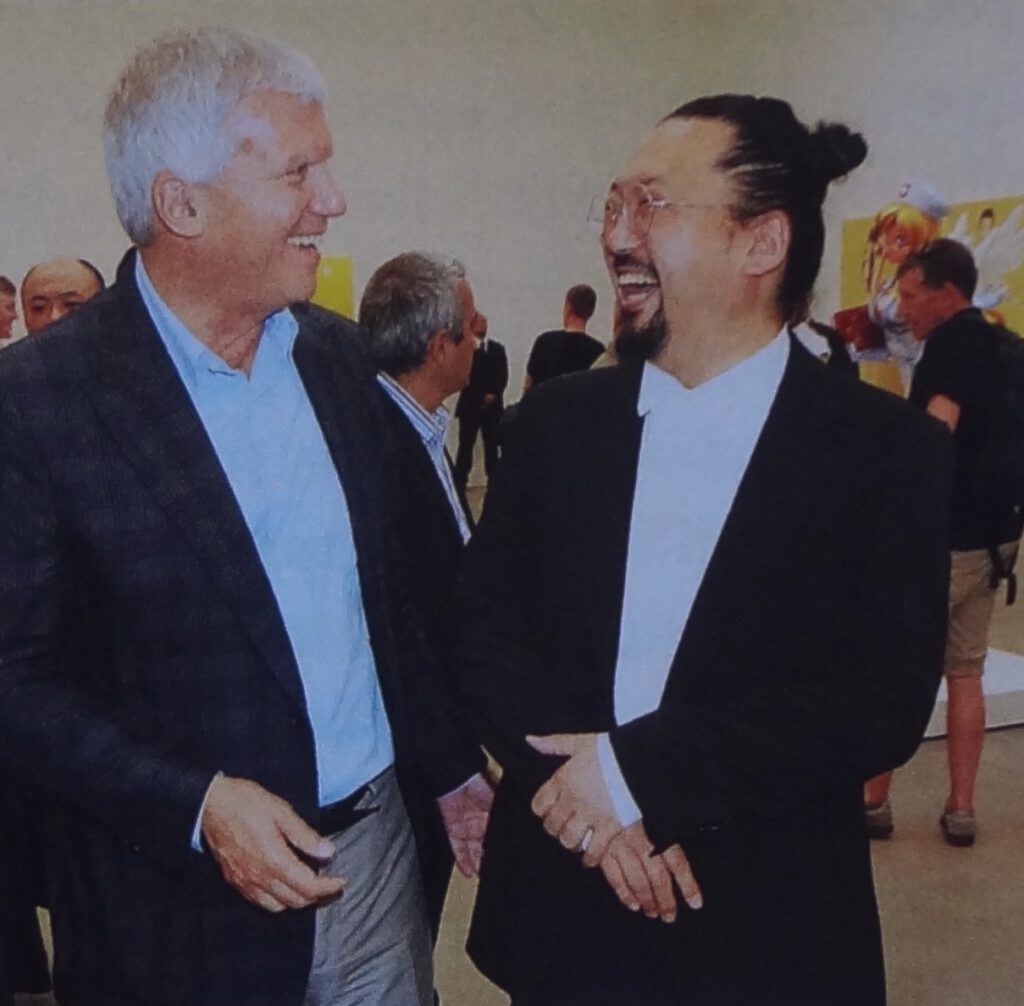

ラリー・ガゴシアンについては、ここの読者のためにいろいろなコンステレーションでたびたび紹介してきました。私も個人的に彼を知っているが、あくまで表面的なものです。ガゴシアン・ギャラリーが扱っている日本人アーティストで最もよく知られているのは、村上隆。

読者が簡単に概要を理解できるように、新しいテキスト(アプロプリエーション・アートとして)の前に、他のART+CULTUREのテキストをここにまとめて掲載させていただきます。

簡単に画商の仕事の説明で、作品を安く仕入れて高く転売することであり、ディーラーとクライアントの間で取引が行われ、お金と品物のごく単純な交換です。

ガゴシアン氏がニューヨークという都市を選んだ理由と言えるのは、ここが世界の証券取引所の中心地、証券取引界のエリートが集まっています。当然、米ドルは世界で最も重要な取引通貨です。

商売根性はすごくて、24時間365日、アート・ディーリング仕事のために生きています。

親しい友人はもういないようで、常に恋人を変えています。

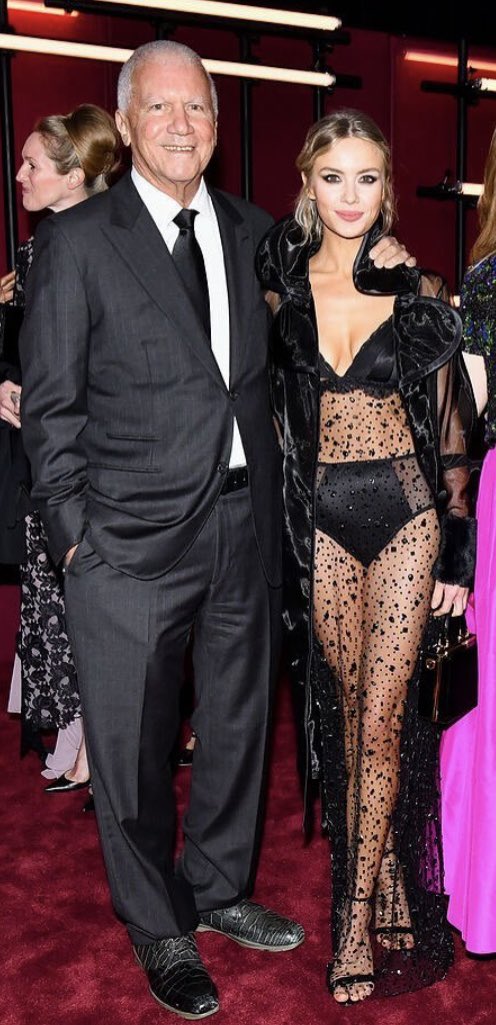

アーティ・パワープレイ:画家アンナ・ウェイアント (27) とラリー・ガゴシアン (77) の「交際中」

Arty Power-Play: Painter Anna Weyant (27) “is dating” Larry Gagosian (77)

https://art-culture.world/articles/larry-gagosian-anna-weyant/

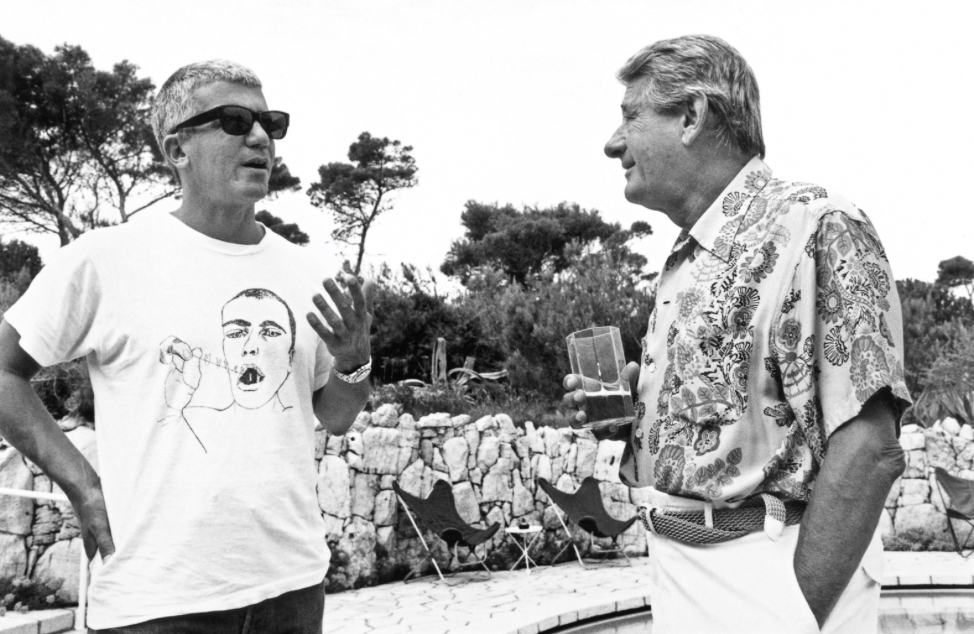

夏休み中でさえ、アートコレクターと会える場所を選んで取引をしています。

マンハッタンの高級マンションでは、ニューヨークのエリート達の為にパーティーを開き、壁に掛けられている作品も販売しています。

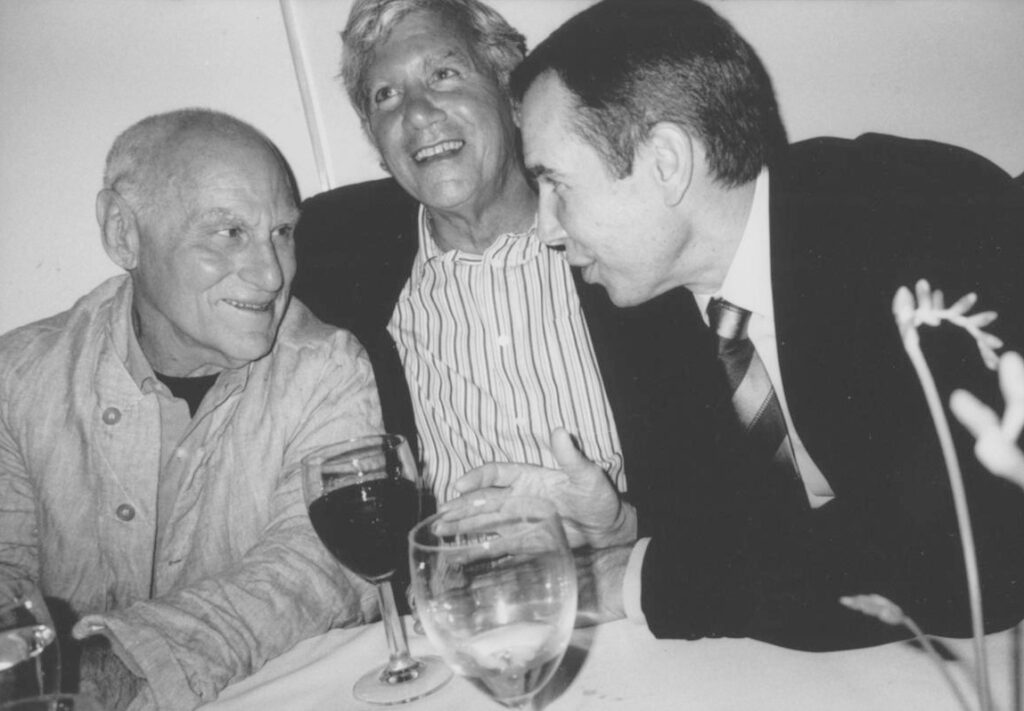

Obvious bribery favouritism and cozy relationship through paintings. A New York Museum Director attending the private party by art dealer Larry Gagosian in Manhattan. Left, sitting: Thomas P. Campbell, Director and CEO of The Metropolitan Museum of Art in New York. (2016, when above photograph had been taken)

信頼できるコレクター又はアートディーラー (Mugrabi, Segalot, Deitch)とともに、彼のアーティスト達をオークションで押し上げたり、買い戻したりします。戦略的に、art market の market makerであると言えるでしょう。これにより、オークションハウスとアートディーラーの間に「癒着関係」が生まれ、元クリスティーズ共同会長のロイック・グゼール Loïc Gouzerの最新コメントを参考へ。

アート・バーゼルのガゴシアン・ブースではクリスティーズが作品を販売しています。 Willem de Kooning’s Untitled III (around 1978) のケースを参考へ。

さらに、ガゴシアンは、雑誌や新聞に事前にレビューを発表する「有料ライター」を多数抱えています。

ガゴシアンがアート業界で最高のパブリシストを雇うのは、ある意味当然のことなのでは?

It’s kind of a no brainer that Gagosian pays for the best publicists in the art business?

“Bribed” journalism at Wall Street Journal: Gagosian pushing up Grotjahn for U.S. Art Flippers, 6 days before the exhibition

https://art-culture.world/articles/gagosian-grotjahn-for-u-s-art-flippers/

そして、Gagosian Art Advisoryを通じて、複雑な事情を持つ国際アート・マーケットや収集方法について助言する会社である。

以下の文章がこれからアップデートされ、deepl.comなどで、お読みになってくださいませ。

GAGOSIAN

https://gagosian.com

Locations: (as of 2023/7/29)

1. 980 Madison Avenue, New York

2. 976 Madison Avenue, New York

3. Park & 75, New York

4. 555 West 24th Street, New York

5. 541 West 24th Street, New York

6. West 21st Street, New York

7. Beverly Hills

8. Gagosian at Marciano Art Foundation, Los Angeles

9. Grosvenor Hill, London

10. Davies Street, London

11. rue de Ponthieu, Paris

12. rue de Castiglione, Paris

13. Le Bourget

14. Geneva

15. Basel

16. Gstaad

17. Rome

18. Athens

19. Hong Kong

20. Gagosian Shop, New York

21. Gagosian Shop, London

Gagosian Art Advisory

Specializing in curatorial advice, appraisals, collection management, industry intelligence, and market analysis, Gagosian Art Advisory offers professional guidance to collectors in all aspects of acquiring fine art, as well as building and refining collections.

Drawing on our specialist expertise and extensive networks of artists, collectors, scholars, and institutions worldwide, our firm advises across the complexities of the international art market. We offer an innovative, client-focused approach in order to provide thoughtful and independent recommendations with the utmost discretion.

https://gagosianartadvisory.com

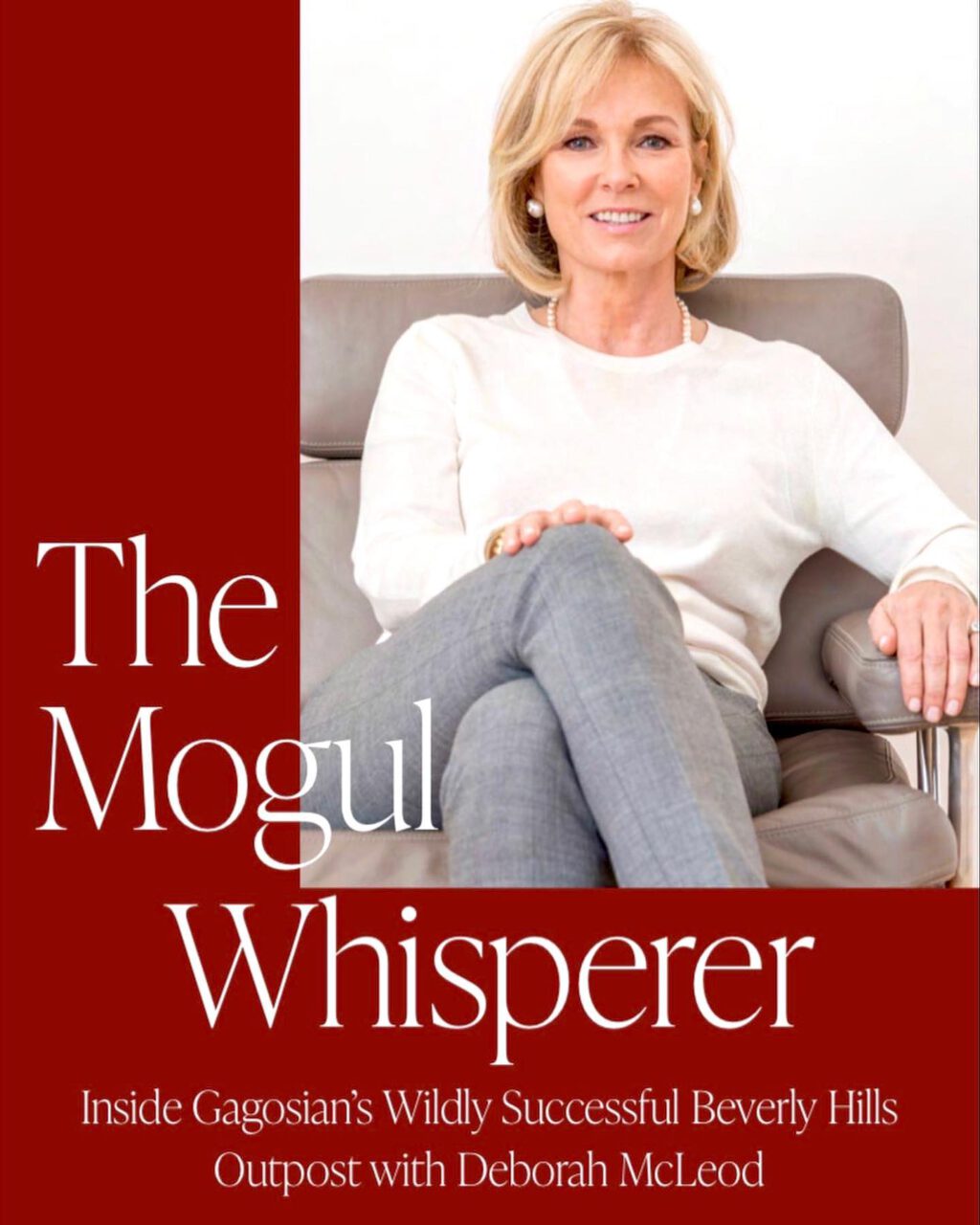

The Women of Larry Gagosian Get the Vogue Treatment

2011/09/23

The October issue of Vogue has a big piece about the “Gagosiennes,” dealer Larry Gagosian’s “fleet of high-powered women directors.” The article has not been posted online, but it is available on newsstands now.

To begin with, there is a two page photo of these women standing in Gagosian’s mammoth 24th Street branch beneath a large Calder mobile (this is somewhat misleading. Gagosian has done shows of Calder’s work, but he is not represented by the gallery; Calder is a part of the stable of Gagosian’s major competitor, The Pace Gallery). They are all wearing gowns by the likes of Oscar de la Renta, Yves Saint Laurent and Valentino. Some of them are smiling.

So, you ask, what is a Gagosienne? According to the article:

“To be a Gagosienne, you have to be ambitious, intelligent, well connected, socially adept, highly discreet, reachable at all times, stress-resistant, and mad about art. It also helps to speak several languages and to dress well…and it doesn’t hurt to be beautiful and come from an aristocratic family.”

Some other things we learned here: Mr. Gagosian claims to have been totally unaware of the fact that his female employees outnumber the men almost two to one.

“‘I’m not even aware of it,’ he says. ‘I guess you’re right. But there have always been a lot of talented women in the art world, women who run galleries and museums. Look at Peggy Guggenheim, Ileana Sonnabend, Paula Cooper. It’s never been a boys’ club, like most corporations.’”

We’ll gloss over Mr. Gagosian referring to the art world as a “corporation” in favor of directing you to Ms. Cooper’s words to The Observer on the subject of the scene’s social geography as a boys’ club.

Andrea Crane, who specializes in Impressionist and modern art at Gagosian, had this to say about her boss:

“Larry is totally gender unspecific.”

Mr. Gagosian had this to say about the female gender:

“The problem with women is they keep getting pregnant.”

(Admittedly, this quote is attributed as being spoken in a “half-joking” tone. It doesn’t help, however, that he follows up the statement by saying, “There are all these maternity leaves, one after the other, and it does create a certain amount of tension.”)

The article stresses that Mr. Gagosian rewards his employees lavishly for their hardwork, but it also points out some of the absurdities of life on the job. Speaking of Valentina Castellani, who according to the article is “closer to Larry than anyone else on staff,” the reporter recounts:

“She had turned off her BlackBerry for the interview. When we finished and she turned it back on, Larry had called seven times. And when she got back to the office, she learned that he had called her husband to find out where she was.”

The conclusion here is: “It sounds a little like the CIA—or a posse of intellectual Bond Girls.”

If that’s true, is Mr. Gagosian James Bond or Ernst Blofeld?

This is an extension of my past articles, which I, as a Japanese artist, published here on ART+CULTURE, see the links. It can be art-re-contextualized also as a body of work, still in progress. This text on this page has to be understood as part of my artistic practice, in this context called “appropriation art”. No commercial interests are involved. Creative Commons Attribution Noncommercial-NoDerivative Works. Photographs have to be understood under the terms of courtesy creative common sense.

2019/4/12

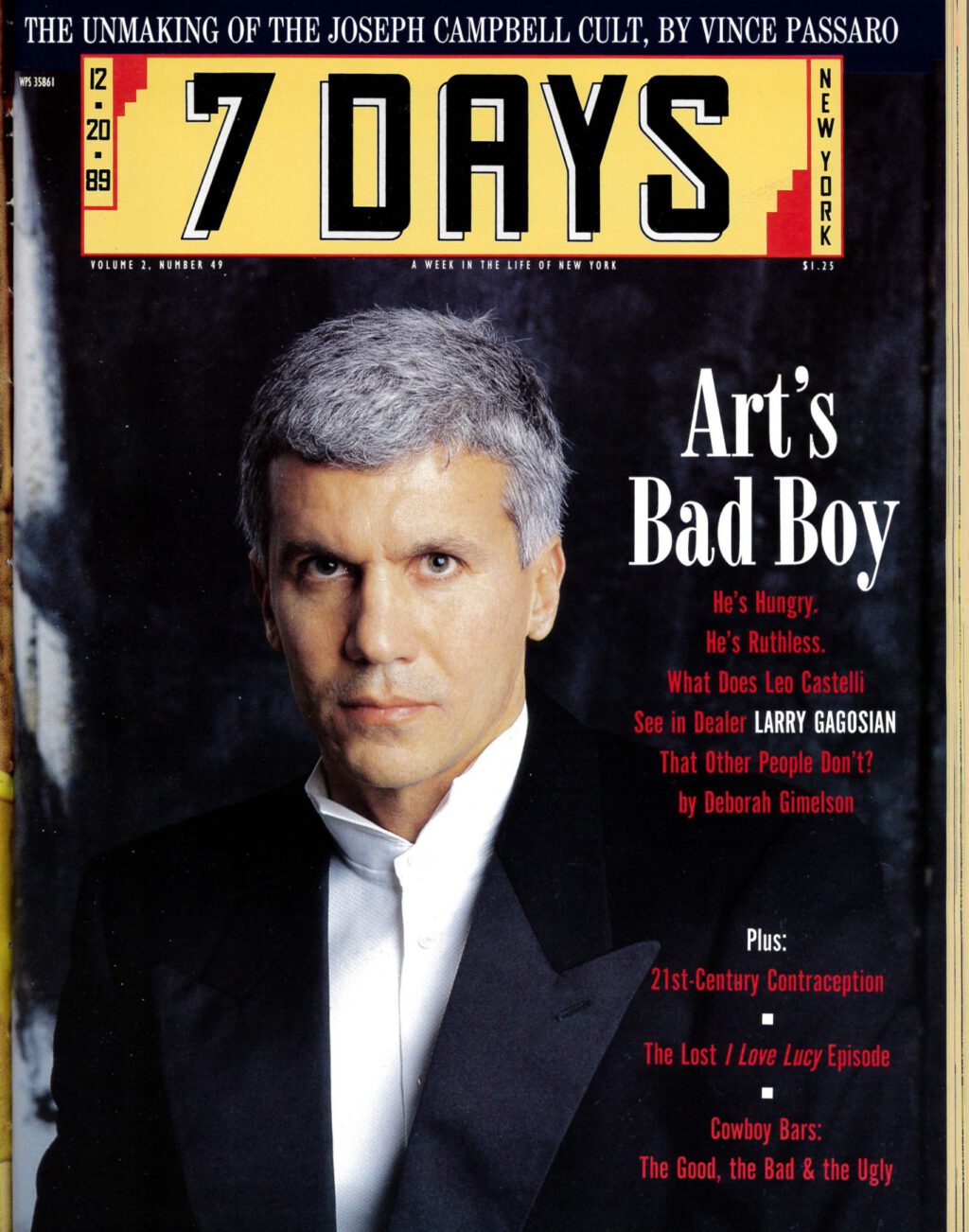

7 Days: Larry Gagosian, Art’s Bad Boy

He came to New York and got Charles Saatchi to sell some paintings. He wooed Leo Castelli and is getting awfully friendly with his artists. He has a “past,” a future, and a slick wardrobe. He’s Larry Gagosian, the man the art world loves to hate.

quote:

What does he actually do? Gagosian’s a human perpetual-motion machine. When it comes to a painting he knows he wants to sell, he demonstrates almost unyielding tenacity with both the original owner and the prospective quyer. He makes hundreds of calls a day — from his office, his home, his car. To catch up with Gagosian on his car phone when the line begins to fade is to find Gagosian talking relentlessly through the static. (“The phone is Larry’s weapon of choice,” a fellow dealer suggests.) No wonder they call him Go-Go.

Day in and day out, he hangs on the wire, offering vast amounts to collectors like Newhouse, MoMA board member Agnes Gund, and Wall Street wizard Robert Mnuchin for their pictures. Not taking no for an answer is almost a game for him.

quote:

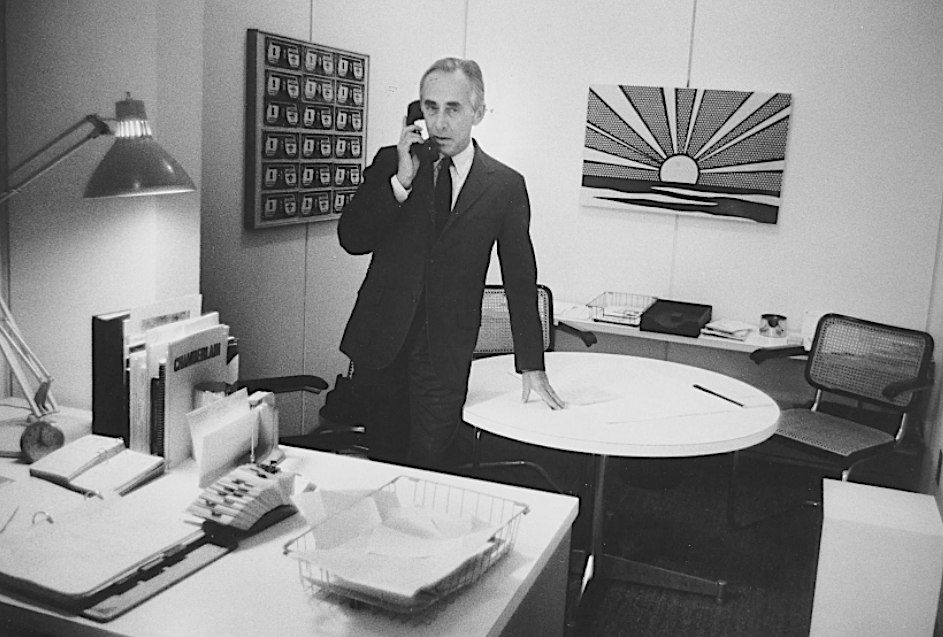

In 1985, almost out of thin air, he managed to pry some important paintings from a number of hotly desired collections, the most notable of which was that of Burton and Emily Tremaine. The Tremaines had assembled a major group of contemporary and modern works, including Jasper Johns’ iconographic White Flag. Other dealers had been dancing around the Tremaines. Gagosian was more direct.

“I looked up their phone number from Connecticut information,” he says. “I offered them a lot of money for a Brice Marden painting. Mrs. Tremaine liked me on the phone; she thought I was funny. Or maybe she liked the money I offered for the painting.”

quote:

Castelli is still sharp — although many art aficionados think that the only sign of Leo slipping is his recent and growing association with Larry Gagosian. Castelli is well-known for helping younger dealers get started (like Deborah Sharpe and Pat Hearn), but his relationship with Gagosian includes a business partnership, which was unprecedented for Castelli.

“After Ileana [Sonnabend, Castelli’s ex-wife and a dealer herself], Larry is the closest person to me in the art world,” Castelli says. That’s the kind of statement that sends a chill into the hearts of those who find Gagosian’s methods crude and fear he may be angling to take over the Castelli stable if and when Castelli decides to retire.

Gagosian and Castelli couldn’t be less alike. Castelli is elegant, discriminating, a true connoisseur in the mold of turn-of-the-century figures like Joseph Duveen and Daniel Henry Kahnweiler. Larry Gagosian, on the other hand, is flamboyant, restless – perhaps the way all dealers will have to be in the ’90s, if the market stays as heady as it is now.

“A dealer isn’t just someone who sells pictures,” says a prominent New York dealer. “The only thing Go-Go proves is that everyone has a price. He has made no contributions of his own, but has coasted on the work of other dealers.”

Castelli disputes this characterization. “Of two great paintings, Larry can determine what makes one greater,” he says.

Gagosian started visiting the Castelli Gallery several years ago, while still in business in California. (His West Broadway loft happened to be across the street from the Castelli Gallery.) Instantly, he began insinuating himself with the master.

“Sometimes we would lose Larry in the gallery and find him browsing in the racks,” recalls Susan Brundage, Castelli’s gallery director, who has worked for the dealer for 16 years. “One of the best things about Gagosian is that he does have a sense of humor. We’d have to say, ‘C’mon Larry, enough,’ before he’d stop going through our inventory.”

It was the Tremaine connection that had made Castelli first sit up and take notice of Gagosian. According to gallery sources, the Tremaines didn’t go to Castelli with their material — much of which was by “his” artists — because they simply weren’t fond of him, something that hurt Castelli deeply.

Gagosian and Castelli act as if they’ve always been in each other’s lives, like family. According to dealer Perry Rubenstein, who lives and works at Gagosian’s first New York premises, Gagosian always woos the person who can give him what he wants.

“With Larry, it’s always a matter of what can you do for me right now,” he continues. “Gagosian’s capable of sitting at someone’s table for dinner, getting information he needs, and leaving without even saying good-bye.”

Susan Brundage and her sister Patty, who also works at the gallery, describe the relationship between their boss and Gagosian as something like a romance. When the younger dealer was trying to ingratiate himself, he tendered endless attention and flattery. There were presents for Castelli, including a $7,500 Patek Philippe watch; long lunches at Castelli”s favorite restaurant, Da Silvano; longer dinners at Odeon and 150 Wooster; innumerable phone calls.

Leo, who likes to be courted (and truly is one of the few art people deserving of such treatment), was won over.

“You would have thought Leo was talking about a girlfriend,” Patty Brundage says of the early courtship days. “He talked about how Larry looked, the things he did, but didn’t say a word about his business acumen.”

Indeed, Castelli has been known to wax rhapsodic about Larry, talking about his “distinctive, close-cropped looks” and how “no one else does things in such a grand style.”

“Suddenly Leo was calling Elaine de Kooning, to try and get Larry the estate,” says Susan Brundage.

Contemporary master Willem de Kooning is still living but has Alzheimer’s disease. When he dies he will leave an estate rich in his work. (Elaine, an artist herself and now deceased, was the artist’s wife.) You may wonder why Castelli wouldn’t chase the de Kooning cache for himself, but he is still devoted to artwork fresh from his artists’ studios; he’s never been an aficionado of the secondary market. Furthermore, he seems to have a great time watching his young associate make deals. (Gagosian, incidentally, hasn’t yet won the de Kooning estate.)

“Not only is Larry the best dealer in the secondary market, but if he weren’t a dealer he would be a brilliant curator,” Castelli says. “The stories you hear about him seem unjustified gossip. People don’t dare offer the prices he offers when he wants to acquire something, and then they complain that he gets all the material.”

Gagosian came along at just the right time, Castelli says: “Art and money, to the degree that they are related, have turned the art world upside down. No one knows how to adequately deal with it. My great love was to detect not painters but movements; Larry’s is the secondary market. I wanted to be involved in the great flowering of the secondary market, and he gave me a way to do it.”

Asked if he thinks Gagosian can resist the allure of the primary market, Castelli grows philosophical. “He will go into it,” he says, “but he’s biding his time. He would not be satisfied with lesser artists, and good ones are difficult to find.”

Sometimes, however, even these two get their signals mixed. In a flurry of phone calls in the early fall, it seems they each sold the same Lichtenstein bronze — to an unidentified collector and to comedian Steve Martin, who had first dibs on it.

Those who first think that Castelli completely lost his marbles over Gagosian should take a second look. Castelli has the opportunity to make money with Larry with relatively little exertion on his part. Their gallery at 65 Thompson St. has almost no overhead, and Gagosian pulls together the shows. True, the gallery has been primarily showing Castelli artists — much, some say, to Gagosian’s chagrin, because the arrangement limits his field — but then the Castelli name, is as good as gold.

”Leo has a history of dealing with people who are universally disliked,” Susan Brundage says. “He gets a kick out of them. Before Larry, it was Doug Chrismas [a rough-and-ready L.A. dealer] and Daniel Templon [a Paris dealer].

“As for Larry, he keeps the other vultures off. Everyone thought that Toiny [Leo’s late wife] would someday be in control. When she died, you wouldn’t believe the people who descended on Leo. Leo admires Larry for being a wheelerdealer, but I don’t think Leo’s so gullible that Larry can send him down the river. You have to remember there is a lot of envy in people’s talk about all this.”

quote:

He frequently repeats one of his classics: “When women meet me, they either want to fuck me or throw up on me.”

https://www.villagevoice.com/2019/04/12/7-days-larry-gagosian-arts-bad-boy/

Larry Gagosian

by Peter M. Brant @ Interview, November 2012

quote:

BRANT: Who would you say was your first big client?

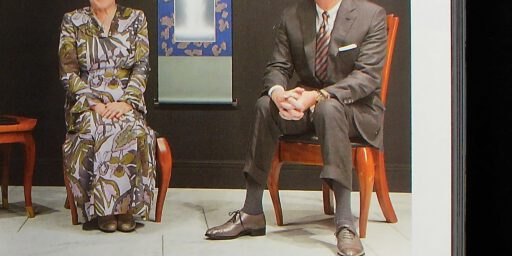

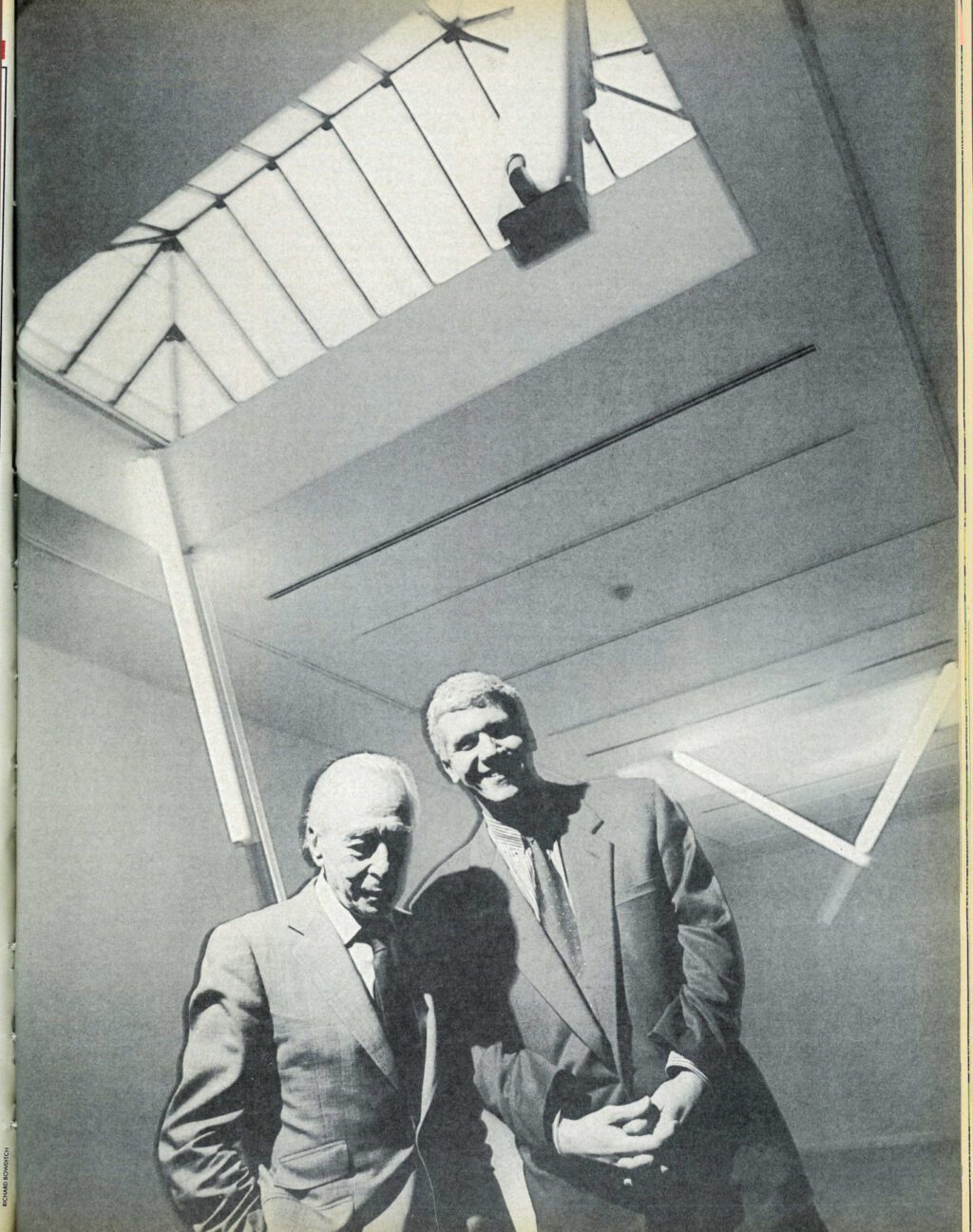

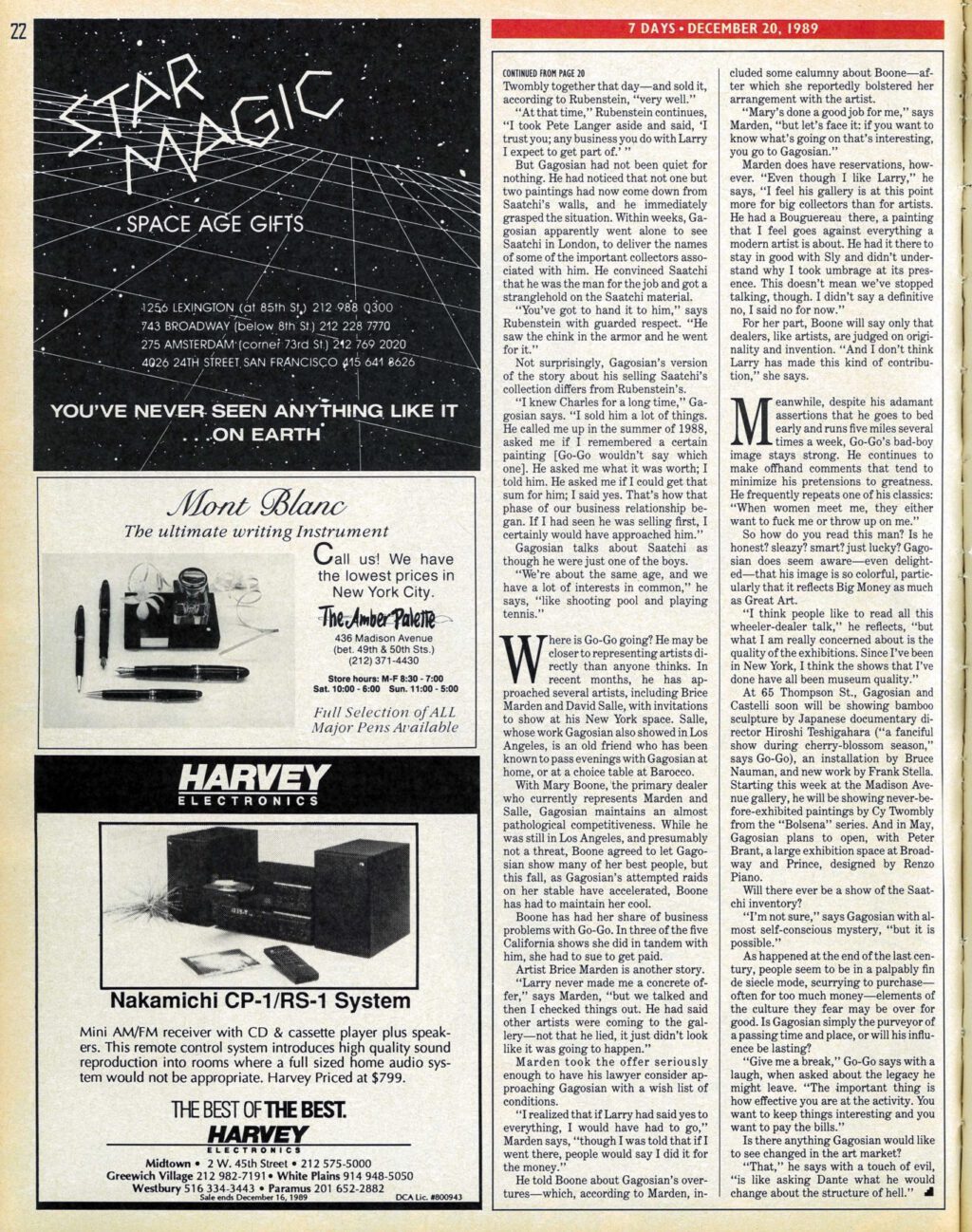

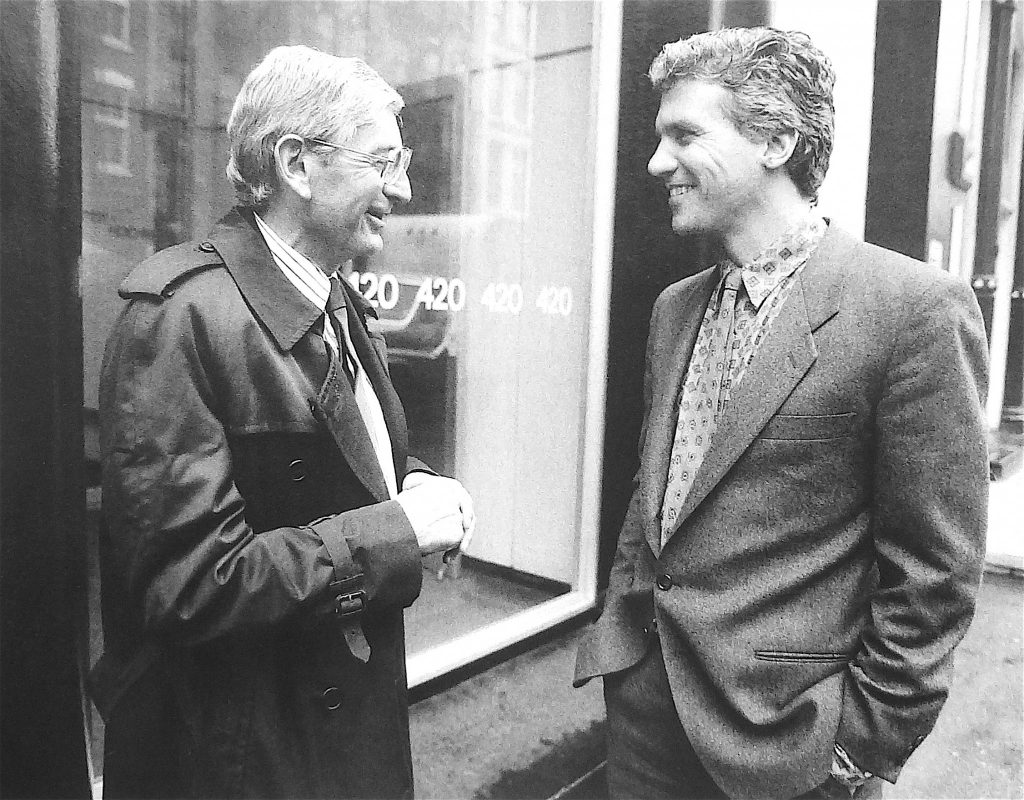

New York 1986: Longtime friends, Eli Broad (BROAD MUSEUM, Los Angeles) and Larry Gagosian in front of ‘Leo Castelli Gallery’.

GAGOSIAN: There were a couple of people. Eli Broad was probably my first client in California. We’re still good friends, and he’s been a great support for my gallery. In New York, I’d say that Si Newhouse was probably my first big client. I bumped into him on the street with Leo Castelli. Some other art dealer might have hustled me across the street, but Leo made a very nice introduction—that’s just the way Leo was. I think I called up Newhouse the next day.

BRANT: Wasn’t [ad exec and television producer] Doug Cramer an early client?

GAGOSIAN: Doug Cramer was a client very early on—maybe even before Eli, now that I think about it. [TV executive] Barry Lowen was also a great client—in fact, he and Doug were always in competition. Unfortunately, Lowen died many years ago. But that taught me a little bit about the art business, about how collectors are competitive, and how, as a dealer, you could sometimes use that to your advantage.

BRANT: One of the first shows you did in New York was the David Salle show in your loft that you did with Annina. How did that happen?

GAGOSIAN: That was in 1979. I’d just gotten the loft, which I’d fixed up pretty much on the cheap, and I’d seen a photograph of a David Salle painting in a magazine. It was a 1978 painting from when he was just starting, where he’d overlay images. I thought it was really beautiful, so I called Annina and she said, “Oh, I know David Salle. We could go to his studio.” Salle was living in Brooklyn at the time, so we went to his studio, and he had seven or eight of these paintings from the same series. On the spot, I said to Annina, “Let’s do a show in the loft,” and that was the first show I did in New York. It got reviewed in Art in America. Bruno Bischofberger bought a painting. Charles Saatchi bought one. The de Menil family bought one. A lot of people came to see the show, so it was a nice way to get a little traction in the art world in New York. I think the paintings were about $2,000 each. I kept one. I still have it.

full text @

https://www.interviewmagazine.com/art/larry-gagosian

The Trials of Art Superdealer Larry Gagosian

quote:

Alberto Mugrabi was having a drink in the lobby at Claridge’s Hotel when his cell phone flashed to tell him Larry Gagosian was calling. It was June 2009, and they were in London for a week of auctions. Gagosian and Mugrabi are among the richest and most powerful figures in the art world, though the two function differently. Working primarily as a gallerist, Gagosian puts on exhibitions for several dozen artists and is responsible for building their careers—or, in the case of the deceased artists he also shows, representing their estates. Mugrabi, along with his father and brother, operates a private art dealership and trades with other collectors behind a cloak of relative obscurity. Gagosian and the Mugrabis collect several of the same artists and sometimes purchase pictures together as a way not so much of halving their own respective costs but of ensuring that they are committed to the same investments.

That was why Gagosian was phoning. In a couple of hours, Sotheby’s big evening contemporary sale would begin at the auction house’s Mayfair headquarters. There were three paintings by Andy Warhol on the block that Gagosian and the Mugrabis were following closely, offerings from, according to the catalogue, “an important European collection.” The owner was Josef Froehlich, a wealthy engineer of automotive parts from Stuttgart, who since the early eighties had painstakingly built a formidable Sammlung of German and American artists: Gerhard Richter, Georg Baselitz, Frank Stella, and Warhol, among others. But, Mugrabi told Gagosian, he’d just been informed by a Sotheby’s executive that at least two of the three Warhols might not sell—which meant that Mugrabi and Gagosian could have to buy them themselves.

Larry Gagosian essentially created the posthumous market for mid- and late-career Warhols, defining them as a subcategory and hugely raising their value. This is arguably his signal accomplishment, paving the way for everything else he’s done. But, as for all his artists, the market still requires careful husbanding.

Gagosian and the Mugrabis weren’t so much looking for a bargain as they were intent on protecting the value of the other Warhols they own. The Mugrabis, Colombian Jews by way of Trump Tower—where the family patriarch, Jose, and his wife raised the boys—possess more than 800 Warhol artworks (in addition to at least 100 works each by Damien Hirst and Jean-Michel Basquiat and numerous large pieces by Jeff Koons and Richard Prince). They didn’t want to see anything “bought in” by the auction house—which is what occurs when bidding doesn’t reach the reserve price the auction house had privately set for a piece, the artwork being returned to the seller. If that happens, says Richard Polsky, a private dealer in California and the author of the books I Bought Andy Warhol and I Sold Andy Warhol—Too Soon, the public reads that “three Warhols failed to sell last night,” and it can trigger some kind of panic: “Maybe prices for Warhol begin to slowly drop, maybe there’s a sell-off.” The effect on the Mugrabis’ or Gagosian’s collection would be like what happens to a hedge fund with a composition overweighted to a given commodity when that commodity’s price goes into a sudden free fall. There might be a ripple effect. Sarah Thornton, a writer for The Economist, has described the Warhol market as a bellwether for the entire contemporary-art market. And the prices for Warhols, as for most of the artists that Gagosian has handled, are set at auction. Which means Gagosian tries to manage what goes on there as closely as possible.

While auction houses are forbidden from explicitly sharing certain details prior to the sale of a lot, such as the reserve price, a good deal of information gets signaled to a favored collector—particularly if interests align. This was certainly the case for Gagosian and Mugrabi, who were told by Sotheby’s not to worry about the most valuable of Froehlich’s three Warhols, Mrs. McCarthy and Mrs. Brown (Tunafish Disaster), a 1963 painting—of two suburban housewives whose deaths from food poisoning had briefly been the subject of tabloid notoriety—with an estimate of £3.5 million to £4.5 million. Sotheby’s already had interest in it, Mugrabi told Gagosian: “The Tunafish Disaster is pretty covered. That’s going to sell.”

As for Froehlich’s two remaining Warhols, they were late-career works. One, a large Hammer and Sickle painting, had been produced in 1976 and was estimated at £2 million to £3 million. The other, a glittering silvery image of women’s pumps titled Diamond Dust Shoes, was made in 1980 and carried an estimate of £600,000 to £800,000. “Do you like the shoe painting or not really?” Mugrabi asked Gagosian. “I’m gonna try to buy it cheap if I can.” Gagosian was apparently interested. “Okay, we’ll always give you an option,” Mugrabi assured him, and also ran through some of the other lots. He suggested Gagosian bid on an Andreas Gursky photograph of Dubai (“the blue one”) that he thought was unlikely to sell above its estimated price range—“especially if you want to try to lure this guy in.” Gagosian was eager to represent Gursky, and has since signed him. But two Alexander Calder mobiles, a large Jean-Michel Basquiat work painted in the year of his death, and “the European art—like the [Lucio] Fontana and the Yves Klein, all that stuff”—would probably do well without their help, Mugrabi said. “I hate that Basquiat, you?” he added. “I like the ones we got so much better than that.”

Finally, according to a word-for-word record of Mugrabi’s end of the conversation, witnessed and transcribed by an associate who was at Claridge’s, he agreed to phone Sotheby’s again to negotiate. It appears that Gagosian told Mugrabi to try to float by Sotheby’s a price of £350,000, for one particular work with an estimate of £500,000, and then call Gagosian back.

What the two dealers were apparently attempting to do was thread the needle on the two lesser Warhols. To bid high—as much as the consignor was hoping to get—might serve to prop up values for the Warhol market at large, but would be expensive and make the paintings that much more difficult to sell down the road. When Mugrabi got off the phone with Gagosian, he immediately phoned Alexander Rotter, a Sotheby’s director. “The Hammer and Sickle will be difficult,” Mugrabi said. “This painting should be much less than that, you know?” He told Rotter that “at the height of the market,” he had sold “a painting like this” for $3 million. “But it’s insane that the market has gone down and I have to pay the same price because there is some stubborn guy?”—meaning Froehlich—“That’s surrealist. He’s a surrealist.” When Rotter attempted to say his piece about the consignor’s attachment to the painting, Mugrabi got agitated. “Obviously, he’s putting the painting because he wants to fucking sell it, not because he wants to, you know? If he wants to sell the picture, tell him to be realistic … Which is only better for him and better for me.”

Rotter doesn’t remember the specifics of the deal, but says that “as a rule we don’t disclose the reserve to a buyer. We have conversations with the seller throughout the process. The buyer can’t say, ‘I’ll give you this’ and make it a sure thing, but we can relay that information to the consignor and say, ‘This is a good price, you might consider lowering your reserve.’ ”

Mugrabi—along with many other art-world denizens—describes a kind of Dance of the Seven Veils. “Of course I want to have the auction house lower their reserves. They’ll tell you where the reserves will be—within a range.”…

quote:

The negotiations among Gagosian, Mugrabi, and the Sotheby’s team reflect the sort of favored-client privileges many gallerists who don’t speculate in the secondary market claim can be dangerous to collectors and artists. Mugrabi told Rotter that if Froehlich, the seller, didn’t agree to their price, he ought to take the piece off the market rather than risk a buy-in. “I’ll tell you what the bottom price is, and if the guy wants it, we can at least have a secure bid on it,” he told Rotter. “And if he doesn’t, then maybe he withdraws it from the sale.”

Then Mugrabi called his father. “Froehlich está muy stubborn,” he complained. He proceeded to have a conversation, mostly in Spanish, about which pictures were covered (“El Tuna, sí. El Hammer and Sickle, no. Los Zapatos tampoco…”). He took his father’s remarks as instructions to make an offer “por los dos.” When Mugrabi called back to Rotter at Sotheby’s, he said, “What’s up, Alex? My dad said that he can pay for the two pictures—for the Hammer and Sickle and the shoes—£2 million, all-inclusive.” Then he said, “Okay, cool. Okay, okay.” They hung up.

All that remained was to hold the auction. At Sotheby’s, Gagosian and Mugrabi sat next to each other and, reporters in the room noted, took turns raising their hands to bid on both paintings until they reached the final price (Gagosian’s lawyer says he did not bid on the Hammer and Sickle.) It appeared to others in the room that there were no other bidders. The prices for the two works were roughly £2 million and over £600,000.

Mugrabi says that a few days after the auction, Gagosian decided not to co-purchase the Hammer and Sickle piece with him, but took sole possession of the shoe painting. The larger piece sat in a warehouse until “about a year or two later,” when the Mugrabis gave it to a European dealer.

“We have several other Hammer and Sickles—three, four, I think—and this was the one we were willing to sell,” Mugrabi said. How much did it go for? Mugrabi laughed. “More than we paid for it, of course.”…

full text@

https://www.vulture.com/2013/01/art-superdealer-larry-gagosian.html

The Art of Larry Gagosian’s Empire

quote:

In 1991, Serra was looking for a space to show some immense forged rounds of steel that wouldn’t fit into a traditional gallery. Walking in SoHo with Gagosian and architect Richard Gluckman, he spotted a parking lot for sale. The trio went to take a look. Serra says, “Larry liked it, and I said, ‘Larry, it’s just an asphalt parking lot.’ He said, ‘How soon do you want to do this show?’ and I said, ‘Six months.’ He said, ‘OK, we’ll build you a gallery.’ Just like that. Didn’t bat an eye.” The head-high steel cylinders went up that same year in a 2,400-square-foot column-free space that was dubbed “Go-Go SoHo.” This month, the artist will take over Gagosian’s two Chelsea locations for a show of new sculptures. Serra says, “He’s never told me no, ever. Everything I’ve ever wanted him to do, he’s done.”

“You might call it risk-taking, you might call it river gambler,” adds Serra. “But Larry doesn’t frighten easily. If he sees an opening, he takes it.”

quote:

Gagosian’s energy is part of what has attracted artists to the gallery, including Koons. In the late ’90s, the famously perfectionist artist was facing ballooning expenses for his Celebration series of sculptures, which had expanded in scope and confounded the dealer trio of d’Offay, Max Hessler and Jeffrey Deitch. Gagosian invested money and rallied new collectors to commit $2 million or more each to mobilize the production of the sculptures.

“At a certain point, I realized that Larry was very connected—he was informing a lot of people about the work,” remembers Koons, who began working with Gagosian regularly in 2001. “Celebration was a little bit in deadlock. We just really needed someone to stand behind the work who had the financial means, so Larry did that, and I was able to proceed.”

“I don’t think there’s anybody in history who’s sold more unfinished artworks,” says art collector Bill Bell of Gagosian. “It’s almost unimaginable.” Bell was one of those who acquired sculptures from Celebration, including Play-Doh, which took 20 years to complete while the complex fabrication was resolved. The sculpture, more than 10 feet high and made of 27 pieces of painted aluminum, finally made its debut as the star of the Koons retrospective at New York’s Whitney Museum in 2015. “It’s a leap of faith. I looked at a computer image of what this was going to be. And then it still took 10 or 15 more years after committing, where you’re paying and you’re putting down money,” says Bell, who is still anticipating delivery of a Celebrationsculpture called Party Hat and two other more recent Koons pieces. Gagosian, Koons says, “kept people patient that if Jeff is working on it, he is working on it.”

Gagosian can be pugnacious, especially on behalf of his artists. “One day I saw him sharply rebuking a curator for presenting the work of one of his artists in a space that he thought was not optimal,” says Christie’s auction house owner François Pinault, a longtime client and friend.

quote:

When Gagosian contemplates a relationship with a new artist, he considers several factors. “It’s about the quality of the work, and it’s about, also, can you sell it?” he says. “Because believe me, that’s what artists want: They want their work to sell. It’s a big responsibility, because you’re their main source of income. So you’ve got to make sure you can do the job. You know, they’re buying their country houses and they’re putting their kids in private schools and they need money, and that makes the world go around.”

full text @

http://www.wsj.com/articles/the-art-of-larry-gagosians-empire-1461677075

This is an extension of my past articles, which I, as a Japanese artist, published here on ART+CULTURE, see the links. It can be art-re-contextualized also as a body of work, still in progress. This text on this page has to be understood as part of my artistic practice, in this context called “appropriation art”. No commercial interests are involved. Creative Commons Attribution Noncommercial-NoDerivative Works. Photographs have to be understood under the terms of courtesy creative common sense.

‘I Hate Him, But He’s a Genius’: How Mega-Dealers Really Feel About Their Colleagues, Artists, and the Cutthroat Game of the Art Market

May 2019

quotes :

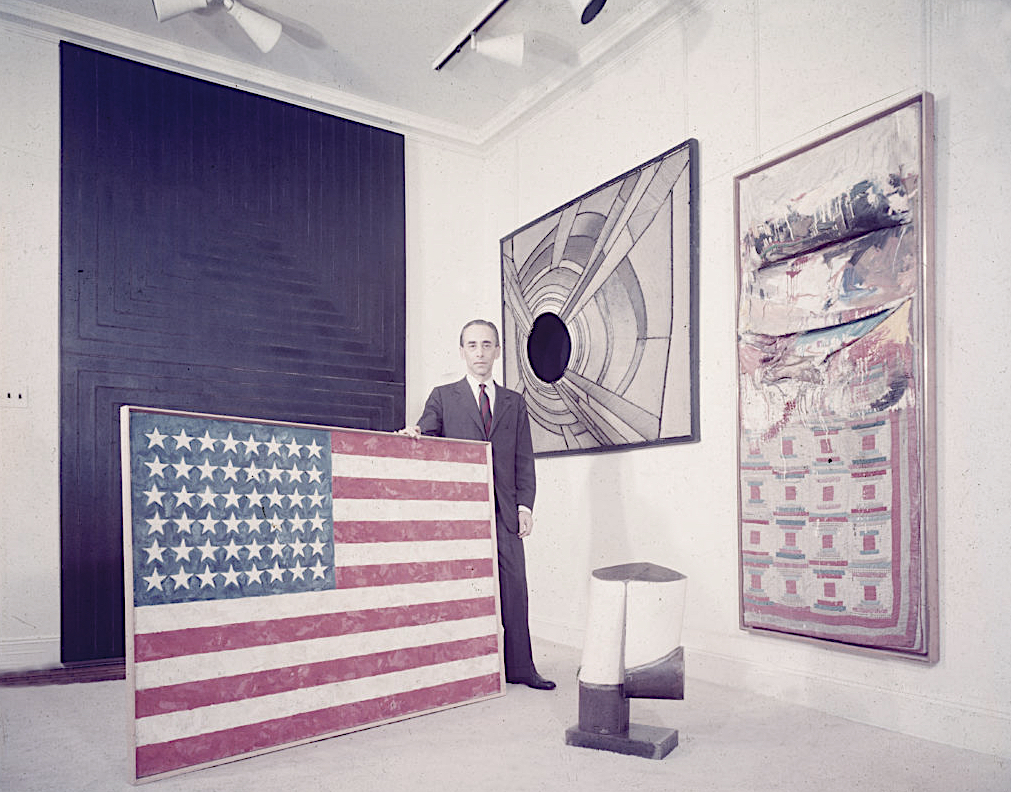

With that growth came a new degree of brazenness on many dealers’ parts for luring away artists from rival dealers. A case in point came in December 2003, with the very popular John Currin, whose figurative paintings seemed plucked from the Renaissance, though not without a satirical edge. Andrea Rosen, a midsize dealer, had nurtured his career from 1991, with slowly but steadily rising prices. She had just celebrated the launch of a three-city retrospective, from Chicago to London to New York, when news broke of the 41-year-old’s jump to Gagosian. Artists went from dealer to dealer, but to do so in the artist’s hometown at the end of the tour?

The best of Artnet News in your inbox.

Sign up for our daily newsletter.

Gagosian was amused by how much ink, as he put it, the New York Times gave to the news, but irked by a quote from David Zwirner, who called Currin’s move “a real shock” and added that “our generation doesn’t have that aggressive behavior.” That was “fucking bullshit,” as Gagosian later put it. “Everyone operates about the same way. To take the high road, or burnish his ethics on my hide—it pissed me off. If the tables were turned, he’d do the same thing. Why try to come off so PC?” No one, he added, had a gun to the head of any artist. “In my experience, it starts with you hearing the artist isn’t happy. In extreme cases, you have a gallery that’s not paying the artist. That’s less likely with a good artist. But it can happen. Or the artist and dealer have just had a falling out. If it’s an artist you like, you pay attention. That’s how I got John Currin.”

…

The departure of Japanese artist Takashi Murakami for Gagosian was even more painful, coming as it did after nearly a decade of steering his career from obscurity and widespread rejection to global acceptance.

Murakami had perfected the style he called superflat. As in a Walt Disney animation cell, there was no visual depth, no brushstrokes or evident human imperfections. Boesky had first become aware of Murakami through a small but plucky gallery called Feature Inc., from which Boesky had poached him. Galerie Perrotin in Paris would also play a role with Murakami. But credit for building his career in the United States went mostly to Boesky and a pair of laid-back Santa Monica dealers, Jeff Poe and Tim Blum, whose story said a lot about how the contemporary art market took off.

Poe was the quiet, even taciturn, one, Blum the upbeat salesman. They had started with a small gallery in Santa Monica in 1994 and found themselves struggling to get by. They had one unusual card to play, and so, in desperation, they played it. Tim Blum had become fascinated with Japan in his twenties, enough to live there for four years, learn the language, fall in love with contemporary Japanese art, and work in a Tokyo gallery. Both Blum and Poe were particularly drawn to the then-unknown Murakami. They began to exhibit his work in 1997 and became his Los Angeles dealers. Boesky became his New York dealer, first including him in a group show in 1998, then giving him a solo show the next year.

In 1999, Blum & Poe first showed Murakami at Art Basel: 10 paintings, surrounding a sculpture of mushrooms with a typical Murakami character beside them. “We were looked at as complete idiots by the rest of the fair,” Poe later admitted. “Superflat wasn’t there yet; we were ushering into Western history an Eastern history that had been excluded.”

Murakami had fabricated those first works at his own expense. In 2001, as his reputation grew, he opened a production space in Japan and began hiring dozens of workers. Clearly influenced by Warhol, he worked in both fine art and commercial art, blurring the line between the two. Ultimately, he wanted to make everything from paintings to scarves to keychains, all with his Murakami brand. In 2003, Murakami also embarked on a handbag partnership with designer Marc Jacobs of the fashion brand Louis Vuitton. The handbags were a huge hit.

By now, Murakami had begun asking his dealers to underwrite production costs—not for Vuitton bags, but for much of the rest of his work. Blum and Poe knew that Murakami was no spendthrift. He slept in a converted crate in his office, just outside Tokyo, and worked every waking hour, making all design decisions, no matter how small.

The problem was his ambition: it was just so sweeping. They underwrote as much as they could, as did the artist’s other dealers, but when Murakami announced that his next project would be a 19-foot-high platinum and aluminum Buddha, his dealers balked. Boesky was pregnant in 2006, and Murakami, she recalled, didn’t like the timing of that at all. “You’re lactating, you can’t be my business partner,” she recalled him saying.

After ten years on Boesky’s roster, Murakami severed relations with her and signed with Gagosian as his New York dealer. Blum & Poe stayed in as Murakami’s LA gallery, going so far as to charter a plane from Japan to bring the still-unfinished Buddha to the Los Angeles Museum of Contemporary Art (LA MOCA), where it would be shown as part of a Murakami retrospective. They also bought $50,000 worth of tickets for the opening night gala and provided a six-figure contribution to help finance the show itself. Even more was needed, so Gagosian and Murakami’s Paris dealer, Perrotin, kicked in. And so did Boesky.

Boesky could accept that Murakami would leave her for Gagosian. What galled her was LA MOCA’s subsequent request to borrow key Murakami works that she owned, followed by Murakami’s reaction. As soon as her Murakami paintings were hung on LA MOCA’s walls, the artist stopped communicating with her. “Murakami is a fucking genius,” Boesky said later. “I hate him, but he’s a genius. What I hate is the way he left—without honor.”

…

One of Gagosian’s great gets in this period was artist Richard Prince, who had gone from Metro Pictures to Barbara Gladstone. In the mid-2000s, Prince’s Nurse paintings, with their images of nurses taken from 1950s paperback covers, reportedly struck Gagosian as “curator art,” reported the Wall Street Journal. He wasn’t the only one: Arne Glimcher declared that Prince didn’t have a touch. “They’re mildly interesting as book covers—photographing art on art,” Glimcher acknowledged. “But how big was that idea?”

Still, as the artist’s market rose, Gagosian began taking an interest. He was seen socializing with Prince—affecting plaid shirts as Prince did. The turning point was a major Prince show at the Guggenheim. Despite Gladstone’s help in making it happen, the artist’s mind seemed set. He left, as Gladstone noted, right after the Guggenheim show.

Clearly, money figured into the decision. According to the Observer, Gagosian granted Prince a generous sixty-forty split on all sales, with the greater share going to the artist. He also put a Prince on pretty much every one of his collectors’ walls. At Gladstone, Prince’s Nurse paintings had sold in the low six figures. In July 2008, a painting from 2002, titled Overseas Nurse, sold for a record $8.4 million at Sotheby’s, indicative of what Gagosian was doing with his primary work to goose the market. It was the start of a hugely lucrative run for Prince and Gagosian, but one that would be tested by lawsuits brought against Prince and the Gagosian gallery by photographers indignant at Prince’s appropriation of their work for his own.

full text:

https://news.artnet.com/art-world/michael-shnayerson-boom-excerpt-1553674

2023/7/31 Print Issue

Money on the Wall

How Larry Gagosian Reshaped the Art World

It was the Friday afternoon of Memorial Day weekend on Further Lane, the best street in Amagansett, the best town in the Hamptons, and the art dealer Larry Gagosian was bumming around his eleven-thousand-square-foot modernist beach mansion, looking pretty relaxed for a man who, the next day, would host a party for a hundred and forty people. A pair of French bulldogs, Baby and Humphrey, waddled about, and Gagosian’s butler, Eddie, a slim man with a ponytail and an air of informal professionalism, handed him a sparkling water. Gagosian sat down on a leather sofa in the living room, his back to the ocean view, and faced a life-size Charles Ray sculpture of a male nude, in reflective steel, and a Damien Hirst grand piano (bright pink with blue butterflies) that he’d picked up at a benefit auction some years back, for four hundred and fifty thousand dollars. On a coffee table before him was a ceramic Yoshitomo Nara ashtray the size of a Frisbee, decorated with a picture of a little girl smoking and the words “too young to die.”

Gagosian is not a household name for most Americans, but among the famous and the wealthy—and particularly among the very wealthy—he is a figure of colossal repute. He is dubious of art dealers who refer to themselves as “gallerists,” which he regards as a pretentious euphemism that obscures the mercantile essence of the occupation. He has always favored a certain macho bluntness, and calls himself a dealer without apology. With nineteen galleries that bear his name, from New York to London to Athens to Hong Kong, generating more than a billion dollars in annual revenue, Gagosian may well be the biggest art dealer in the history of the world. He represents more than a hundred artists, living and dead, including many of the most celebrated and lucrative: Jenny Saville, Anselm Kiefer, Cy Twombly, Donald Judd. The business—which he owns without a partner or a shareholder or a spouse or children or anyone, really, to answer to—controls more than two hundred thousand square feet of prime real estate. All told, Gagosian has more exhibition space than most museums, and he shuttles among his outposts on his sixty-million-dollar Bombardier Global 7500 private jet. He’s been known to observe, with the satisfaction of Alexander the Great, “The sun never sets on my gallery.”

Traditionally, the model for dealers has been to bet on raw talents, and support these artists until work by some of them sells well enough to cover the bets made on all the others. Under the mega-gallery model that Gagosian pioneered, the top dealers don’t even bother with nascent artists. He has said plainly that an artist must achieve certain sales metrics before he’ll consider getting involved. Ellie Rines, who runs 56 Henry, a small gallery on the Lower East Side, told me, “What I can do that the big galleries can’t is that I spot someone who has potential. I say, ‘There’s something brewing here—the actual work may not be good, but there’s something tingling, it’s getting at something.’ ” Gagosian is content to let people like Rines do the wildcatting. Once they’ve discovered an unknown and nurtured her into a valuable commodity, he can lure the artist away with promises of more money, more support, and a bigger platform. When contemporaries describe Gagosian, they tend to summon carnivore analogies: a tiger, a shark, a snake. His own publicist once described him as “a real killer.”

The languid calm that he exuded on the eve of the Amagansett party was that of a predator between meals. At seventy-eight, he remains tall and broad-shouldered, with a full head of white hair that he keeps trimmed close to the scalp, like a beaver pelt. Gagosian has blue eyes, which often flash with mirth—he has a quick, salty sense of humor—but they can just as suddenly go blank if he feels threatened or wants to be inscrutable. In conversation, these abrupt transitions from easy bonhomie to enigmatic hostility and back again can be jarring.

“I have a weakness for entertaining,” Gagosian told me. At seven the following morning, he explained, trucks would arrive with garden furniture, and his staff would mobilize. There would be barbecue. Pizza baked in an outdoor oven. An Aperol-spritz bar and a gelato truck. Even as a child, Gagosian recalled, he liked to “have people over to my place,” and to his many friends and customers and sycophants the yearly swirl of “Larry parties” has become its own exclusive social calendar. In addition to the Memorial Day party, there is a Labor Day party, also in Amagansett; a dinner at Art Basel, in Switzerland, every June; a one-night-only exhibition at Casa Malaparte, a cliffside house in Capri; birthday parties and pre-release film screenings and opening-night banquets; a New Year’s bash at his place in St. Barts; and a pre-Oscars party at his home in Los Angeles. The sheer magnitude of his overhead is a source of envy—and confusion. His close friend Glenn Fuhrman, a financier and art collector, told me, “I’ve had so many conversations with other dealers over the years who are just dumbstruck that Larry could possibly be making money. They say, ‘I know how my business works—I don’t understand how he could be making a profit.’ ”

Gagosian vets each guest list with the vigilance of a night-club bouncer. Of the Memorial Day festivities, he said, “There’s nobody invited that I didn’t approve.” The crowd, he explained, would consist of “billionaires, artists, neighbors—mostly people I really know and am close to.” A pause, a wolfish grin. “Or want to be close to.” Derek Blasberg, a writer and fashion editor who has held a staff position at Gagosian’s gallery since 2014, told me, “Larry is a full-time gallerist and a part-time casting agent. He knows how to pull the right mix of people from worlds that are financially lucrative and creatively inspiring.” Blasberg is known for his friendships with models and actresses, which he chronicles on a popular Instagram feed. Often, Blasberg told me, Gagosian will call him and say, “I saw you with So-and-So. Can you invite them?”

A Gagosian party requires adroit curation. Too many billionaires and it’ll be as dull as Davos; too many artists and celebrities and who’s going to buy the art? Some years ago, a staffer planning a dinner for a Richard Prince opening wrote in an e-mail to colleagues, “Before Larry approves this list he would like to know if you have sold any art to these people.” That list included actors (Robert De Niro, Leonardo DiCaprio), fat-cat art collectors (Steve Cohen, Henry Kravis), and models (Gisele Bündchen, Kate Moss). Models are important, Gagosian once explained, because they “look good at a dinner table.”

The beach house’s front door opened and Anna Weyant, Gagosian’s girlfriend, entered. She is petite and blond and was wearing oversized sunglasses and holding a half-finished beer. Her hair was wet and she greeted him warmly.

“Were you swimming?” Gagosian asked.

“Yeah,” she said, smiling, before disappearing upstairs.

At twenty-eight, Weyant is half a century younger than Gagosian. She is also one of his artists, and her work has sold at auction for more than a million dollars. One painting, an eerily sensual oil portrait of an upside-down young woman who is sticking out her tongue, hangs in the vestibule, between a Prince and a Twombly.

Gagosian has been so successful selling art to the masters of the universe that somewhere along the line he stopped being their servant. “He’s one of them,” Andy Avini, a senior director at the gallery, told me. In fact, for much of Gagosian’s clientele he is less a peer than an aspirational figure.

Unlike many luxury items, art works tend to be unique objects—“one of one,” in the parlance of the trade. The designer Marc Jacobs told me, “Larry sells things that aren’t for sale.” Typically, the most coveted items become available only when the previous owner dies, or gets divorced, or goes bankrupt. An élite dealer like Gagosian, however, can sometimes wrest away a treasure by offering the owner—ideally someone he knows—a whopping premium. If you want the right kind of Jasper Johns to round out your collection, you enlist Gagosian to help you find one hanging on somebody else’s wall, then make the owner an offer he can’t refuse. If he does refuse, double the offer. Then, if necessary, double it again. It is the super-rich equivalent of ordering off-menu.

Gagosian maintains his influence by attending to the discreet status anxiety of the buyer who already has everything. Aaron Richard Golub, an attorney who represents galleries and wealthy collectors—and who has litigated against Gagosian on numerous occasions—told me, “People in the art world are incredibly insecure. The richest guy walks into the room. He wants a certain painting, but he can’t get it. Immediately, he’s insecure. That really is part of what Larry does. He exploits that.” A friend of Gagosian’s described attending a dinner at the dealer’s Manhattan town house, along with a fabulously wealthy tech founder, and witnessing a look of “real consternation” on the young man’s face as it dawned on him that, for all his money and power, he was not as connected as Gagosian, not as cultured, not as cool. Everybody was having a grand time, yet this potentate was experiencing an unspoken social demotion. Suddenly, he was a mere arriviste—a visitor at a club to which he didn’t belong. “It’s incredible,” Loïc Gouzer, a friend of Gagosian’s and a former co-chairman of contemporary art at Christie’s, marvelled. “He inverted this thing where normally the art dealers were trying to emulate their clients. Larry’s clients are trying to emulate him.”

Gagosian isn’t the first to pull off this transposition. He is a big reader, and one of his favored subjects is the life of Joseph Duveen, the great dealer who helped assemble the collections of Andrew Mellon, J. P. Morgan, and other Gilded Age titans. There are several biographies of Duveen, Gagosian informed me, and he has “read ’em all.” According to one of them, by S. N. Behrman, Duveen made a point of “showing his multimillionaire clients that he lived better than they did.”

Numerous friends of Gagosian’s cautioned me not to mistake the merry-go-round of parties and galas and superyacht cruises for a life of sybaritic leisure. The dealer and collector Tico Mugrabi, who has made many deals with Gagosian, said, “The guy is always working, even when he’s having fun. This motherfucker works 24/7.” The British painter Jenny Saville, the most expensive living female artist, who has worked with Gagosian throughout her career, concurred: “Even if he’s having dinner, or if he’s on holiday on a boat, it’s not a holiday. All the fun dinners—they have a reason for being fun.”

Gagosian’s longtime friend Jean Pigozzi, a photographer and collector, described the parties as marketing showcases in disguise. “Larry’s a genius at finding these guys, then he brings them to his house, and people say, ‘Oh, perhaps I should get a couple of Picassos.’ ” Once, Pigozzi recalled, he was at Gagosian’s Manhattan home with the French billionaire Bernard Arnault, and Arnault expressed enthusiasm for some art on display. “I told him, ‘Everything here is for sale. Don’t be nervous. You want to buy the chair? You can buy the chair. You want to buy the painting? Just ask! It’s all for sale.’ ” Gagosian insisted to me that he does not “sell art out of my house,” then allowed that he actually has. A true dealer knows that everything has a price, and the best way to raise the price of something is to say that you would never sell it.

As Gagosian likes to point out, he didn’t start life as an insider. He came of age in the San Fernando Valley, in a middle-class Armenian American family. His father, Ara, was a municipal accountant who later retrained as a stockbroker. The family never went to museums or emphasized the visual arts. But Gagosian’s parents both dabbled in show biz, performing in an Armenian theatre troupe, and his mother, Ann, had a small role in “Journey Into Fear,” a 1943 movie that was produced by Orson Welles. Once, when Gagosian asked his mother what Welles had been like, she revealed that he’d taken her out for coffee. “And I said, ‘O.K., I don’t want to know any more,’ ” Gagosian recalled with a chuckle, adding, “My mom was attractive.”

It wasn’t a happy childhood. Ara “liked to gamble, I think more than he should,” Gagosian said, and also “drank probably more than he should.” Gagosian rebelled as a teen-ager, and he told me that it was hard for his father “to discipline me, in a certain way, because his life didn’t seem particularly disciplined.” Most of Ara’s stockbroking, Gagosian said, seemed to consist of “trying to talk his relatives into buying securities from him.” (Gagosian has a sister, Judy, who declined to be interviewed for this article.) One peculiarity of Gagosian’s origin story, at least in his telling, is that his early years had a notable deficit of the quality that has come to define his life: ambition. He attended U.C.L.A., where he studied English, joined the swim team, and did a little photography. But he dropped out twice and took six years to graduate. It was the sixties, and he was in no hurry: he was a good-looking guy who liked chasing girls and playing pool and getting stoned with his pals. There was a brief, ill-considered marriage, in Vegas, to a college girlfriend, Gwyn Ellen Garside. They divorced after sixteen days. It was “stupid” to marry so young, Gagosian says now. In the divorce papers, Garside explained that she’d married him with the false understanding that they would “have children” and “both work and save to be self-supporting and to build a future together.” Gagosian’s aimlessness was so pronounced that his father once said, in exasperation, “If you just do something with your life, I’ll buy you pot.” (In 1969, the year Gagosian finally graduated, Ara died, of lung cancer. He was fifty-nine.)

After college came a string of menial jobs: in a record store; in a grocery store; the graveyard shift at a gas station. Then, through a cousin, Gagosian became an assistant at the William Morris Agency, answering phones and reading scripts. But he hated the airless corporate environment and the jockeying of his colleagues, likening the experience to “a knife fight in a phone booth.” He has occasionally suggested that he was fired by William Morris, but when I spoke to Michael Ovitz, who supervised him there, he insisted that Gagosian quit. “I tried to get him to stay!” Ovitz recalled, adding that he thinks Gagosian could have made a formidable agent. He noted of art dealing, “The vocations are similar. You’re buying and selling.”

Gagosian started working as a parking attendant in Westwood. He didn’t mind the job, he says: it paid better than the ninety dollars a week he’d made at William Morris. Then one day, in a moment now enshrined in art-world lore, he noticed a street vender selling posters at the edge of the parking lot. If Gagosian possesses one secret weapon that has equipped him for success, it might be his disinhibition. He approached the vender. The posters were “schlock,” Gagosian told me—a kitten toying with a ball of yarn and other images you might find on the wall at a pediatrician’s office. But they seemed to be selling. So Gagosian proceeded to, in his words, “copy the guy’s business.” The posters came from a company called Ira Roberts of Beverly Hills, and Gagosian started buying directly from the firm and selling on his own. Art was an arbitrary choice, in his account: “If he’d been selling belt buckles, I might’ve tried to sell belt buckles.”

By adding a cheap frame, he discovered, he could sell a two-dollar poster at a considerable markup, for fifteen bucks. He leased a little patio on Broxton Avenue, in Westwood, and sold framed posters to passersby. Gradually, Gagosian’s slacker instincts gave way to a more hard-nosed entrepreneurialism. He began letting local craftspeople sell leather goods and painted trinkets on the patio, in exchange for six dollars a day and ten per cent of their gross. In an optimistic flourish, he bestowed a name on his ad-hoc enterprise: the Open Gallery. In 1972, Gagosian told the Los Angeles Times, “It’s sort of a halfway house, halfway between having to be in business for yourself and being a stone-freak-do-nothing hippie.” Eventually, he hired a few people and moved indoors, opening a proper shop on Broxton. One early employee was the musician Kim Gordon, who, before she formed the band Sonic Youth, assembled thousands of picture frames for Gagosian. In a 2015 memoir, Gordon recalled him shouting at her when she worked too slowly, and noted, “He was erratic, and the last person on the planet I would have ever thought would later become the world’s most powerful art dealer.”

Ara Gagosian might never have made much money, Larry told me, but he always had “a nice car in the driveway.” At the start of Larry’s ascent, he also projected an image of success that was out of proportion to how well he was actually doing. From his first days in the business, stories circulated about unpaid bills, creditors chasing him, a repo man showing up for his car. Doreen Luko, an early staffer in L.A., told me that on payday Gagosian’s employees “literally ran to the bank in hopes that there would be money there for our paychecks—whoever got there first was going to get paid on time.” Mike Shatzkin, a U.C.L.A. classmate with whom he lived for a period during the seventies, told me that Gagosian sometimes walked out of a restaurant without paying the check. “I did it with him once, but it was a thing he did,” Shatzkin said. (Gagosian denies this.) One detail that has gone largely unreported in chronicles of Gagosian’s career is that, in 1969, he pleaded guilty to two felony charges of forgery, stemming from his use of someone else’s credit card. The card was “being passed around by a bunch of my friends,” he told me. “It was a stupid mistake.” He received a suspended sentence and probation.

Sensing an opportunity to make a bigger mark, Gagosian began carrying fine art, mostly prints and photographs. The actor Steve Martin told me, “When he had his poster shop in Westwood, I went in. I was a novice art collector and he was a novice art dealer.” Martin and other young Hollywood types who were starting to collect would get drawn in by something in the window and find themselves in conversation with the eager, gregarious proprietor. Gagosian had no training in art history, but the business he’d stumbled into was one for which he was preternaturally suited. He had a keen sense of aesthetics and design, and what fellow-connoisseurs describe as a near-photographic visual memory. He also was a quick learner. “Next to his bed, he had these stacks of art books,” a woman he briefly dated around this time, Xiliary Twil, recalled. “He was really studying.” One day in the mid-seventies, Gagosian was paging through a magazine and came across a series of photographs he liked—moody black-and-white shots by the New York photographer Ralph Gibson. Gagosian cold-called Gibson and announced, “I’ve got this gallery.” How about a West Coast exhibition?

“In those days, I was selling prints for two hundred dollars,” Gibson told me. “So I said, ‘O.K., but you’d have to buy three or four as a guarantee.’ ” Gagosian flew to New York with a check. Gibson was represented there by Leo Castelli, the legendary dealer who had nurtured the careers of Jasper Johns, Frank Stella, and Roy Lichtenstein. “In those days, Leo was just the Pope,” Gibson recalled. He introduced Gagosian to Castelli, and “Leo took a liking to him.”

Castelli, then in his late sixties, had grown up in Trieste and come to America during the Second World War. A debonair man with courtly manners, he was a lifelong art lover who didn’t become a full-time dealer until he was middle-aged. He spoke five languages and was so devoted to his artists that he supported many of them with generous stipends. Gagosian began spending more time in New York, and cultivated a friendship with the older dealer over long lunches at Da Silvano. The photographer Dianne Blell once joked that Gagosian chased Castelli around “like a puppy.” At one point, Gagosian presented him with a gold Patek Philippe watch. Patty Brundage, who spent decades working for Castelli, told me, “Leo was always looking at other people to kind of keep him new, to make him vital, and I think Larry was one of those people.” In “Leo and His Circle,” a biography by Annie Cohen-Solal, Gagosian posited that his impatience with art-world pretense may have endeared him to Castelli: “I did not do a lot of blah-blah-blah. I think my bluntness appealed to him.”

One day, Castelli and Gagosian were crossing West Broadway when Castelli greeted an unassuming-looking gentleman in his fifties who was walking by.

“Who was that?” Gagosian asked.

“That was Si Newhouse. He can buy anything he wants.”

Gagosian doubled back and introduced himself. “Give me your number,” he suggested, without an ounce of blah-blah-blah. It was one of the most fateful introductions of his life.

Castelli specialized in what is known as the primary market: he guided the careers of living artists and sold their new work in exchange for a commission. He took pride in spotting talent in chrysalis. “When I first saw the work of Johns and Stella, I was bowled over,” he told an interviewer in 1987. Castelli, who said that he dealt art chiefly “because of its groundbreaking importance,” regarded the commercial side of his profession as secondary. When Gagosian initially ventured beyond poster-hawking, he had no relationships with artists, so he couldn’t be a primary dealer in the Castelli mold. But what he did have was a gallery in Los Angeles, access to an untapped ecosystem of West Coast collectors, and something that Castelli decidedly lacked: chutzpah. The art dealer Irving Blum knew both men during this era, and he told me, “Leo was really aristocratic and civilized. And Larry”—he laughed—“Larry was a tiger.” Castelli, who had no gallery of his own in California, began consigning works to Gagosian, including pieces by Frank Stella. Gagosian established a reputation for showing top artists who already had representation in New York. “I’m a very bad salesman and Larry is a very good salesman,” Castelli conceded, with a gentle caveat about his more brazen protégé: “Of course, he wouldn’t be as scrupulous as I am in advising one of my clients not to buy a painting because it’s not good enough for them.” He added, “He also knows how to deal with very rich people.”

In pursuing a very rich clientele, Gagosian carved out a different niche from Castelli’s—one that harked back to Duveen’s relationships with the robber barons. The secondary market involves the buying and selling of previously owned work. Castelli had little interest in it, and in the mid-twentieth century—when Americans were creating the most dazzling art—the secondary business was perceived as a backwater by some dealers. It was also considered a bit distasteful: Duveen had often supplied his nouveau-riche clients by obtaining Old Master paintings from noble European families that had fallen on hard times.

By the nineteen-eighties, however, a new generation of wealthy Americans was eager to assemble great collections—and what they desired most was contemporary art. Si Newhouse had a media empire, and for more than three decades he was the owner of this magazine. (His family still owns Condé Nast, the parent company of The New Yorker.) He was also obsessed with twentieth-century art. On Saturday mornings, a car ferried him from his town house, on East Seventieth Street, to the galleries of SoHo. He had a sharp eye and a ready checkbook, and before long Gagosian could be seen squiring him on these excursions.

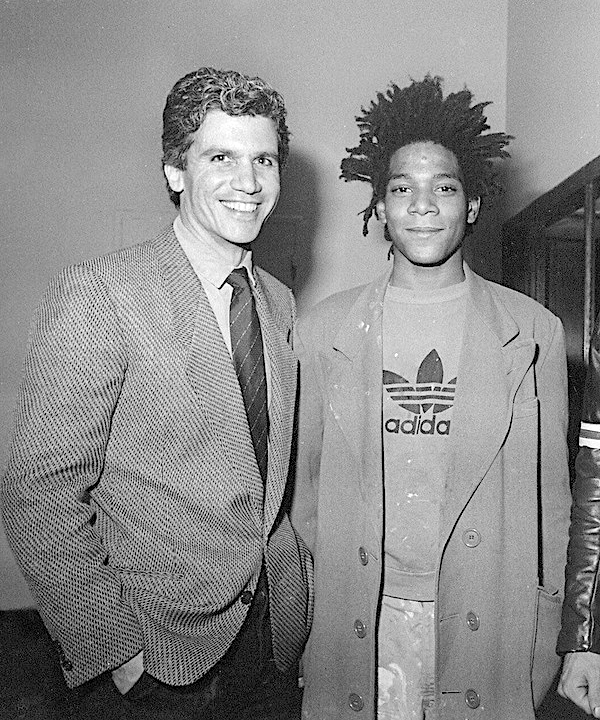

While Gagosian was on the rise, he occasionally championed promising young artists. When he saw the work of Jean-Michel Basquiat for the first time—at a 1981 group show in SoHo, organized by the dealer Annina Nosei—he bought three pieces on the spot. The following year, he mounted Basquiat’s first show in L.A., where he had opened a bigger, nicer gallery. (Basquiat stayed at Gagosian’s house in Venice, along with Basquiat’s girlfriend at the time, a not yet famous Madonna.)

But the main service that Gagosian provided for Newhouse wasn’t scouting out the primary market; it was being his detective on the secondary market. The œuvres of even the most renowned artists are inconsistent. Masterpieces are rare and often hard to find. No central registry records the owners, locations, and prices of art works. Being a good secondary dealer requires knowing which people are collectors, where they live, what hangs inside their houses—and whether they might be induced to part with any of it. Gagosian excelled at what Douglas Cramer, a soap-opera producer and an early client, once called “the hunt.”

Like a secret society, the art market was governed by obscure social codes, and Gagosian was so unbound in his energies and so shameless in his tactics that he immediately attracted notice and controversy. The telephone was his instrument of choice, and he often made upward of a hundred cold calls a day, sniffing out the location of an art work, lining up buyers, then haggling with the owners until the work shook free. The artist Jeff Koons, who first encountered him in this period, and went on to work with him for many years, told me that the young Gagosian infused the market with a thrilling sense of possibility: significant art that had been “locked up” suddenly became accessible. One reason that Gagosian knew where so much noteworthy twentieth-century art was hidden is that he had access to a treasure map, in the form of Castelli. “I could give him a lot of information on where the paintings were,” Castelli once acknowledged. “Because I sold most of them.”

Nosei told me that, during Gagosian’s parvenu years, he sometimes talked his way into parties and showed up at dinners to which he wasn’t invited. When we met in Amagansett, he mentioned that, in the eighties, he’d ventured into the house we were sitting in while the owner was throwing a party. Friends he was staying with at the time were invited, he told me, so he tagged along. “There wasn’t a place for me at the table, so I ate over there,” he said, indicating a side garden. He developed a reputation for wandering away from the festivities at private homes, taking clandestine Polaroids of any impressive art that he spied on the walls, and then offering those works to his collectors. A few days after a party, he would telephone the hosts and startle them with the news that he had a buyer who was very interested in the Matisse above their living-room sofa. His hunger, aggressiveness, and stamina were so conspicuous that people in SoHo began referring to him as GoGo.

Gagosian has denied surreptitiously photographing art works and offering them for sale without authorization, but there is ample evidence that he did just that. Douglas Cramer told the Times, “I was in Larry’s office once and I saw Polaroids of pieces that were in my home.” Indeed, a version of this gambit (minus the Polaroids) remains part of Gagosian’s repertoire. Marc Jacobs told me about a dinner he once hosted at his apartment in Paris; among the guests was Gagosian. Several days later, Gagosian called Jacobs and proposed buying two paintings in the apartment—a John Currin and an Ed Ruscha. As it happened, Jacobs was about to build a new house, in New York, and needed money, so they quickly came to terms. “The deal was he would pay immediately,” Jacobs recalled. “Somebody came and picked up the paintings three days later, and the money was in my account. Done.”

In 1985, Gagosian relocated to New York and opened a gallery on Twenty-third Street, in Chelsea, which at the time was considered a deeply inauspicious location. (He has always possessed a genius for real estate—the investment paid off handsomely.) It can be difficult these days to recall how polarizing a figure he was when he first swept into the city. Then, even more so than now, people wondered about his finances: How could he afford to live so lavishly and pay so much for pictures? Did he have a secret backer? Gagosian has always denied it. (Newhouse, for his part, said that he was not Gagosian’s backer, but he once noted, “There are moments when I wish I were.”) Rumors circulated—without any apparent foundation—that Gagosian might be fronting for arms merchants, or in league with drug traffickers. His sudden success had prompted hostility and suspicion in the business, and he portrayed the scuttlebutt as a calculated effort to undermine him. In a 1989 interview, he lamented that “people don’t have anything better to do than make up gossip,” adding, “I’m not going to stop making money to squelch rumors.”

One widespread story at the time was that Gagosian liked to make lewd telephone calls to women. In a 1986 diary entry, Andy Warhol alluded to these accounts, writing, “Larry, I don’t know, he’s really weird, he got in trouble for obscene phone calls and everything.” (In the 1996 book “True Colors: The Real Life of the Art World,” by Anthony Haden-Guest, Gagosian responded, “He called me weird. Warhol!”) The gossipy art magazine Coagula once expressed surprise that such allegations hadn’t slowed Gagosian’s ascent, noting, “Despite persistent rumors about dirty money and dirty phone calls, Larry Gagosian continues to fill his stable with big names.”

During this period, Gagosian developed an enduring reputation as a Lothario. He dated many glamorous women, including the model Veronica Webb and the dancer Catherine Kerr; he and Kerr were briefly engaged, but days before the wedding he called it off. (“Cold feet.”) On more than one occasion, he told people, “When women meet me, they either want to fuck me or throw up on me.” An item from Coagula in 1995 described a woman who allegedly called the police because Gagosian had been sending “a chauffeur-driven limousine to her pad every night, which patiently waits for her to emerge, kidnapping-style.” (Gagosian denied to me that he ever did this, pointing out, “It’s expensive to send a limousine.”)

“Talk to anyone you want—talk to people who don’t like me, I don’t care,” Gagosian told me when I first proposed writing about him, before catching himself and saying that maybe I shouldn’t talk to his “ex-girlfriends.” When I mentioned that I might be duty-bound to do so, Gagosian gave a little laugh, looked at me without blinking, and said, “I hope you have a good legal department.” He dismissed the stories about obscene phone calls as “complete horseshit.” He suggested that the rumors had originated with a woman who worked as an art adviser and was unaccountably upset with him, even though “I never had anything to do with her.” He wouldn’t tell me who the woman was.

I spoke to someone—not an art adviser—who said that she’d received such a phone call. She didn’t want to be named, she told me, because “Larry is very powerful and the art world is very small.” But she described an incident, in New York in the early eighties, in which she and her husband attended a party, and were introduced to Gagosian. They chatted only briefly, but then Larry came back and, looking at her intensely, asked her to tell him her name again. She told him, and he repeated it a few times, then walked off. Later that night, she and her husband were asleep in bed when the telephone rang. Her husband answered and a man asked for her by name. When the woman took the phone, the caller said a series of sexual things. “I hung up, and immediately we said, ‘It must have been Larry,’ ” she recalled. “It was so blatant. He could have waited a week, and I wouldn’t have figured it out.” It was only after this incident, the woman said, “that I started hearing from others, ‘Oh, he’s sort of known for doing that.’ ” (I also spoke to the husband, who corroborated this account, and to a friend of the woman’s, who remembers her recounting this experience four decades ago.)

When I told Gagosian about my conversation with the woman, without sharing her identity, he said, flatly, “Not true. Never happened. Never. I’m not that kind of guy.” In any case, the consensus among people who say that Gagosian made harassing phone calls is that he stopped. I did not hear so much as a rumor about this sort of conduct occurring at any point in the past twenty-five years.

As the business grew, Gagosian lost his patina of disreputability. He built a base of top-tier clients, and often played them off one another. The Chelsea gallery’s first show was an exhibition of Pop art from the collection of Burton and Emily Tremaine, a Connecticut couple with a sheet-metal fortune. Gagosian had established this relationship with his usual brio, looking up the Tremaines in the phone directory, then cold-calling them and offering to buy a Brice Marden painting that they owned. Gagosian befriended the couple, and soon they were entrusting more of their art to him. In his recollection, Burton would call and say, “Larry, we got too much art, we need some cash,” and he’d reply, “I’m your guy.” The Tremaines owned Piet Mondrian’s final painting, “Victory Boogie Woogie,” and Gagosian told them that he thought he could get eleven million dollars for it. He then telephoned Si Newhouse and sold him the painting for exactly that amount. (After the sale, Newhouse said of Gagosian, “I think he has a refined eye. But at the level I’m dealing with, his eye is less important. It doesn’t take an eye to sell Mondrian’s ‘Victory Boogie Woogie.’ It takes a willing buyer and a willing seller and someone like Larry to bring them together.”)

In 1990, the owner of the Amagansett house was getting divorced, and Gagosian bought it, for eight million dollars. He bought a carriage house, with its own lap pool, on the Upper East Side. He bought a Ferrari. He also leased a big new gallery space in the Parke-Bernet building, on Madison Avenue. Allan Schwartzman, who was then a journalist and is now an art adviser, recalls meeting with Gagosian shortly after he signed the lease. The new space was still under construction, and they stood in the vestibule, looking out at the wealthy men and women of the Upper East Side walking by, like salmon running thick in a river. “He was clocking which men of extreme high net worth and which existing or potential art collectors were passing by, saying, ‘There goes So-and-So,’ ” Schwartzman said. “He knew who everyone was. He saw them before they knew him. That kind of aggressiveness and that eagle sharpness for who mattered—there was no precedent for that. That’s the eye of an industrialist. That’s someone who was seeking to build a massive financial empire.”

The Gagosian gallery is still headquartered in the Parke-Bernet building, and now takes up two whole floors. There’s a retail shop on the ground floor, which sells art books, prints, and T-shirts, offering the more budgetarily constrained consumer a little piece of the action. In what seems unlikely to have been an accident of design, you must pass through the gift shop in order to access Kappo Masa, the high-end restaurant that occupies the building’s basement, and is billed as a “collaboration” between Gagosian and the renowned Japanese chef Masayoshi Takayama. This was where I first met with Gagosian, for lunch in January. He was sitting at a prominent table in the wood-panelled, art-filled space, framed by an open kitchen where great flames occasionally ignited, like petroleum flares. The place was boisterous, and he greeted passing supplicants with the smiling disengagement of a village mayor. (“Hi, how ya doing? Maybe I’ll see you in Paris.”) He still lives nearby, but in 2015 he sold the carriage house, for eighteen million dollars, and moved into the Harkness Mansion, a twenty-thousand-square-foot domicile that he bought for thirty-six million dollars and then subjected to an exacting multiyear renovation. (He wanted a swimming pool on the roof.) It’s a lot of house, he concedes, but at the time he bought it he was dating Chrissie Erpf, a longtime employee, and she had four children, so he wanted enough space to accommodate her family. Then they broke up. Now Gagosian shares it with Anna Weyant, whom he started seeing in 2021, and their respective dogs, along with some staff. The house, which was renovated with an eye for entertaining, can comfortably seat fifty people at a dinner.

When Gagosian established his gallery, he disdained formal meetings—he finds bureaucracy and protocol dull. To increase sales, he hired several people to join him as “directors,” but he treated them a bit like those crafts peddlers in Westwood who had paid a commission to sell trinkets on his patio. Directors were given a phone and a computer and instructions to sell. There was no mentoring from Gagosian, and little lateral collaboration. A senior director in London, Millicent Wilner, once observed, “There’s no hierarchy. There’s Larry—and everyone else.”

Gagosian telephones his directors all day. If he can’t reach them, he will call them ten times. He will call their spouses. He will send company-wide e-mails demanding to know why people haven’t picked up the phone. When he won’t be reachable for any length of time, an e-mail is sent out: “Larry will be unavailable between 3 and 4:30 today.” By implication, he is accessible the rest of the time—and he expects the same of his underlings. Because the business is commission-driven, and still dominated by its charismatic owner, competition among directors can be ferocious. “There’s a lot of money on the table,” a source who has worked at the gallery told me, explaining that directors can make ten per cent of the gallery’s profit on a sale. The directors “are Larry’s children,” the person said, “and they all want to look the best in their father’s eyes.”