“The Japanese Art Market 2024” by Dr. Clare McAndrew Commissioned Project by the Agency for Cultural Affairs, Government of Japan

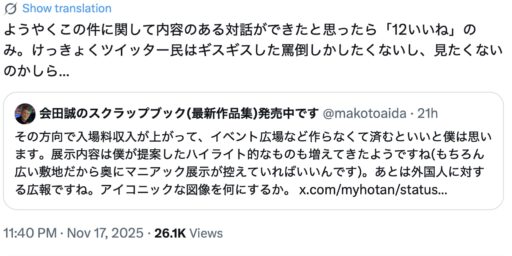

新鮮!

記録させていただきます。

「報告書によると、日本には2,060以上のアートディーラーやギャラリーが営業しており、そのうち59%が東京に拠点を置いているという。」

言わせていただくと:これは嘘。

「日本のコレクターは2023年に平均10回のギャラリーの展覧会に参加しました。」

言わせていただくと:これも嘘。😂

「•According to surveys of the sector in 2023, 63% of dealers and galleries operate some or all of their sales in the primary market, supporting the careers of living artists in Japan.

•Dealers represented an average of 27 artists in 2023, up from 20 in 2022.」

言わせていただくと:これも嘘。😂

Japan’s Art Market Outperformed the Global Average Over the Past Five Years: Report

Its relatively small has art industry has some unusual characteristics, according to economist Clare McAndrew.

Japan’s art market has outperformed the global industry over the past five years, according to a new report from art economist Clare McAndrew. While global sales ticked up just 1 percent from 2019 to 2023, amid a general downturn, Japan’s saw an 11-percent increase, going from $611 million to $681 million, McAndrew reports.

The new report, “The Japanese Art Market 2024,” examines a field that remains somewhat opaque to the international art community. It was commissioned by Japan’s Agency of Cultural Affairs, which operates under the nation’s Ministry of Education, Culture, Sports, Science and Technology. McAndrew, of the firm Art Economics, also authors the UBS Art Basel art market reports and the U.K. art market report.

While Japan has produced reports on the art field for about a decade, this high-profile publication comes as it aims to strengthen its local art market, particularly for contemporary art, by promoting homegrown events like Art Collaboration Kyoto (ACK) and Art Week Tokyo, which have been gaining attention overseas, and the young Tokyo Gendai fair, which is organized by the Art Assembly.

“There is an obvious shift in the art market towards Asia, away from Europe and the U.S.,” McAndrew said in a media briefing on the report. “There is a lot of interest in Japan, which is a wealthy economy, and in terms of high-net-worth wealth, it is the most evenly distributed. It deserves a bigger market.”

Despite its strong five-year showing, Japan underperformed the global market last year, according to the report. Its $681 million total in 2023 was off 10 percent from 2022, while the global market saw just a 4-percent contraction. The U.S. was also down 10 percent, while China saw a 9-percent climb, per the report. Business seems to have continued apace in the country, but at a lower price point: Works at or below $50,000 accounted for 95 percent of dealer’s sales in 2023, compared to 65 percent in 2022.

Japan’s share of the global market remains small, at about 1 percent, but it has the second-biggest market in Asia, the report noted, accounting for 5 percent of the region’s business in 2023. China holds the number-one slot, with 80 percent. That finding corresponds with The Asia Pivot‘s report in October. According to data from the Artnet Price Database, Japan’s art and design auctions from October 2023 through September 2024, accounted for 5.1 percent of the Asian auction market, second to China’s 85.5 percent. India came in third at 2.9 percent and South Korea came in fourth at 2.5 percent.

Gallery sales are the core of the country’s art market, accounting for about two-thirds of transactions by value, according to the report, with auctions and art fair sales being less important than in many peer countries. There are more than 2,060 dealers and galleries operating in Japan, the report says, with 59 percent based in Tokyo. Eight percent operate in the ancient city of Kyoto. Three percent of galleries have overseas premises. Collectors in Japan attended an average of 10 gallery shows in 2023, compared to eight by their international counterparts.

Auction sales accounted for about one-third of Japan’s total sales last year, whereas, in China, the figure was around 70 percent, McAndrew said. Prices at Japanese auctions are lower than those in many other leading countries, with 91 percent of works selling for $10,000 or less. While the three top-selling living Asian artists at auction are Japanese (Yayoi Kusama, Yoshitomo Nara, and Takashi Murakami), according to Artnet Price Database, many of their high-value works are sold in international hubs like Hong Kong, rather than at home.

Sales generated at art fairs account for only 10 percent of galleries’ total sales—8 percent at Japanese fairs and 2 percent overseas. This percentage is significantly low compared to the global average, where sales at art fairs account for 29 percent of global art sales. The weak Japanese yen and an increase in costs have discouraged dealers from taking part in fairs, especially overseas.

Online art sales in Japan remain remarkably low, with direct gallery sales accounting for just five percent and third-party platforms contributing one percent, compared to the global averages of 20 percent and 3 percent, respectively.

Another report on the Japanese art market is expected to be released between in the second half of 2025.

The Japanese Art Market 2024 is published as part of the “FY2024 Art Ecosystem Infrastructure Development Promotion Project,” commissioned by the Agency for Cultural Affairs to enhance understanding of Japan’s art market and to visualize its potential. The report was prepared in collaboration with Dr. Clare McAndrew, a cultural economist and founder of Arts Economics.

The report provides an estimate of the Japanese art market by combining data from the dealer and auction sectors in Japan. Data on dealers is from a survey of sales data from 2023 collected from domestic art dealers and auction houses as part of the FY2023 Agency for Cultural Affairs’ commissioned Art Market Research Project with national economic statistics. These include National Accounts (GDP data), Economic Census activity surveys, and the Agency for Cultural Affairs’ Cultural Administration Research and Study (Cultural GDP).

Key Findings

Global and Regional Context

•The Japanese art market reached an estimated $681 million in sales in 2023, a 10% decline year-on-year from 2022. The market has grown 11% since 2019, outperforming the global market’s modest 1% growth.

•Japan ranked as Asia’s second-largest art market in 2023, holding a 5% share by value, behind China’s dominant 80%.

Dealers and Galleries

•Dealers and galleries generated 68% of total sales ($460 million), playing a vital role in fostering connections between artists and collectors.

•The market includes over 2,060 dealers and galleries, most located in Tokyo (59%) and the Kanto region (66%).

•According to surveys of the sector in 2023, 63% of dealers and galleries operate some or all of their sales in the primary market, supporting the careers of living artists in Japan.

•Dealers represented an average of 27 artists in 2023, up from 20 in 2022.

•While aggregated dealer sales dropped 9% year-on-year in 2023, smaller dealers with

annual turnover under $500,000 showed growth.

Auction Market

•Auction sales in Japan reached $221 million in 2023 and remained highly accessible, with 91% of lots sold for prices under $10,000.

•Japanese artists like Yayoi Kusama continue to achieve significant recognition and premium prices internationally, demonstrating global appreciation of Japanese art.

The Art Market’s Economic Impact

•The art market supports over 78,000 jobs across the ecosystem, contributing to Japan’s cultural and economic vitality.

•Ancillary spending by the art trade reached $136 million in 2023, generating a positive contribution to supporting highly skilled professional services employment in Japan.

•Japan’s position as a major art importer, with $457 million worth of art imported in 2023, strengthens its connection to global art hubs like the US and France.

1. The Japanese Art Market

The Japanese art market was estimated to have reached $681 million in sales in 2023. These estimates include sales of art and antiques carried out by dealers, galleries, and auction houses within Japan. They represent only part of the very significant value added of the Japanese visual arts ecosystem, which also includes a large and growing network of artists, cultural institutions and related ancillary businesses and events.

The value of the art market in Japan fell by 10% year-on-year from a high of $756 million in 2022, paralleling the global trend of declining sales, with the international art market’s value also down 4% (from $67.8 billion to $65.0 billion).1 The COVID-19 pandemic created an exceptionally difficult operating context for the art trade, with restrictions on operations, travel, exhibitions, and events all contributing to a contraction in sales globally of 22% in 2020 to its lowest point since the global financial crisis in 2009. Sales in Japan fell by an even greater 38% in 2020 to $377 million, with double-digit declines in both the auction and dealer sectors. However, like the global market, values bounced back quickly in 2021, with an even stronger uplift in Japan of 62% to $611 million, surpassing pre-pandemic values achieved in 2019. This momentum continued in 2022 with a further uplift of almost 24%, however, growth faltered in 2023 as both auction values and reported sales by dealers declined.

Despite this slowdown in 2023, considering the period from 2019 before the COVID-19 crisis disrupted the market, sales in Japan have increased 11%, against a more moderate global rise of just 1%, and significantly more than major markets such as the US and UK.

more @

https://www.bunka.go.jp/koho_hodo_oshirase/hodohappyo/pdf/94146701_03.pdf

https://www.instagram.com/p/DIgF4-QSThz/