Capturing the Zeitgeist, Japan’s Coolest Artist KYNE KYNE:福岡のストリートから世界へ

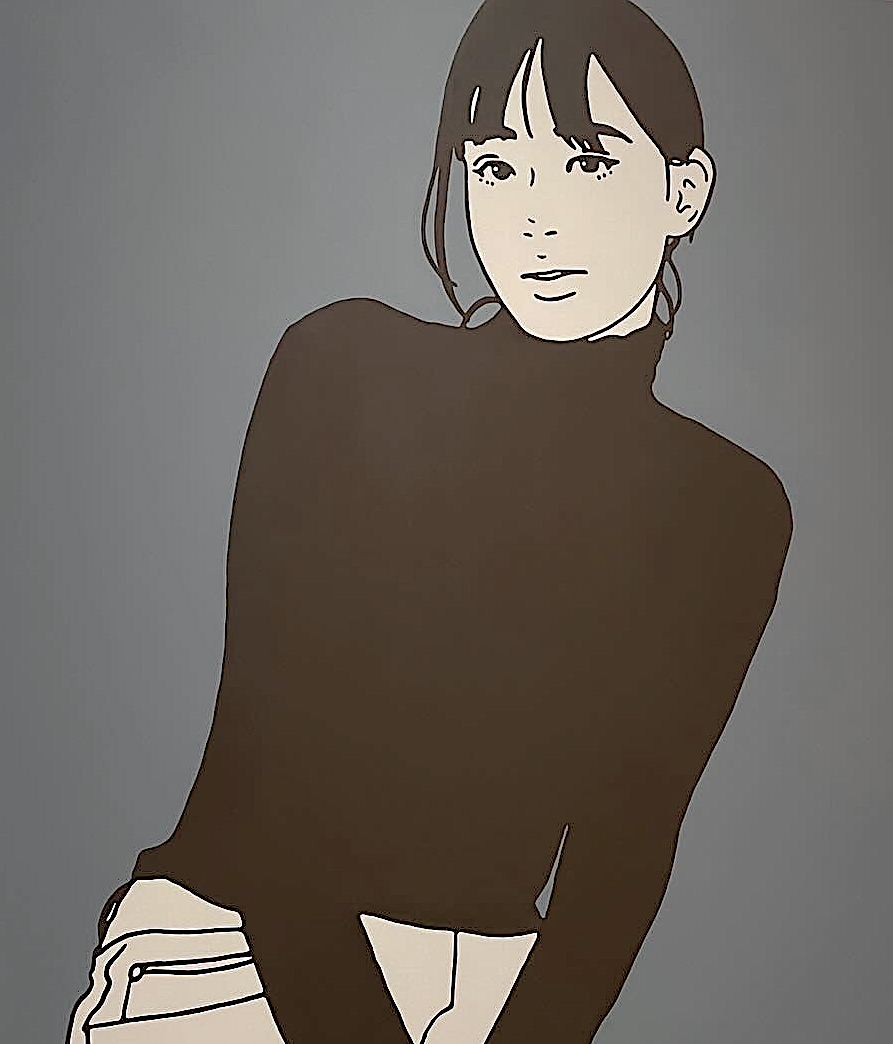

Slowly but steadily, street artist KYNE キネ (English pronunciation: “Key” + “Ne” like “never”) provides the Japanese art scene a new gig, a phenomenal paradigm shift regarding local art practice. Coming from Fukuoka 福岡, southern Japan, his illustration paintings capture the Zeitgeist. Having been featured twice on the cover of influential magazine Casa BRUTUS カーサ ブルータス the hype on his works continues to rise.

The dream of a street artist came true. By scrolling through his Instagram account you can watch the fascinating development as a time-lapse. Really fun to look at.

His mentally crucial episode, being insecure if he found the right “touch” or not, can be noticed on the 2nd of December 2013: “This week-end: full risk – “victory or defeat”. When the chance pops up, you truly understands what’s lacking.”

route3boy 今週末が勝負。チャンスが来た時こそ足りないモノがよくわかる。

https://www.instagram.com/p/hbFUYSgJTF/

It is probable that KYNE’s notion of street culture and fashion, which approaches the mood amongst his peers, led him realize in the meantime, that he could continue professionally-wise. How to conquer Tokyo was only a question of time.

First, dear art aficionados, can you guess the creators’ names of the following 20 pictures? Give it a try. You’ll find the answers at the end.

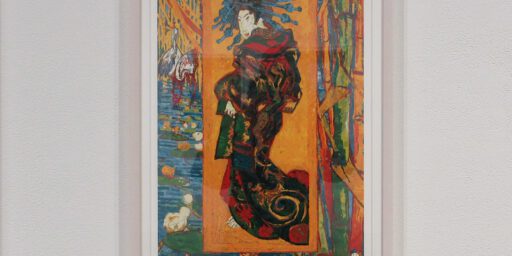

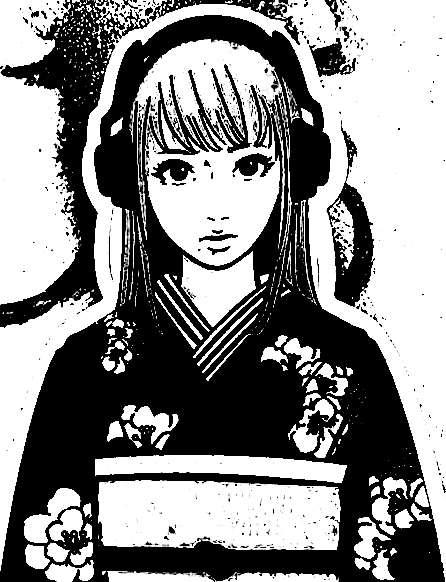

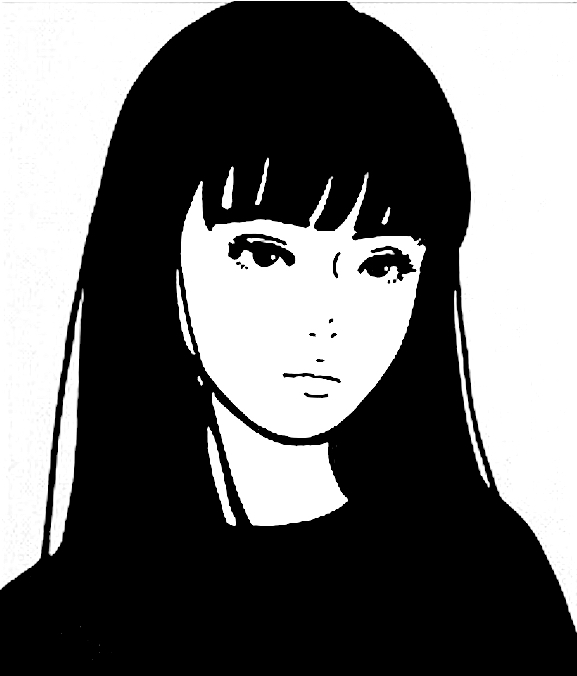

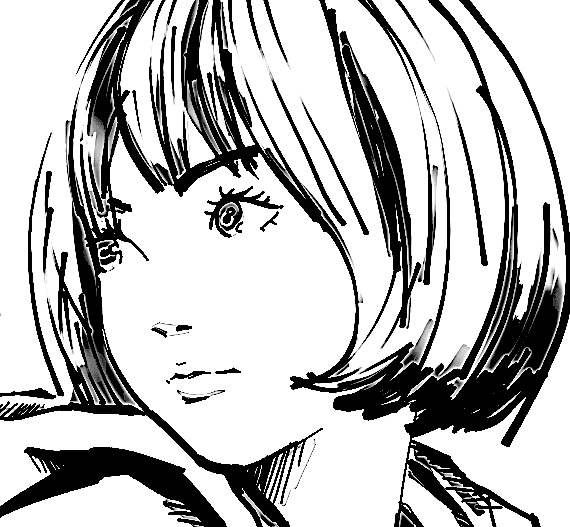

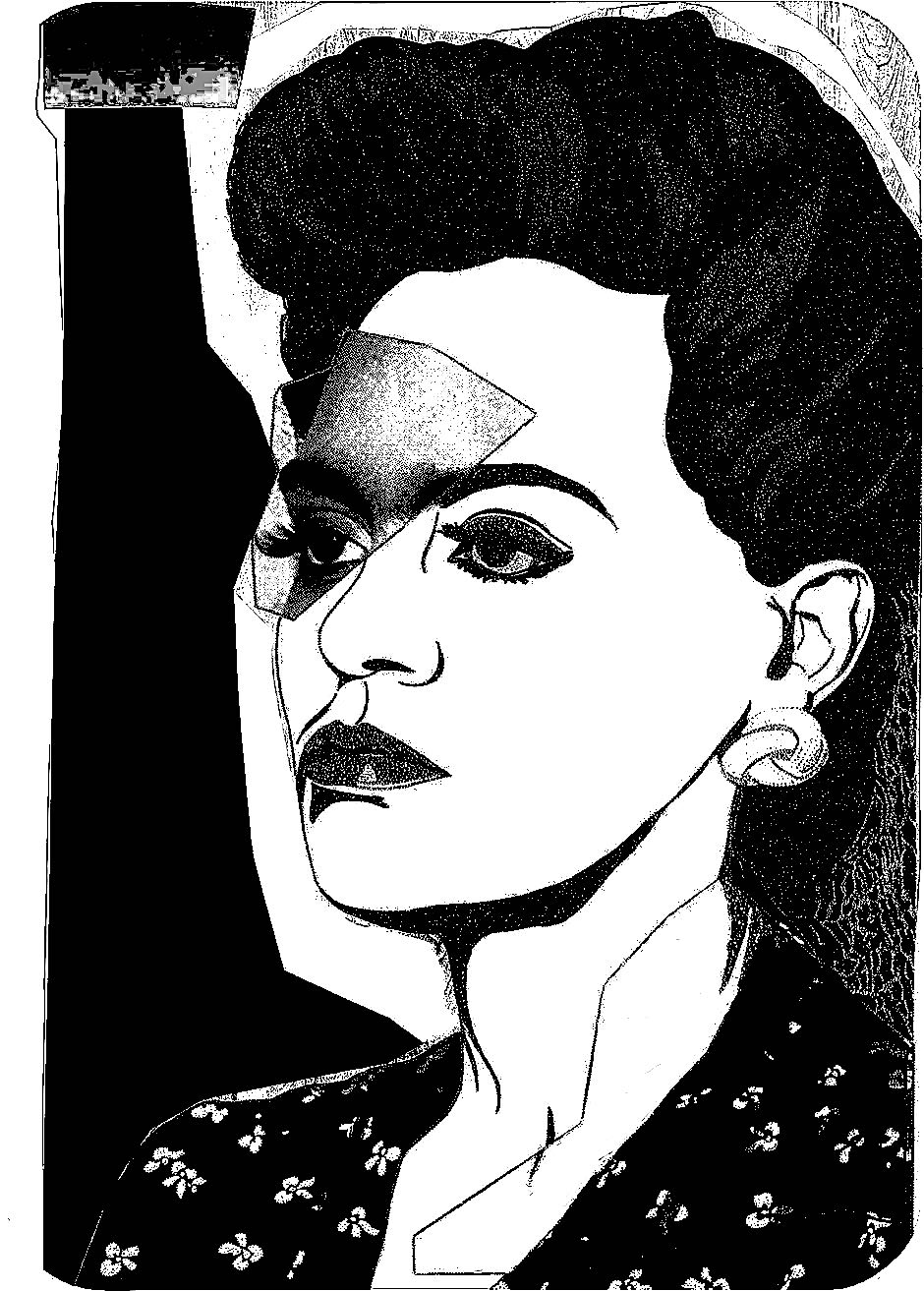

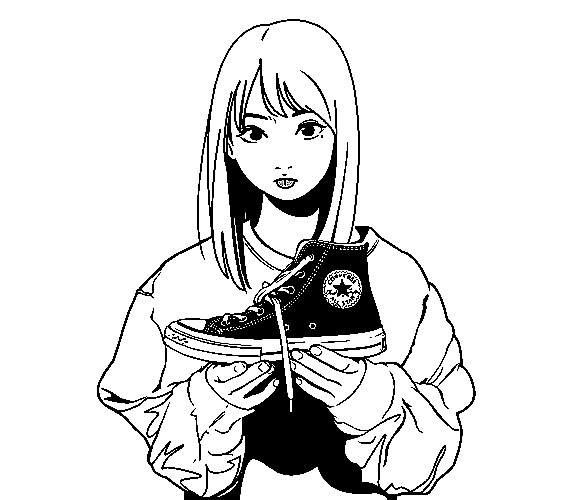

You may have noticed the context of these 20 pics; via subtraction of photographic portraits, everybody can execute similar works. KYNE simply does this kind of illustrative, old method and hit hereby the jackpot by using, for example, kawaii 可愛い, cute Japanese アイドル idols’ faces from the 80’s, copied from record jackets. Slightly altered, with a melancholic, contemporary touch and hair style. For the Manga-initiate, in some cases, visual and content similarities between veteran 江口寿史 EGUCHI Hisashi and KYNE can be seen. Obviously, KYNE denies that kind of influence.

As a reference, you may learn more @

現代日本のオタク文化:名取さな

Contemporary Japanese Otaku Culture: SANA NATORI

https://art-culture.world/articles/japanese-otaku-culture-sana-natori/

Quick to create and easy to sell, as those relatively small, innocuous paintings embody no social or political comment. When he joined the GALLERY TARGET (located in trend-setting Harajuku, Tokyo; showed a.o. Larry Clark and feels close to Warhol’s philosophy) in July 2017, his exhibition attracted some art directors’ attention.

https://www.gallery-target.com/kyne2/

https://www.gallery-target.com

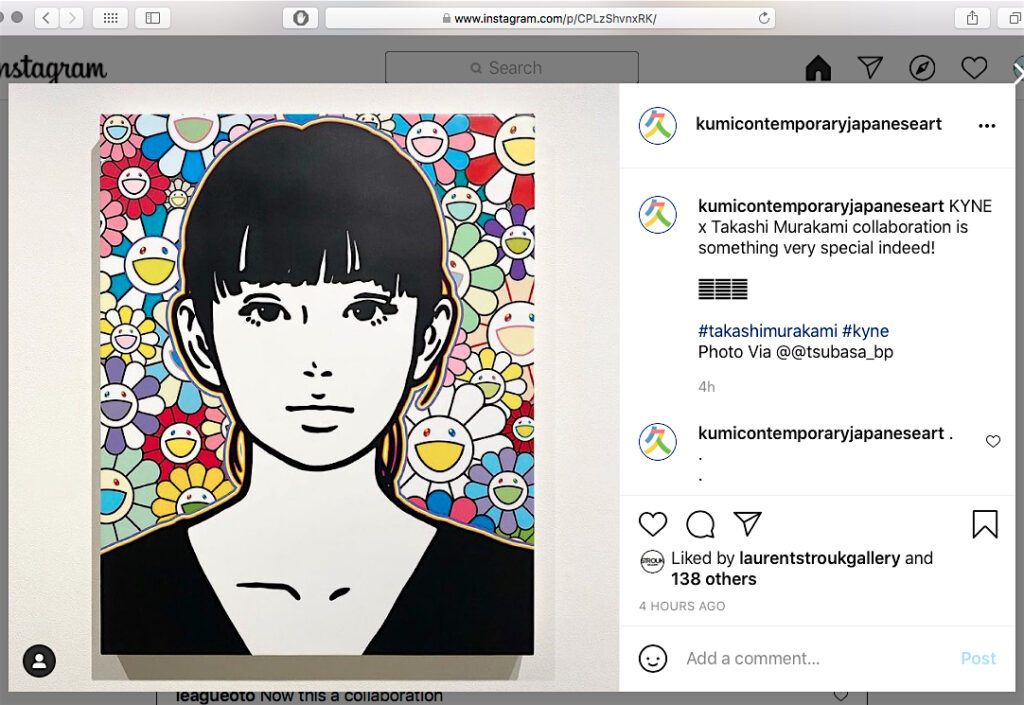

Commission works and a collaboration with MURAKAMI Takashi followed.

https://www.instagram.com/p/CPLzShvnxRK/

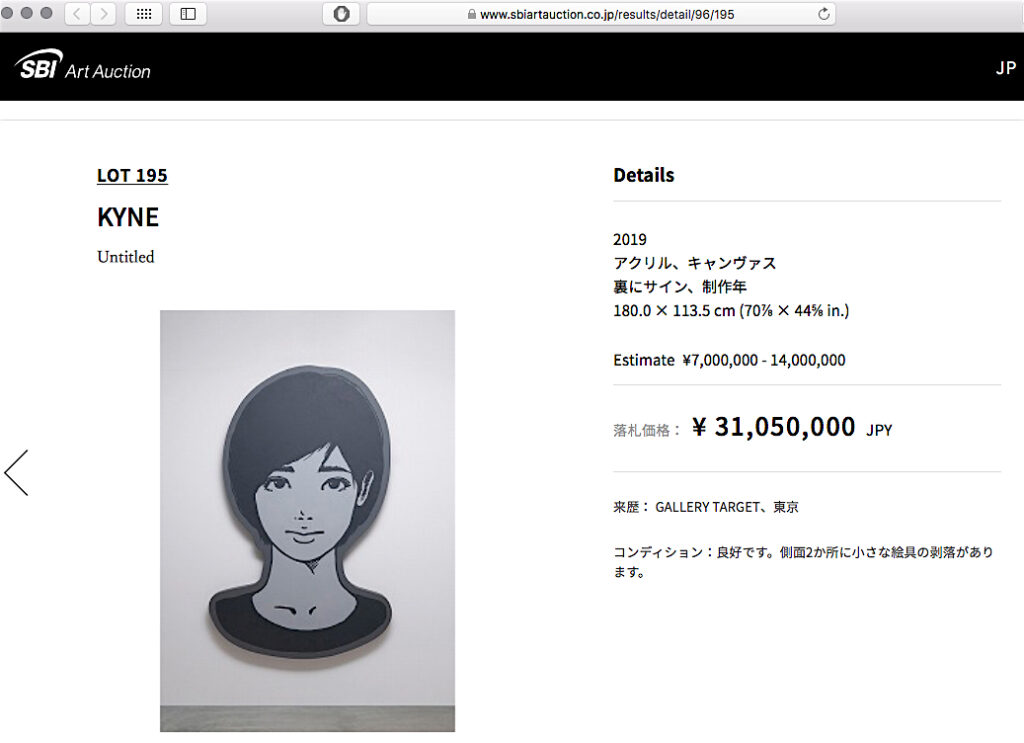

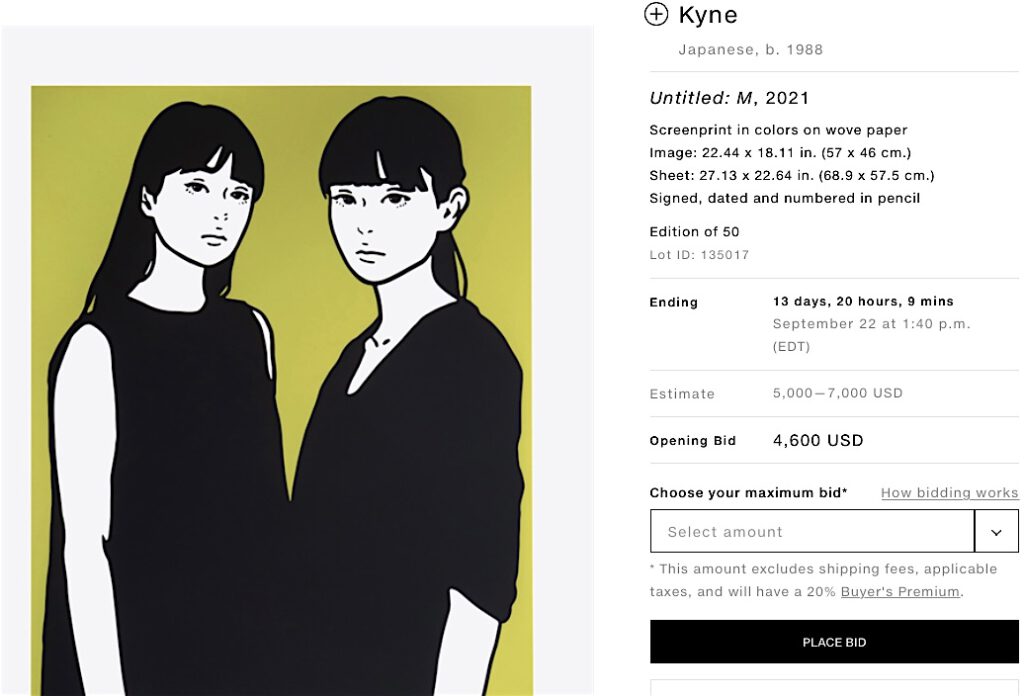

In the meantime several paintings appeared in the auction arena, with the latest hammer price of a painting (“Untitled”, Acryl on canvas, 180.0 × 113.5 cm) executed 2 years ago @ 31.050.000 ¥en (3105万円) or 283.000 US$.

https://www.sbiartauction.co.jp/results/detail/96/195

From what I’ve heard, it seems KYNE gained also a wide following amongst young, male Chinese collectors, who can pay with cryptocurrency.

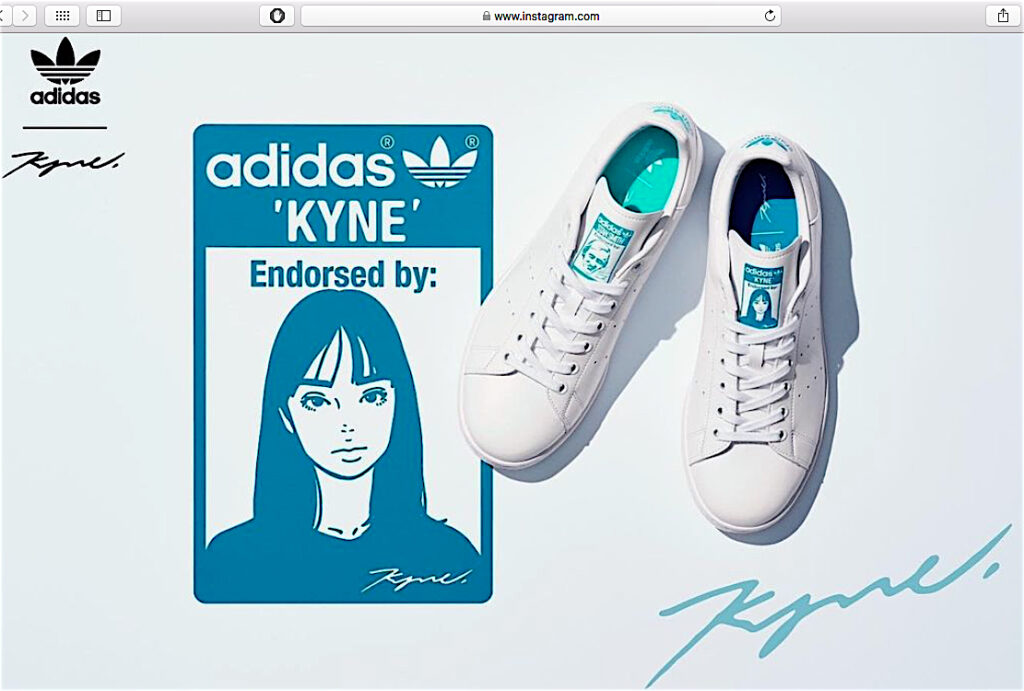

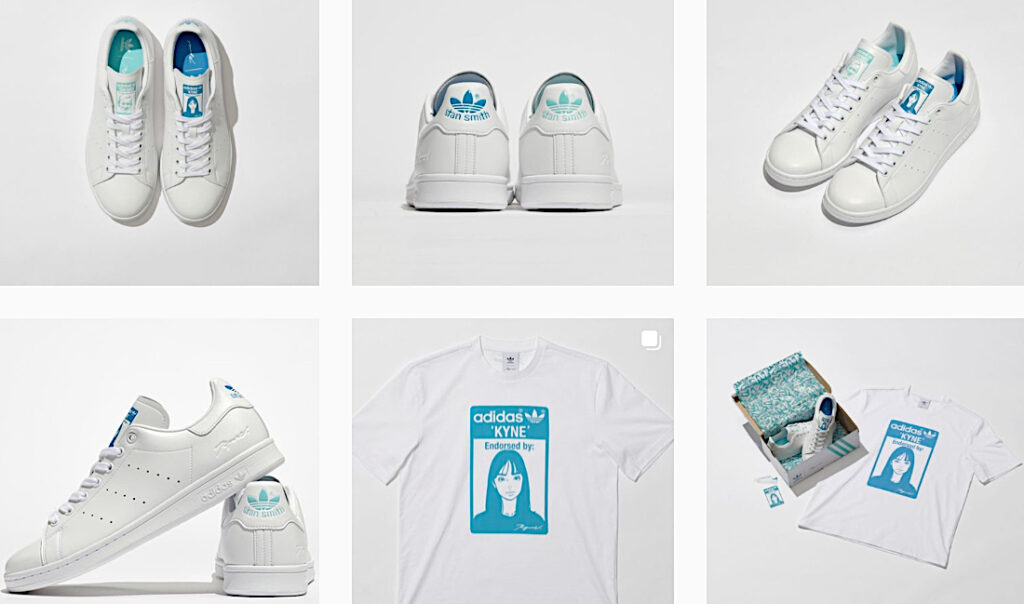

The recent collaboration with adidas enforces KYNE’s paradigm shift in artistic practice, “leaving” the street, joining the realms of art dealer’s business.

His former peers will miss him. His new peers will envy him. KYNE, the cool, highly sought-after, contemporary Zeitgeist Künstler in Japan. His next step could be joining one of the internationally operating mega galleries in the United States of America.

PACE? Watch out.

69’21

Mario A

Check his Instagram account and website

https://kyne.jp

https://www.instagram.com/route3boy/

up-date 2021/9/8

https://www.artnet.com/auctions/artists/kyne/untitled-m

ここに載せた写真とスクリーンショットは、すべて「好意によりクリエーティブ・コモン・センス」の文脈で、日本美術史の記録の為に発表致します。Creative Commons Attribution Noncommercial-NoDerivative Works photos: cccs courtesy creative common sense

1 Backside works.

Sticker on a graffiti wall in Tokyo (thx to and courtesy by Tsukasa Miyazaki)

2 Julian Opie

3 Julian Opie

4 KYNE

5 Rainych Ran

check @

Link_https://twitter.com/RainychRan

6 Julian Opie

7 Hotaru

8 Julian Opie

9 Roy Lichtenstein

check the original: MOT now! ベスト オブ東京都現代美術館!素晴らしい100年日本アート展と2010年代に制作された作品群コレクション展!

MOT now! ‘Best of’ the Museum of Contemporary Art, Tokyo! Excellent Exhibitions ‘100 Years of Japanese Art’ + ‘New Acquisitions in Recent Years’!

https://art-culture.world/articles/mot-now-best-of-the-museum-of-contemporary-art-tokyo-東京都現代美術館/

10 Rainych Ran

11 KYNE

12 Rainych Ran

13 EGUCHI Hisashi

14 Andy Warhol

15 EGUCHI Hisashi

16 Mickalene Thomas

17 Bettmann

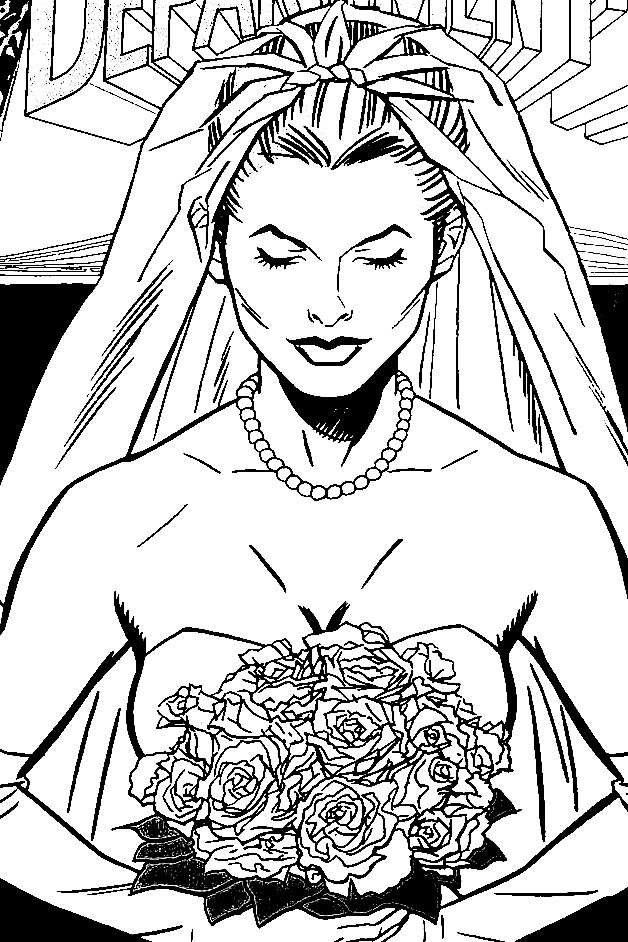

18 DepartmentH Flyer

19 KYNE

20 Backside works.

Link_https://twitter.com/route3boy/status/1616052026609381377

ヤフオク3連敗。

Up-date 2023/5/11

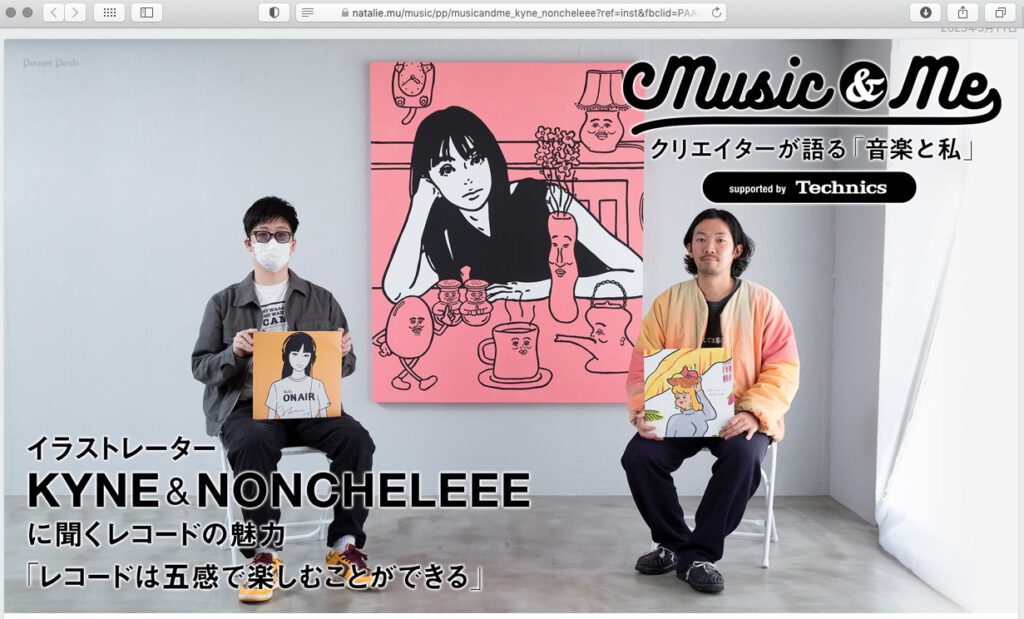

「Music & Me ~クリエイターが語る音楽と私~」第3回|イラストレーターKYNE&NONCHELEEEに聞くレコードの魅力 – 音楽ナタリー 特集・インタビュー

2023年5月11日

screenshot. ここに載せた写真とスクリーンショットは、すべて「好意によりクリエーティブ・コモン・センス」の文脈で、日本美術史の記録の為に発表致します。Creative Commons Attribution Noncommercial-NoDerivative Works photos: cccs courtesy creative common sense

さまざまなクリエイターに話を聞き、音楽と創作活動の分かちがたい関係を探る企画「Music & Me ~クリエイターが語る音楽と私~supported by Technics」。第3回は福岡を拠点に活躍するイラストレーターKYNEとNONCHELEEEをゲストに迎えてお届けする。iriのジャケットでもおなじみ、モノトーンの線画でクールな表情の女性を描く独自のスタイルで国内外のアートシーンで人気を集めるKYNE。一方のNONCHELEEEも、cero、YOUR SONG IS GOOD、FNCYといったアーティストのビジュアルを手がけ、そのユーモラスかつ味わい深いタッチで注目を浴びている。2人の独創的な作風は福岡の地でどのように育まれていったのだろうか? 彼らが運営しているON AIRにて、Technicsのターンテーブル「SL-1200」シリーズの最新モデル「SL-1200MK7」でお気に入りのレコードを聴いてもらいつつ、話を聞いた。

more @

https://natalie.mu/music/pp/musicandme_kyne_noncheleee

【Music & Me ~クリエイターが語る音楽と私~】第3回 KYNE / NONCHELEEE

Hiroshi Fujiwara – TERRITORY (OFFICIAL MUSIC VIDEO)

January 2023:

Price: 363万円 Yen 3.630.000 + tax

Price: 550万円 Yen 5.500.000 + tax

Price: 330万円 Yen 3.300.000 + tax

see:

銀座のギャラリー EARTH 2 GALAXY Gallery in Ginza

https://art-culture.world/articles/earth-2-galaxy/

April 2024 up-date

My question about the price got the following answer by the staff: “adidas ‘KYNE’ Endorsed by: Kyne” from 2021, (adidas Stan Smith x KYNE, Silkscreen Print A) edition 29/30 = 350万円 3.500.000 Yen + tax; as of April 2024.

NEWS / MARKET 2024.1.19

落札総額は約52億円。SBIアートオークション株式会社が2023年の活動を振り返るレポートを発表

昨年、計7回のオークションを開催したSBIアートオークション株式会社が、2023年の活動を振り返るレポートを公開した。

https://bijutsutecho.com/magazine/news/market/28342

Ultra Contemporary Art Market

より.jpg)

ここに載せたテクストとスクリーンショットは、すべて「好意によりクリエーティブ・コモン・センス」の文脈で、日本美術史の記録の為に発表致します。

Creative Commons Attribution Noncommercial-NoDerivative Works

Above screenshot and the following text by Katya Kazakina @ artnet: cccs courtesy creative common sense

The Art Detective

‘It’s Not a Soft Landing’: Contemporary Art Prices Come Crashing Down. Is This the End?

Current market conditions challenge the popular belief that art always goes up.

by Katya Kazakina

March 22, 2024

The fog of flipping is lifting, and the emerging landscape is littered with casualties.

Just look at any number of contemporary art auctions that occurred this month. “Contemporary Curated” at Sotheby’s on March 1: 82 percent of lots sold (after 22 lots were withdrawn). “New Now” at Phillips on March 12: 72 percent sold by lot (after 12 withdrawals). “Postwar to Present” at Christie’s on March 13: 73 percent sold by lot (with 8 lots withdrawn). And much of what did sell went for well below previous highs.

“There’s a bit of a carnage in the market at the moment,” one collector told me, as we reviewed the results. “Many things are not selling at all or selling for a fraction of what they used to.”

A glaring example: Emmanuel Taku’s painting Sisters in Pink, which I featured in a column about the soaring prices for emerging African artists two years ago.

The painting first hit the auction block in 2021, the year it was painted, after a couple of rapid-fire flips. It fetched a whooping $189,000 against a top estimate of $35,000.

Its new owner had no such luck this month: Sisters in Pink hammered at just $8,000 against an estimate of $10,000 to $15,000.

Let that sink in: Someone who bought the painting for $189,000 sold it for $8,000 three years later. No, I am not missing a zero.

That stark result got me thinking about how people in the art industry think about prices, myself included.

Over the past two decades, there emerged a perception of art as an alternative asset that could—with the right moves and timing—store value as well as (if not better than) traditional assets like stocks, bonds, and real estate.

But what happens to this narrative when prices come crashing down, as they are now? Why does investment-grade art appear to be a lot less liquid than even two years ago? Are we facing a future where investors may be hard-pressed to recoup their money? How did we get here?

I will examine these topical questions in a series of articles. But first, allow me to backtrack.

When I started on the art-market beat at Bloomberg in 2006, discussing prices was considered borderline gauche. I had to jump through all kinds of hoops to get prices from the galleries. At art fairs, many dealers would take one look at my press badge and clam up.

Things changed as the financialization of art became a huge story. Auction houses and galleries realized that they could generate a lot of publicity with big prices. Here are some typical Bloomberg headlines from years past:

– “$110 Million Basquiat Sold by Family Who Bought It for $19,000”

– “A Brass Sculpture Could Deliver a 1,400,000% Return for Heirs”

– “How to Handle the $85 Million Gain From That Basquiat Windfall”

I once worked with an editor who pioneered art-market coverage at the Wall Street Journal in the 1970s. He urged me to do a story about the market’s big problem: liquidity. “Art is very hard to resell,” he said. I shrugged it off, laser-focused as I was on art as an investment.

Now I am finally doing it—or, at least, dipping my toes into this massive topic. I was tempted to call it “the art market’s dirty secret,” but no one I spoke with seemed surprised.

“I’d say that 85 percent or 90 percent of all art is like a new car,” one art advisor told me. “As soon as you roll it off the lot, it’s worth a lot less—except for the very rare collectors’ cars that have waiting lists and, for the time being, are worth a heck of a lot more.”

The advisor, who has a thriving business, asked not to be named, and it’s easy to see why. The transactional fever of the past two decades has been built on the notion that art rivals stocks and real estate as an investment.

Fractional-ownership companies like Masterworks are selling the dream to small investors, while art funds target wealthy ones with blue-chip trophies, and art bros speculate on hot emerging names. Market insiders just kept smiling and ringing the register. Cha-ching!

Over the past year, I began hearing concerns about a growing disconnect between the primary and secondary markets. Primary prices have gotten so high for many artists that they cannot be resold for a profit any longer, sources told me.

That complaint speaks volumes about this investment-obsessed moment in the art world.

“Until relatively recently, the common wisdom was that if art held its value over time, that was a success,” an auction executive said. “Most importantly, you had the pleasure of living with it, and if you could sell it years later and get your money back, that was impressive.”

The newer narrative has been seductive for all involved. Headlines touting major returns have convinced many that buying art low and selling high is a walk in the park.

It isn’t.

“If you are lucky, and if you buy smartly,” the advisor likes to remind clients, “one of the 10 things in 20 years will pay several times over and will pay for the rest of your art collection that might be worth next to nothing.”

There are plenty of cautionary tales: Anselm Reyle, Zombie Formalism, and more recently, Rudolf Stingel and Wade Guyton, whose markets suffered in the aftermath of the Inigo Philbrick fraud.

Galleries work hard to create the imprimatur of value by building up their brands and placing prized artworks in prestigious collections, museums settings, and biennials. An entire ecosystem is there to reinforce the belief that art goes up.

“The average rich person wants to believe that it’s true,” another advisor said.

Just a few examples can demonstrate the actual reality.

Take Pat Steir, a revered octogenarian whose 14 new paintings at Hauser & Wirth in Los Angeles sold in 24 hours, I hear, at prices ranging from $700,000 to $850,000. A quick search of the Artnet Price Database reveals that just 10 works by Steir (out of the 167 listed) fetched more than $700,000 at auction. The artist’s auction record of $2.3 million was set back in 2018.

Ditto Frank Stella. On March 1, a massive sculpture he made in 1982 was sold without a reserve at Sotheby’s for just $48,260 against a low estimate of $150,000. His new works are currently priced at $2.5 million at Jeffrey Deitch in New York. “They cost so much to make that the asking price is not that much more than the fabrication,” Deitch said. “When people seeing these new works they are stunned.”

Ditto Oscar Murillo, whose new paintings have been sold by David Zwirner for $350,000, $400,000, and $500,000, according to Artnet’s invaluable Price Check column. Meanwhile, Murillo’s recent auction prices are a fraction of those figures. Since the pandemic, 50 paintings by the Colombian artist came up for sale and a quarter flopped—including, most recently, a painting at Phillips in London that was estimated at £50,000 to £70,000 ($63,000–$88,000), according to the Artnet Price Database. His auction record, $401,000, was set in 2013.

Ditto Dan Colen, another erstwhile speculators’ darling, whose large-scale painting Vengeance (2015) from Miami’s esteemed de La Cruz collection, recently fetched $15,400 at Sotheby’s. New paintings of its size retailed for $450,000 on the primary market, according to people familiar with his pricing. It’s safe to assume that the mega collectors got a mega discount, but even so, the question looms: Why would the market-savvy family take such a huge loss? (The answer will have to wait: Sadly, Rosa de la Cruz died last month.)

Ditto Loie Hollowell, who has her first museum show at the Aldrich in Ridgefield, Connecticut, right now. Her painting Lick Lick in Blue, Green and Yellow (2015), estimated at $500,000 to $700,000, didn’t find a taker at Christie’s earlier this month.

This could go on and on, including artists at every price point and career stage. Here are some whose works didn’t sell at the most recent Phillips auction: Robert Rauschenberg, Hank Willis Thomas, Lisa Yuskavage, Vaughn Spann, Peter Saul, Petra Cortright.

“It’s not a soft landing,” Deitch said of the current market conditions.

How do collectors feel about this? Naturally, opinions vary.

Many agree that primary prices have gotten too high. Some are clearing out their art storage and dumping the contents at auction before it all goes down to zero. Others don’t concern themselves with the market.

“I don’t buy art because I think that the prices are going to go up,” said Beth Rudin DeWoody, a veteran collector and philanthropist. “There are a lot of young artists. I have no idea what’s going to happen with their careers. I like to support young artists or artists who’ve been overlooked. Sometimes they do go up and sometimes they don’t.”

Evan Ruster, who’s been collecting for more than two decades, considers himself lucky when it comes to his art acquisitions. He’s made a couple of shrewd sales along the way, but doesn’t buy art with a plan to resell it.

“You are buying because you love it,” said Ruster. “It’s a passion. So you are not rational in a way.”

How do you price art, anyway?

“It’s so subjective,” Ruster said. “You are like: I just bought a piece of paper with some marks on it. I could have bought a fucking Audi.”

https://news.artnet.com/market/primary-versus-secondary-market-prices-2455677

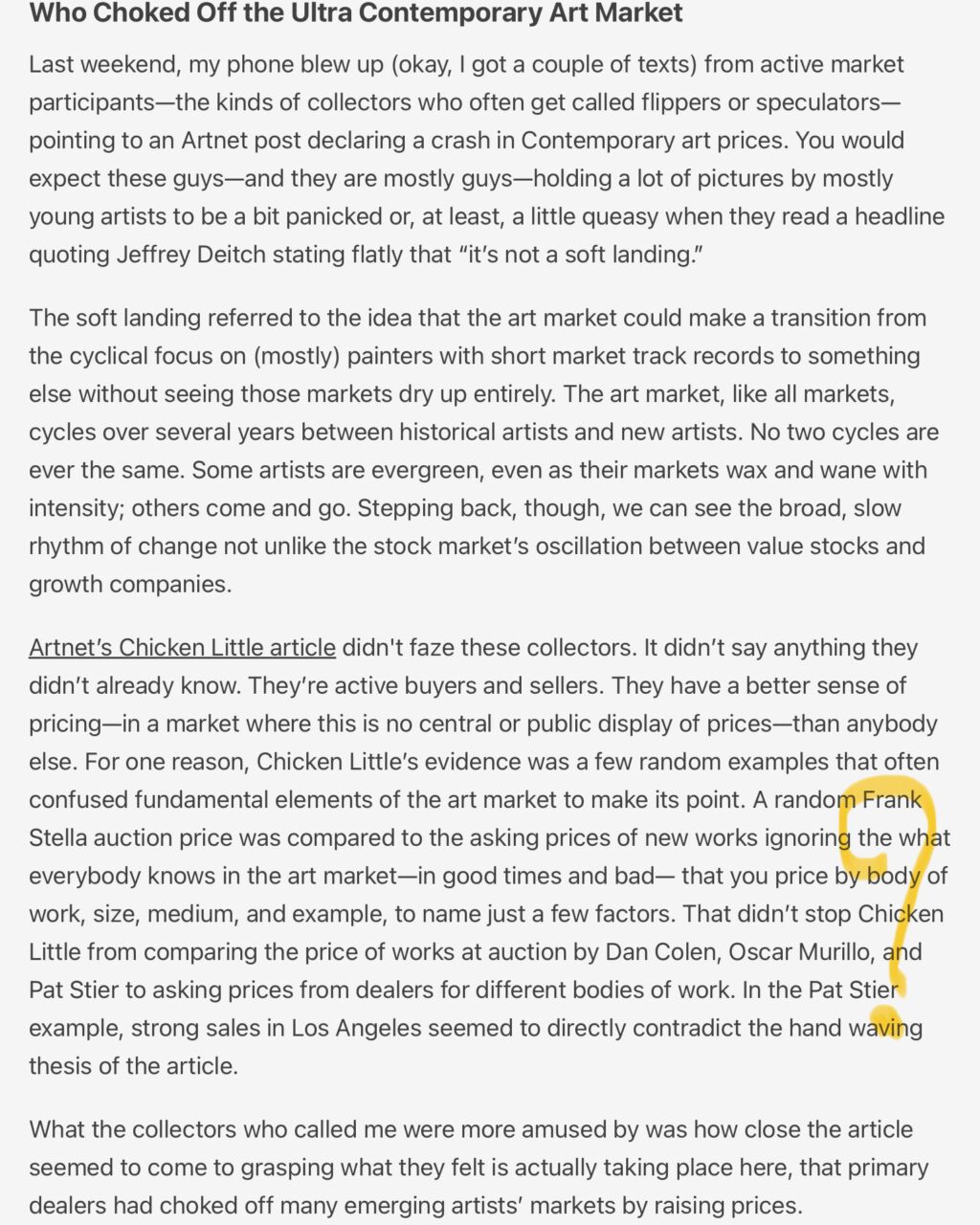

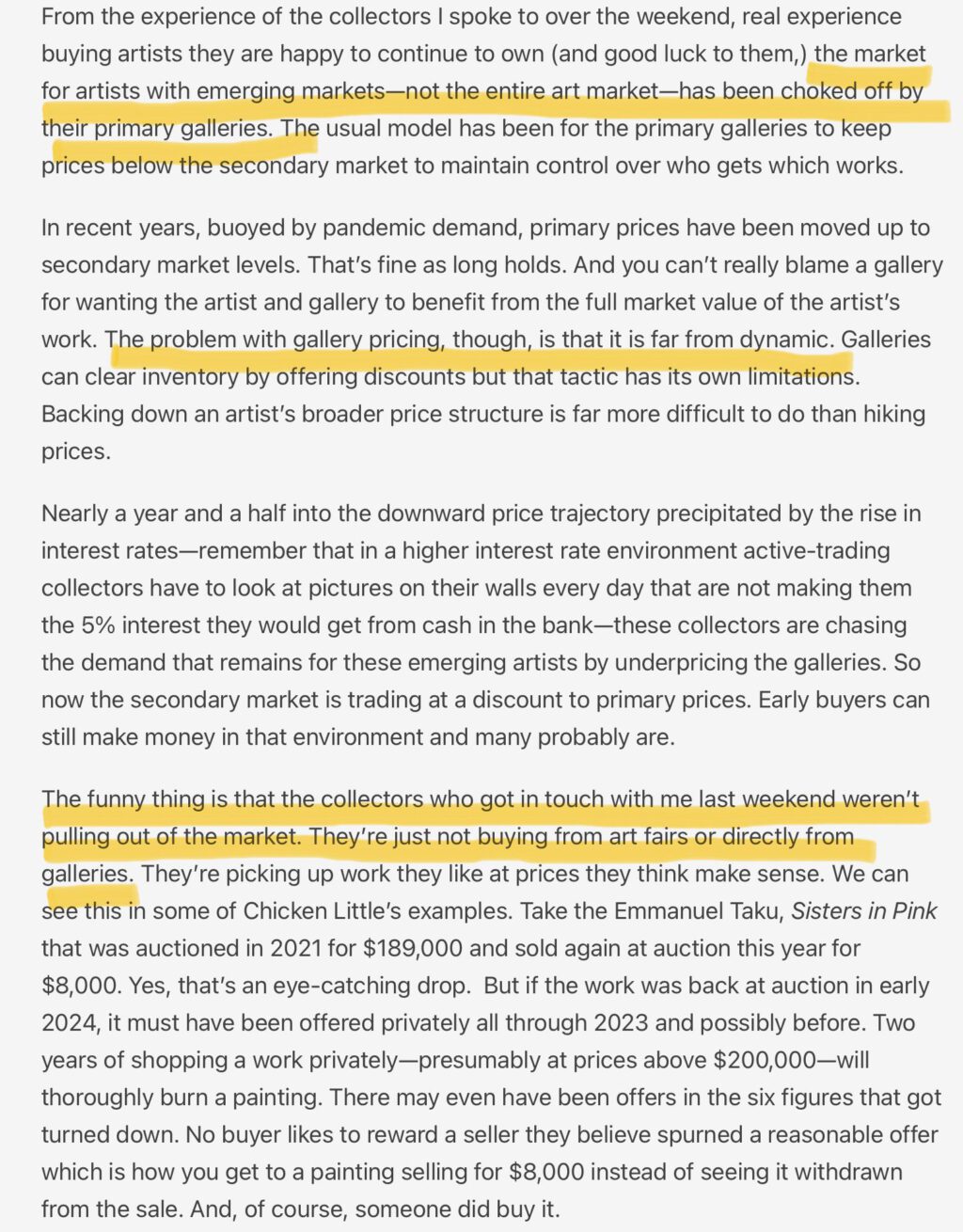

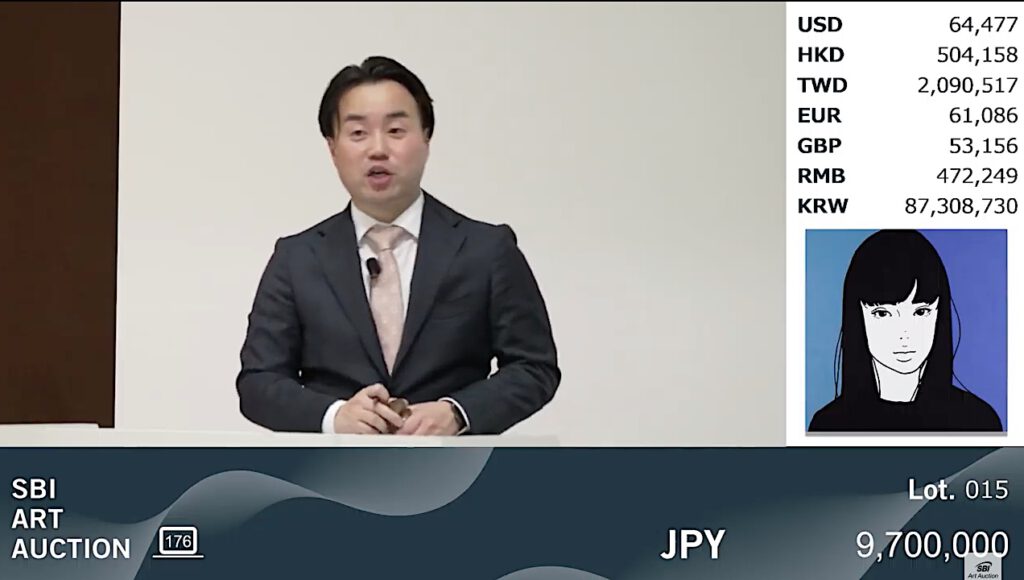

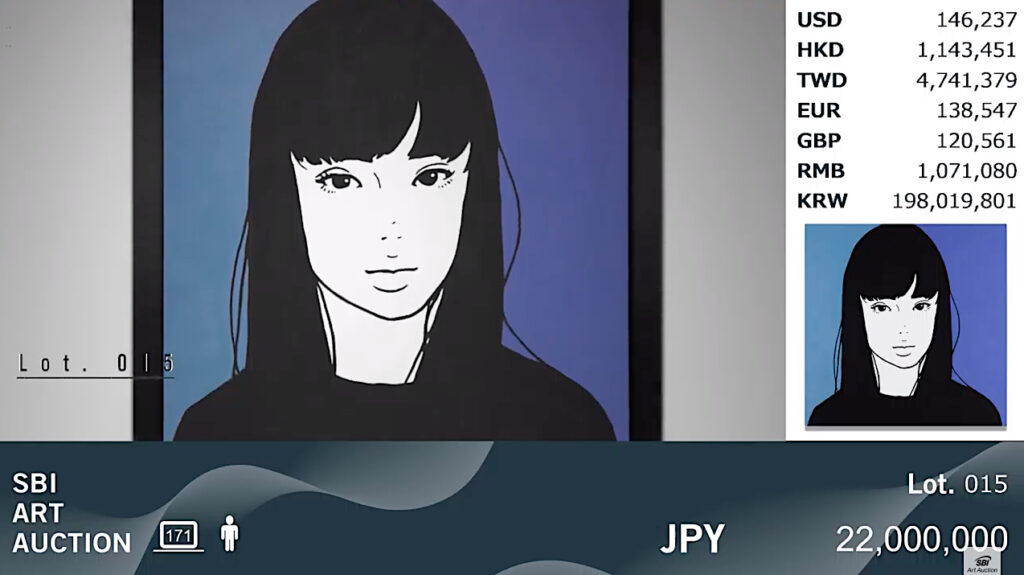

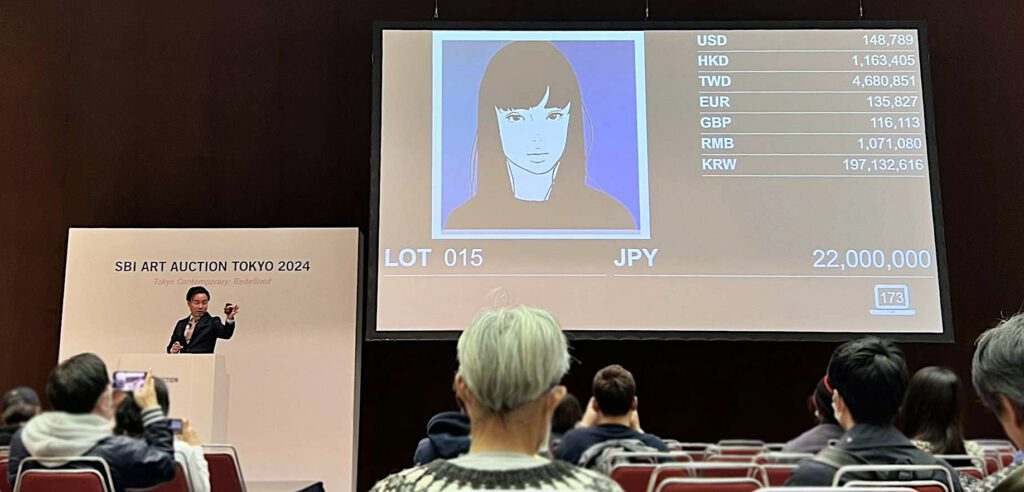

https://www.sbiartauction.co.jp/en/auction/detail/110/172

Provenance: GALLERY TARGET, Tokyo

Exhibited: July 20 – August 4, 2017 “KYNE TOKYO” GALLERY TARGET, Tokyo

Quote from BT 美術手帖:

KYNEの50号キャンバス作品は、版画の原画ということもあり、エスティメイト1000万~1500万円のところ、日本語の電話を抑え、2200万円で会場のビッダーが落札している。

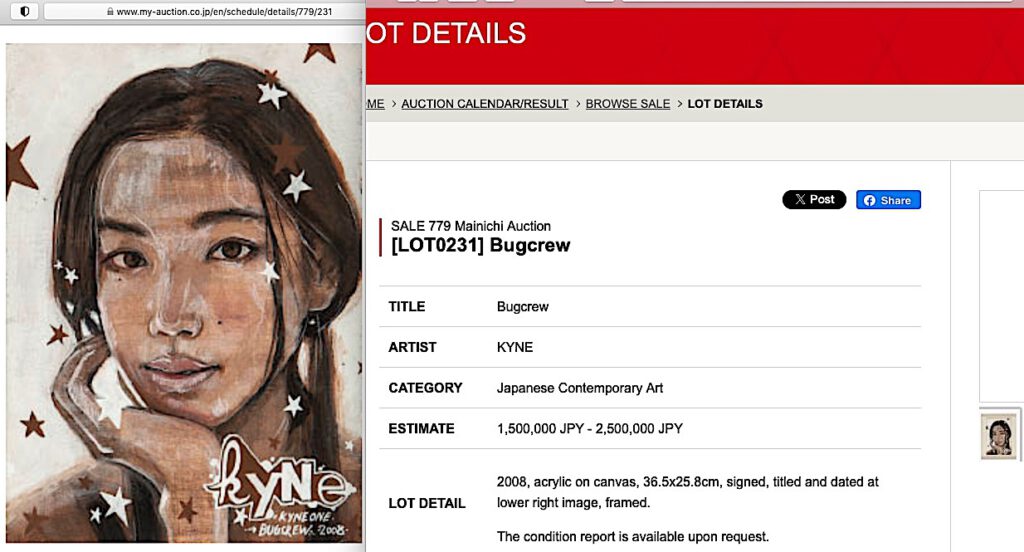

KYNE Bugcrew 2008

Kyne (Japanese, born 1988)

Title: Bugcrew, 2008

Medium: acrylic on canvas

Size: 36.5 x 25.8 cm. (14.4 x 10.2 in.)

Sale: Paintings, Prints and Sculpture, Saturday, April 27, 2024,

Lot 231

Estimate: Est. 1,500,000–2,500,000 JPY

(9,522–15,869 USD)

Price: Bought In

https://www.artnet.com/artists/kyne/bugcrew-QKJiT9-9axmCb5uOcGUqiQ2

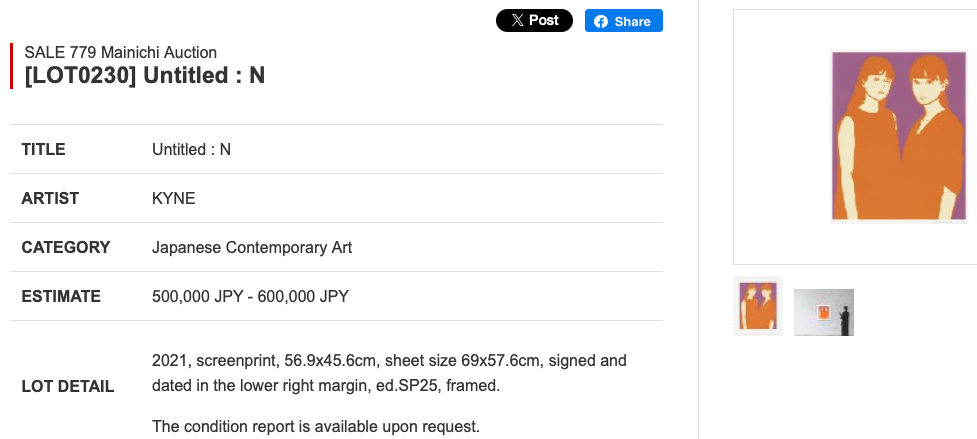

Kyne (Japanese, born 1988)

Title: Untitled : N | Untitled:N, 2021

Medium: screenprint

Edition: SP25

Size: 56.9 x 45.6 cm. (22.4 x 18 in.)

Sale: Paintings, Prints and Sculpture, Saturday, April 27, 2024,

Lot 230

Estimate: Est. 500,000–600,000 JPY

(3,174–3,809 USD)

Price: Bought In

https://www.artnet.com/artists/kyne/untitled-n-untitledn-dbXR4UFDB-xMtj9q0MbUlQ2

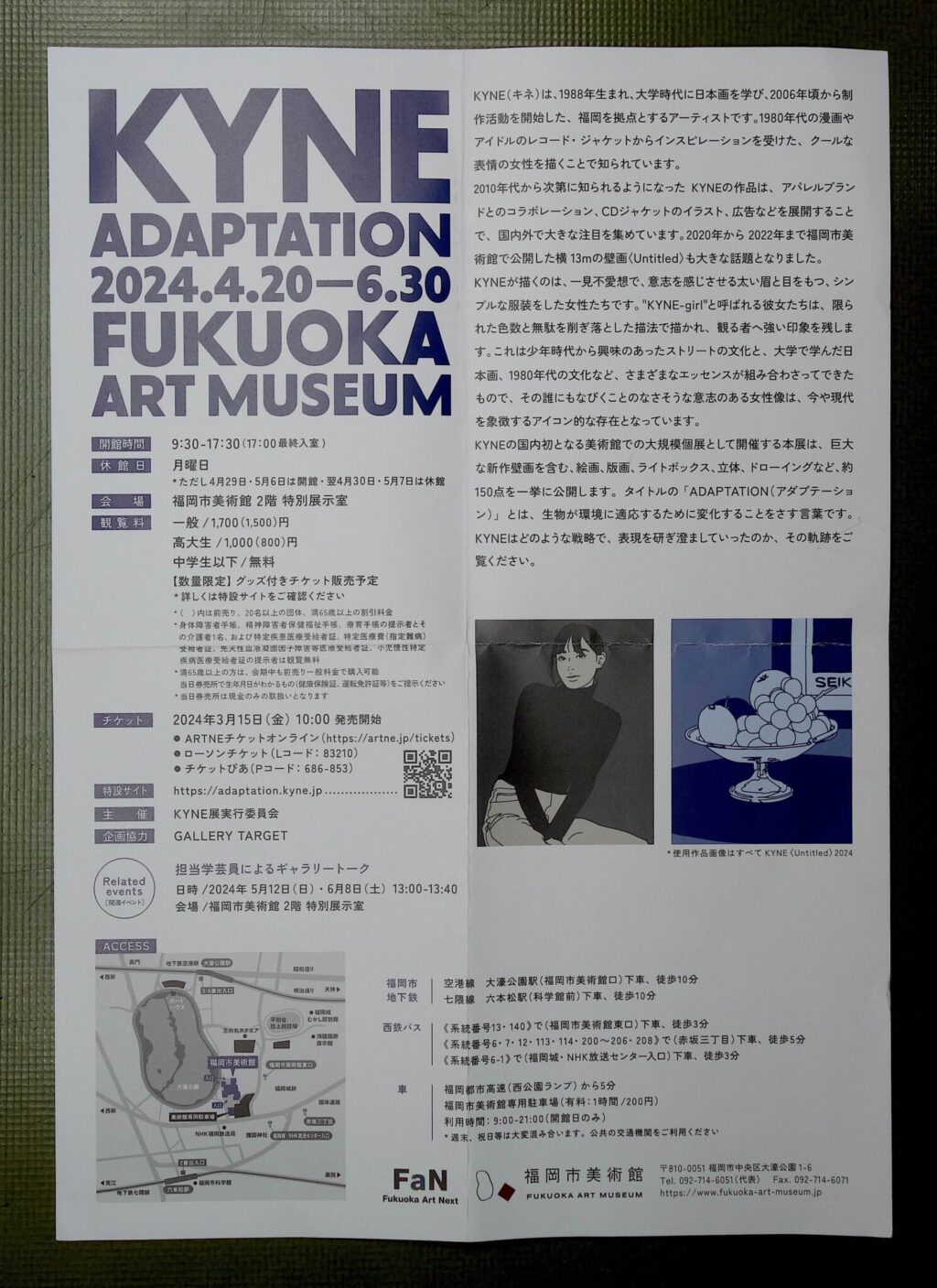

ADAPTATION – KYNE @ Fukuoka Art Museum

2024/4/20 〜 6/30

https://www.fukuoka-art-museum.jp/en/exhibition/adaptation-kyne-2/

Fukuoka-based artist KYNE has attracted much attention in Japan and abroad for his paintings of women with cool, quiet expressions. As KYNE’s first large-scale solo show in Japan, this exhibition brings his early and latest works together, inviting viewers to explore the fascinating world of his art.

講演会

「ADAPTATION – KYNE」トークセッション

日時 2024年5月25日(土)

午後2時~午後3時30分

※13:30から受付開始

会場 1階 レクチャールーム

料金 参加無料、ただし本展観覧券(または半券)もしくはQRチケット画面の提示が必要。

申込方法はこちら

定員 54名

講師 KYNE氏(アーティスト)

特別展「ADAPTATION – KYNE」の開催を記念して、KYNE氏によるトークセッションを開催します。

[聞き手]岩永悦子(福岡市美術館 館長)

※状況により会場が変更となる場合があります。

https://www.fukuoka-art-museum.jp/event/132428/

up-date 2024/9/24

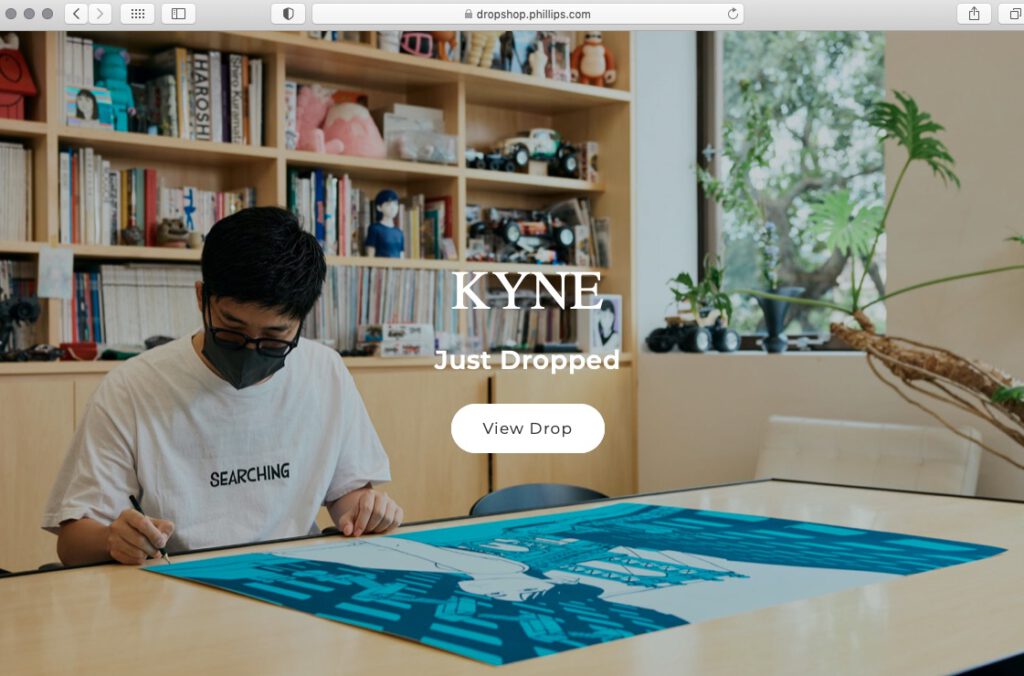

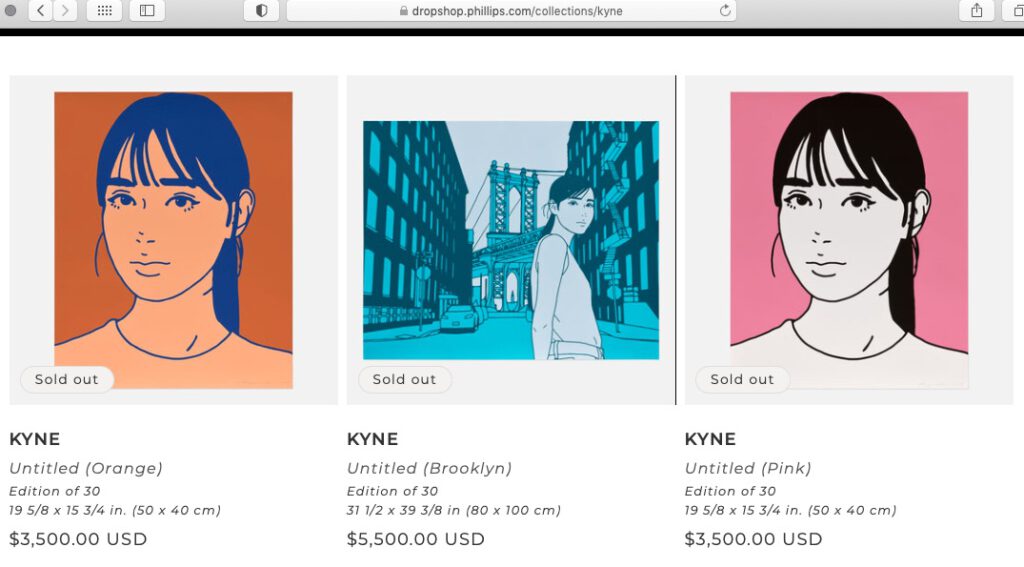

PhillipsX together with DROPSHOP is pleased to present KYNE Paintings for the Drop featuring the artists’ iconic figures within the metropolitan landscape of New York City, and by an equally iconic landmark: the Manhattan Bridge.

KYNE’s ever-changing approach to art making has prompted multiple partnerships with Japanese streetwear brands and even Takashi Murakami. In his debut collaboration outside of Japan, DROPSHOP x KYNE also includes two additional portraits: one in pink and one in orange – that will bring KYNE’s style to the forefront of the American art market.

KYNE. The Artist in his studio. 2024

https://exhibitions.phillips.com/collections/kyne-new-york

CONTACT

Takako Nagasawa

Senior International Specialist

Modern & Contemporary Art Department

tnagasawa@phillips.com

KYNE

Untitled (Brooklyn)

Regular price $80,000.00 USD

Sold

signed and dated “KYNE ’24” on the reverse

acrylic on canvas

51 1/4 x 63 3/4 in. (130.2 x 161.9 cm)

Painted in 2024.

https://exhibitions.phillips.com/products/untitled-brooklyn

ここに載せた写真とスクリーンショットは、すべて「好意によりクリエーティブ・コモン・センス」の文脈で、日本美術史の記録の為に発表致します。Creative Commons Attribution Noncommercial-NoDerivative Works photos: cccs courtesy creative common sense