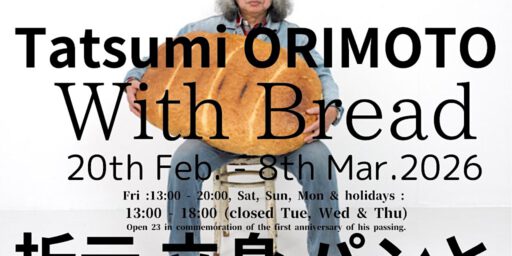

#USABS U.S. ARTY BULL SHIT. NFTデジタル・アーティスト ビープル:「美術史の流れを変えたい」や「悪役である」というメリット #USABS。NFT Digital Artist Beeple: "I want to change the course of art history" and the merit of "being the bad guy"

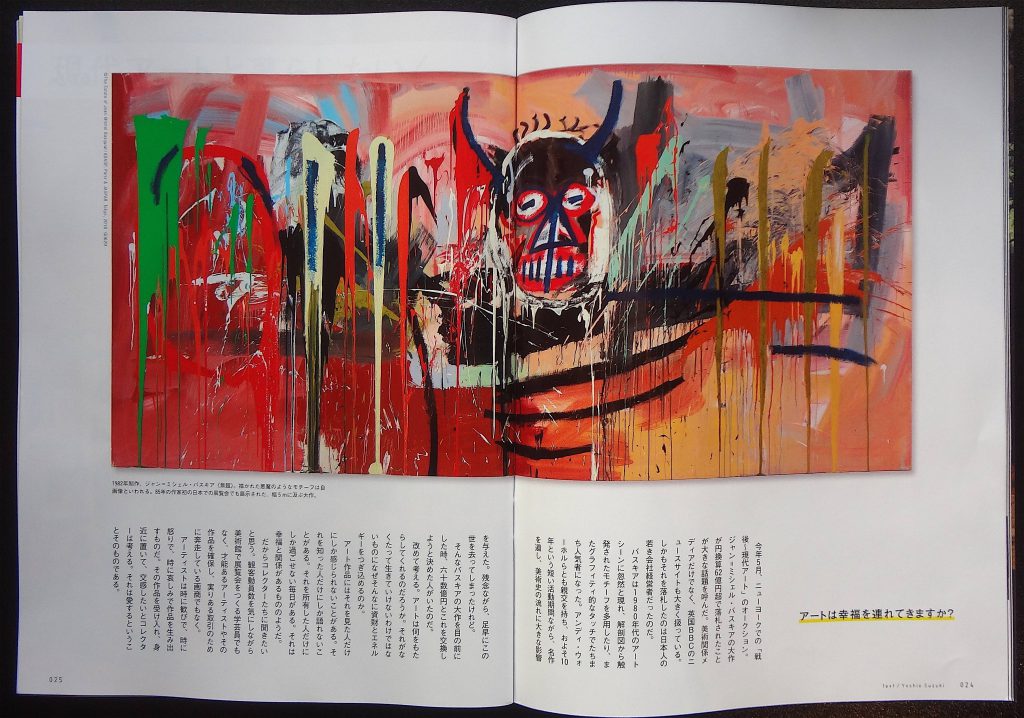

アート業界の関係者がNADAマイアミフェアに集まる中、最近になってようやく作品がディーラーや機関に受け入れられるようになったアウトサイダーであるBeepleとPeter Saulが、Bass美術館で対談を行いました。ソウルとビープルは、年数、動き、性格、そして作品の媒体によって分けられています。一人はポップの影響を受けた具象絵画を制作し、もう一人は過去1年間に数百万ドルで販売されたNFTを制作しています。

しかし、2人の作品には意外な人物が登場します。それは、ハンバーガーが大好きなドナルド・トランプ氏です。SaulとBeepleは、トランプの混沌とした性格を受け継ぎ、それを増幅させて、ある種の少年らしさを加えているのです。

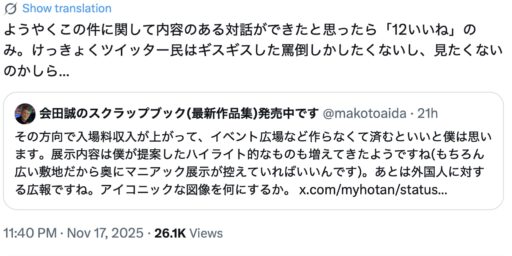

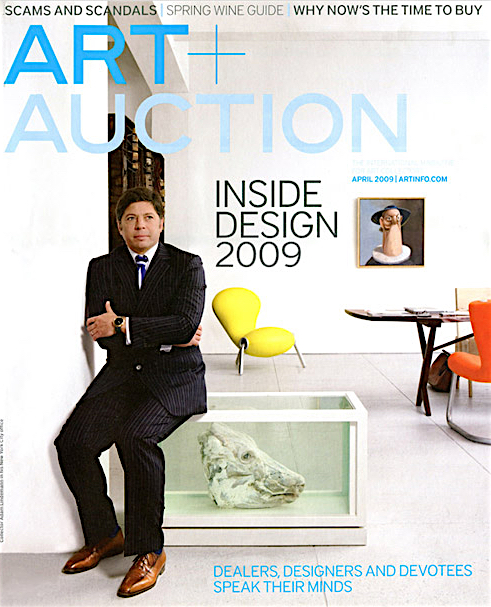

二人の対談は、「キュレーター・カルチャー、ビープル&ソール、15分か永遠か?と題した対談は、コレクターのアダム・リンデマン氏が司会を務め、2人のアーティストに作品の物議を醸すような側面について語ってもらいました。例えば、アンジェラ・Y・デイヴィスを十字架に描いたことで、彼の作品が人種差別的、性差別的であるという疑惑を引き起こしました。(リンデマンに「なぜアーティストになったのか」と聞かれたソールは、「どこに行っても、誰かに定期的に指示されるのは嫌だった」と答えた。つまり、合法的な職業に就くことができなかったので、芸術家になることを選んだのです」。

リンデマンは、ソールもビープルも政治家や億万長者を描く傾向があると指摘したが、ソールは「僕は悪い奴しか描かない」と答えた。60年代の一部の人々が考えていたように、ソールが本当に悪いポップアーティストであるならば、彼はその役割を喜んで演じることを決意したのだ、と彼は説明する。

ソウルは自分の評判を楽しんでいたが、ビープルはそうではなかったようで、「悪者であることが自分にとって完璧に機能しているとは思えない」と言っていた。また、ビープルはリンデマンに訂正を加え、彼の作品が政治的な側面を持つようになったのはここ2年のことだと付け加えた。

ソウルは本質的に少し生意気な性格であるのに対し、ビープルは非常に真面目でまろやかな性格であることが明らかになりました。しかし2人とも、物議を醸すような作品を作ることがビジネスにつながることを理解しているようでした。

ビープルはソーシャルメディアで多くのファンを獲得しており、彼のミームのような、狂気に満ちた作品を支持していました。一方、ソールは、自分の姿勢を端的に表したエピソードを語ってくれました。ジャクソン・ポロックの絵が『ライフ』誌に掲載されたとき、人々はとても憤慨しましたが、それは誠実な仕事とは思えなかったからです。それで、有名になるためには、芸術家として生きるためには……多少のトラブルを起こさなければならない、という考えが生まれたんだ」。

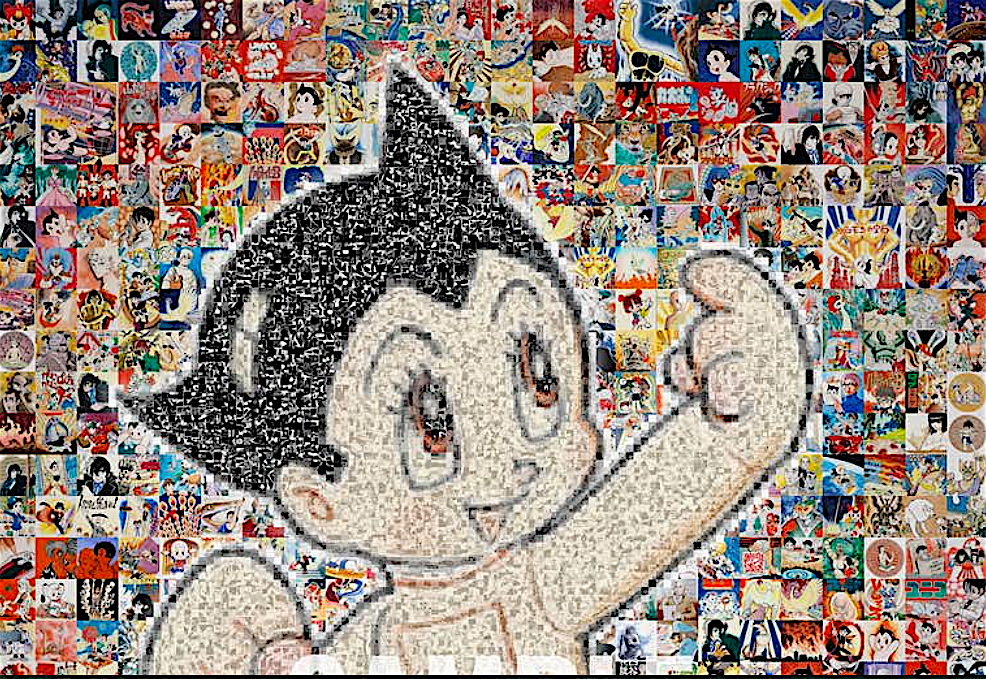

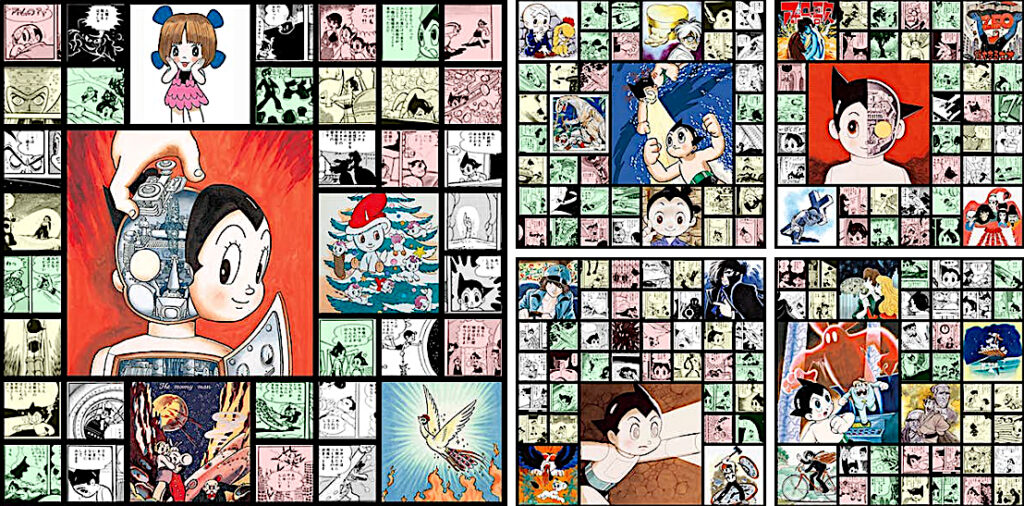

Work by Peter Saul, check this one:

桶田コレクション展 ‘LOVE @ FIRST SIGHT’ @ スパイラル 東京

Oketa Collection exhibition ‘LOVE @ FIRST SIGHT’ @ SPIRAL Tokyo

https://art-culture.world/articles/oketa-collection-exhibition-love-at-first-sight-桶田コレクション/

ビープル:「美術史の流れを変えたい」というメッセージ。こちらのインタビューをぜひ:

Beeple (Mike Winkelmann) the new “phygital” artist about his visions and ambitions…

Jehan Chu, Blockchain and crypto Investor, Hong Kong about Beeple and his art

About NFT and Beeple, check these links:

キュレーター フランチェスコ・ボナミ:バッドアート連邦捜査局に電話してください !!!

Curator Francesco Bonami: Please call FBBA Federal Bureau of Bad Art 1-800-Badart 000 !!!

https://art-culture.world/articles/francesco-bonami/

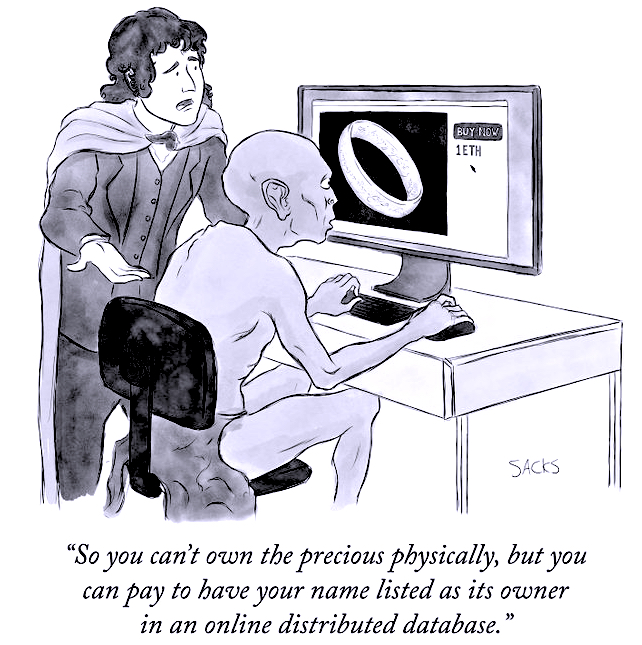

クリスティーズ:ビープルのデジタル作品 NFT(非代替性トークン)「The First 5,000 Days 」69.3 Million 米国ドル

Beeple “The First 5,000 Days” NFT Fetches US$69.3 Million @ Christie’s

https://art-culture.world/articles/beeple-ビープル/

村上隆とNFT:芸術家は、死ぬまでの短い数十年間で、その後何百年も対応可能な作品を作らねばなりません。

MURAKAMI Takashi thinks, to be remembered hundreds of years later, he has to join shitty NFT: “Murakami Flowers” for dumb NFT digital money speculators

https://art-culture.world/articles/murakami-takashi-村上隆-nft-murakami-flowers/

世界のNFT作品70%下落。今日の村上隆:すでに入札をしてくださっていた方々には誠に申し訳ないのですが、より便利に楽しく安心して私のNFT作品を楽しんで頂く為にも、今回の取り下げをご理解頂けますと幸いです。

NFTs prices linked to art down 70%. MURAKAMI Takashi, today: I sincerely apologize to those who have already put in their bids, but I hope you will understand the logic behind this withdrawal, the aim of which is to later allow you to enjoy my NFT works more conveniently and with peace of mind.

https://art-culture.world/articles/murakami-takashi-nft-apology/

NFT デジタル作品 コレクターズ NFT digital artworks collectors

https://art-culture.world/articles/nft-digi-デジタル作品-コレクターズ/

原産のデジタル式。池田亮司の非代替性トークン作の直接販売 @ サザビーズ

Origins of Digital Formula. IKEDA Ryoji’s direct sale of NFT @ Sotheby’s

https://art-culture.world/articles/ikeda-ryoji-池田亮司/

artnet AG

Einführung der ArtNFT: Artnets NFT-Plattform und umfassender ‘Artnet NFT 30’-Bericht am 15. Dezember

– Die On-chain NFT- Auktion wird am 15. Dezember 2021 eröffnet

– Artnets NFT Beirat mit führenden Marktexperten wird bekanntgegeben

– ‘Artnet NFT 30’, ein von Justin Suns ‘APENFT’ geförderter NFT Bericht, wird zeitgleich veröffentlicht

– Artnet News: Branchenführende Journalisten erweitern NFT-Berichterstattung einschließlich Interviews mit wichtigen Akteuren im NFT-Bereich

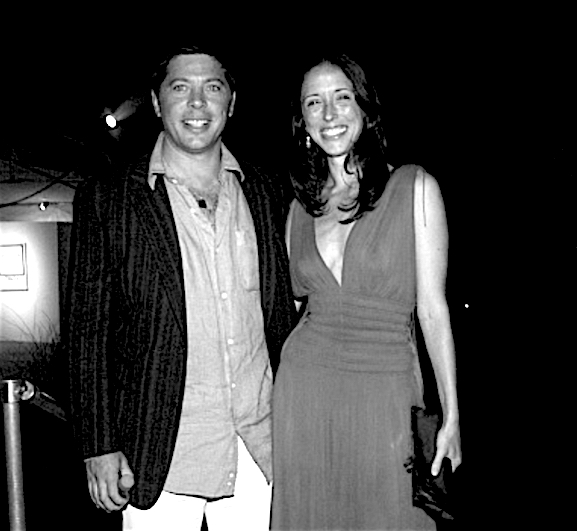

Berlin / New York, 7. Dezember 2021 – Die Artnet AG, der führende Online-Kunstmarktplatz, Anbieter von Kunstmarktdaten und -analysen sowie globaler Nachrichtendienst, freut sich, ArtNFT anzukündigen: die Einführung Artnets erster On-Chain NFT-Plattform, dem NFT-Beirat und dem ‘Artnet NFT 30’ Bericht. “Als Pionier der Online-Kunstbranche ist artnet perfekt positioniert, um den NFT-Bereich zu erobern. Unser Ziel ist es, die Distanz zwischen der Krypto-Community und der traditionellen Welt der bildenden Kunst zu überbrücken”, sagt Colleen Cash, Vizepräsidentin von artnet Auctions.

ArtNFT, artnets erste On-Chain-NFT-Plattform, wird am 15. Dezember 2021 mit einer kuratierten Auswahl von Werken bedeutender NFT-Künstler eingeführt. Als On-Chain-Plattform verfolgt artnet das Ziel, Sammlern eine transparente, effiziente, vertrauenswürdige und integrierte Erfahrung beim Entdecken und Kauf von NFTs zu bieten.

Um die bestmöglichen Werke und das optimale Nutzererlebnis zu bieten, hat artnet einen NFT-Beirat einberufen, der sich sowohl aus Branchenexperten als auch aus Markt- und Meinungsführern in diesem Bereich zusammensetzt.

Zeitgleich zur Einführung der ArtNFT-Plattform wird Artnet auch den von der ApeNFT gesponserten Bericht ‘Artnet NFT 30’ veröffentlichen. In Zusammenarbeit mit den im Kunstmarkt führenden Journalisten des artnet News-Teams und den uns vorliegenden Daten wird der Bericht eine tiefgehende Analyse der NFT-Welt anbieten und auch diejenigen Menschen die am Aufbau des Marktes beteiligt sind, vorstellen.

Mit der gleichzeitigen Veröffentlichung der ArtNFT-Auktionsplattform, dem ‘Artnet NFT 30’ Bericht und begleitenden Interviews mit wichtigen Akteuren ist Artnet auf dem besten Weg, eine Anlaufstelle für NFT-Künstler, -Sammler und -Fachleute zu werden. Damit setzt sich das Unternehmen verantwortlich für Transparenz, Innovation und positive Veränderung in der Kunstbranche ein. “Die NFT-Welt hat eine facettenreiche Gemeinschaft aufgebaut. Wir freuen uns, ArtNFT als einen Ort einzuführen, an dem man diese innovativen Werke entdecken und sich mit ihnen auseinandersetzen kann. Mit dem Start von ArtNFT liefern wir der digitalen Kunstwelt ein umfassendes Nutzererlebnis dank Artnets globaler Reichweite und dank der von Experten kuratierten Auktionen”, erklärt Jacob Pabst, CEO von Artnet.

Artnet gehört zu den Pionieren des digitalen Kunstmarktes und war das erste Unternehmen, das den Online-Verkauf von bildender Kunst eingeführt hat. Heute veranstaltet Artnet Auctions jährlich mehr als 70 kuratierte Auktionen die sowohl zeitgenössische Kunst als auch Fotografie und Grafik umfassen. Das Unternehmen bietet Sammlern das ganze Jahr über strategische Kauf- und Verkaufsmöglichkeiten. Bis Ende August stieg der Wert der über artnet Auctions verkauften Werke im Vergleich zum Vorjahr um 20 % auf 18,5 Millionen USD und der Umsatz um 15 % auf 3,6 Millionen USD.

Today’s bonus 今日のおまけ。

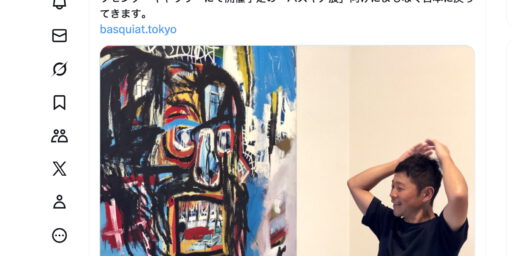

前澤友作とアダム・リンデマンのアート・ビジネスを巡り:

American Adam Lindemann sold Japanese MAEZAWA Yusaku the below work by Basquiat through auction practice:

A Collector’s-Eye View of the Auctions

By ROBIN POGREBIN

MAY 15, 2016

quotes:

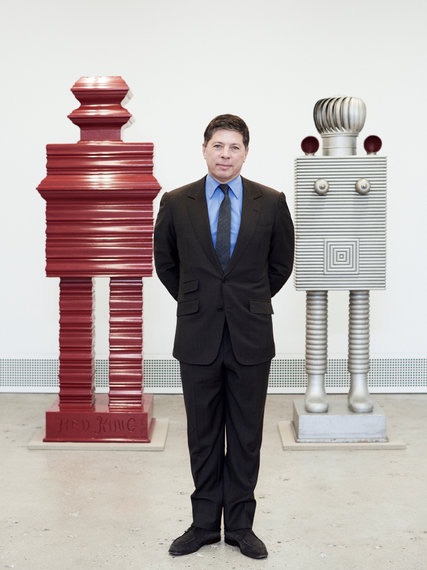

Twenty-four hours after Adam Lindemann sold a Jean-Michel Basquiat at Christie’s for $57.3 million — an auction record for the artist — he found himself in the role of bidder as selling began for a 1942 Calder standing mobile at Sotheby’s last Wednesday night. He thought the $3 million to $4 million estimate was too low, that the piece was worth $10 million, given that it had once been owned by Alfred H. Barr, founding director of the Museum of Modern Art.

Mr. Lindemann, 54, an established collector and dealer, jumped into the bidding himself, but dropped out before the piece ultimately sold for $8.3 million with fees.

“Had I pushed it, it would have gone to 10,” he said later. “It wasn’t destined to come to me. Sometimes when you bid, you’re not going to get it — you just know. It was an amazing purchase for someone to own and to keep for a decade. It was not necessarily the right purchase for someone like me.”

Mr. Lindemann, a regular in the New York auction rooms, agreed to share his impressions of the spring sales in real time with a reporter. As both a buyer and a seller, he was active last week, offering an up-close view of the negotiations that go into each sale.

Why didn’t he buy the Calder? He wouldn’t divulge his final bid, but indicated that it wasn’t a work he would want to sit on until it appreciated enough to resell. Given his legal and business expertise (he has a degree from Yale Law School and used to run his own investment firm), he has established himself as a knowledgeable insider, and buys for both love and value, tending to spend in the $20 million-and-under range. Before selling the Basquiat he bought an Uli figure from Papua New Guinea, the cover lot at Sotheby’s African, Oceanic and Pre-Columbian art sale, for $4.7 million.

“He’s part of the trade,” said Brett Gorvy, Christie’s worldwide chairman of postwar and contemporary art. “He’s been a collector and a dealmaker for most of his career, he knows all the ins and outs of what actually happens in an auction room. He’s used to selling and trading up. That gives him a different kind of mentality. You have to have a certain ability to detach yourself from objects.”

Mr. Lindemann’s decision to sell the Basquiat was therefore carefully considered. Given the uncertainty in the market, it could have seemed like a risky time to sell one of the most valuable pieces in his collection. But Christie’s had a buyer who had committed to paying at least $40 million for the piece. And Mr. Lindemann said the moment was actually opportune, given the lack of competition from other major consignments.

“If it were a regular bullish sale in 2014, we would have been fighting a Rothko or a Picasso and a $50 million balloon dog,” he said, referring to a Jeff Koons sculpture. “The question is, do you want to be the lead in a smaller movie or do you want to be in a film with Brad Pitt and Leonardo DiCaprio?

“If you know that you can deliver,” he said, “you do the smaller movie, where you’re the lead and the movie is about you.”

Mr. Lindemann had sold major works before; for example, Mr. Koons’s bright red “Hanging Heart (Magenta/Gold)” at Sotheby’s in 2007 for $23.5 million. But the Basquiat — sold to the Japanese billionaire Yusaku Maezawa — was a prize that auction houses had been trying to wrest away from him since he bought the painting for $4.5 million in 2004.

“Almost every six months or every year, I would put forward an offer,” Mr. Gorvy said. “Each time it was someone who was looking for a masterpiece. He was willing to listen, but he always had a firm number in his head, and that number was 50.”

Mr. Lindemann, who comes from wealth — Forbes puts his family’s net worth at $2.9 billion — has collected for about 20 years and showcases art through two galleries: Venus Over Manhattan, which opened in 2012, and Venus Over Los Angeles, which opened in 2015. Mr. Lindemann’s exhibitions tend to be deliberately untraditional, like his current show of Warhol’s “Little Electric Chairs.”

He is married to an art dealer, Amalia Dayan, and the two live in a Brutalist Upper East Side townhouse designed by the architect David Adjaye. Last year Mr. Lindemann bought Andy Warhol’s former oceanfront compound in Montauk.

…

quote:

But behind his desk in his Madison Avenue gallery the following day, Mr. Lindemann commended the sale. “It was a solid 10,” he said. “Everyone in the room felt good.”

Sotheby’s had selected items that it knew it could sell, he said — “artists who continue to make the same kind of things, like Christopher Wool, Robert Ryman, Rudolf Stingel and Agnes Martin.”

“This market wants what’s identifiable,” Mr. Lindemann said. “This market wants security, because this market is nervous.”

He also made a point of noting who the auction houses are not selling, suggesting that certain artists are currently out of favor. “Why are there no Damien Hirsts in the evening sale anymore? Where are they?” he said. “Where are the Wade Guytons?”

In his view, estimates placed on works by auction houses are too often mistaken for actual value, when they are simply the result of deals between auction houses and sellers: The prices represent how much the auction house is willing to commit to a seller and what that seller is willing to accept.

“You have to appreciate the views of the consignor and the agenda of the auction house,” Mr. Lindemann said. “People think the estimate represents the value. And often it doesn’t.”

He believes that putting more than 20 Calders up for sale this season among the three main auction houses was a mistake, glutting the market, even though Calders generally do well and brought solid prices this time around. And he said that while an auction can seem ”inappropriately decadent,” given “all these numbers being thrown around,” if it were real estate, “no one would have a problem with it.”

“In a way,” he added, “many pictures today are worth as much or more than anybody’s home.”

full text, check:

http://www.nytimes.com/2016/05/16/arts/design/a-collectors-eye-view-of-the-auctions.html

more NFT shit, check it out @

https://art-culture.world/articles/banksy-girl-with-balloon-love-is-in-the-bin/

quotes:

Banksy’s ‘Love Is in the Air’ to Be Fractionalized into 10,000 NFTs

“I always wanted to own art, even when I had absolutely no money—I wished I could have at least a tiny stake in the paintings that I liked.” So said Loïc Gouzer, the ex-head of contemporary art at Christie’s and a co-founder of Particle, a new NFT company that aims to fractionalize ownership of traditional artworks by converting them into sets of NFTs called Particles, thus allowing for potentially thousands of people to share ownership of certain works. After receiving $15 million in seed funding from a venture capital firm and announcing its presence as a company this past summer, that wish is now a reality.

Particle revealed on Wednesday that its first acquisition is Banksy’s Love Is in the Air (2005), which the Particle team acquired for $12.9 million at auction. The work has been segmented into 10,000 NFTs, each representing a unique section of the painting. An initial offering of Love Is in the Air will begin January 10 and run through January 14, allowing collectors a chance to purchase a Particle of the work for about $1,500. After the initial offering, the Particles will enter the secondary market across NFT platforms and there’s no telling how they might change in value.

The physical version of Love Is in the Air will be handed over to Particle Foundation, the nonprofit arm of the company that will maintain, preserve, and tour the work so that collectors can see the pieces they can rightfully claim to own. Royalties received in the resale of Particles (like all NFTs, Particles are attached to a smart contract that ensures a portion of the resale value is returned to the creator of the NFT) will be partially used to fund Particle Foundation. And the foundation will also retain 1 percent of Love Is in the Air Particles to act, as a press release explains, “as a protective shard and ensure no one person can envisage claiming possession of the physical painting.”

With the entanglements intrinsic to the fact that each Particle will fluctuate in value across a vast and changing collector base, it would be intensely complicated to ever attempt to sell the physical work. To make a comparison: For a company like Rally, which fractionalizes ownership of collectibles in a more traditional manner, the sale of an entire object or work is the only way for collectors to see a return on their investment. Currently, some 5,500 joint holders of a copy of the Declaration of Independence are voting on whether or not to sell the historical document. If they decide to sell together as a group, they’ll all get their investment returned, and potentially more.

In Particle’s case, the potential for return on investment is not a collective decision but instead something immediate and individual to be carried out on secondary NFT platforms. The downside of that is that each investor must take the responsibility of marketing and selling their asset in the volatile NFT market.

Together, Particle and the Particle Foundation have stated ambitions to create a kind of meta museum, combining the stewardship of traditional institutions with the exclusivity of a private collection and the returns and risks related to the rabid digital market that is NFT trading. The enterprise’s vision is highly dependent on its own ability to endure the challenges of this complicated matrix.

For Gouzer, the challenge is worth it for what it might mean for more people to know the feeling of owning great works of art. “Particle Foundation is going to be a museum for the people, but also by them,” he said. “It will be great to see art like that, because pure enjoyment of art is not complete until you feel you own it.”

up-date:

デジタルの商品認証技術「NFT」 経産省が初の実証実験へ

2021年12月27日

アメリカのIT大手フェイスブックが社名変更し、力を入れているメタバースなどのデジタル空間で、売買される商品がオリジナルのものだと証明する認証技術がNFTです。

高度なブロックチェーン技術が使われていて、偽造や複製が困難とされています。

アート作品が高額で落札されるなどことしに入って世界で市場が急拡大しています。

こうした中、経済産業省は初めてNFTを活用した実証実験に乗り出すことになりました。

実験は来年2月ごろからファッションの分野で行うことにしています。

デザイナーが制作した1点ものの洋服にNFTを付けてそれを3Dでデータ化します。

その洋服はデジタル空間で転売されてもNFTで履歴が管理でき、収益の一部がデザイナーに還元される仕組みをつくりたいとしています。

海外ではNFTを活用したデジタルファッションの販売が始まっていて経済産業省としてはこの分野で日本が出遅れないよう後押しするとともに国としてできる環境整備を急ぐ考えです。

デザイナーの収益源多様化へ

経済産業省の実証実験は、すでにアートの分野でNFTの技術を使ったサービスを提供しているスタートアップ企業に委託して行います。

この企業は絵画がオリジナルであることを示すNFTを発行していて、作品が転売された場合には収益の一部が作家に還元される仕組みです。

今回の実験はこの仕組みをファッションに応用して行います。

商品の展示会で1点ものの洋服にNFTをつけて販売するほか、洋服を3DのCGにして仮想空間メタバースのアバターに着せるデータや自分の写真に合成したデータも合わせて販売します。

取り引きの履歴がNFTで管理されるため、実物でもデジタルでも転売された場合には収益の一部をデザイナーに還元することができるということです。

経済産業省は、NFTを活用して新たな取り引きを生み出すことによって、デザイナーの収益源を多様化し競争力の強化につなげたい考えです。

https://www3.nhk.or.jp/news/html/20211227/k10013405271000.html

#FallonTonight #Beeple #JimmyFallon

Beeple Went from Selling Art for $100 to Selling an NFT for $69 Million | Tonight Show

Thieves Steal Gallery Owner’s Multimillion-Dollar NFT Collection: ‘All My Apes Gone’

“I have been hacked. All my apes gone. This just sold please help me,” wrote gallery owner Todd Kramer, of New York’s Ross + Kramer Gallery, in a since-deleted tweet posted on December 30.

A phishing scam had drained his Ethereum wallet of 15 NFTs valued at a total of $2.2 million, including four apes from the “Bored Ape Yacht Club” collection. The thief seemed to have sold off many of the pieces in Kramer’s collection, and Twitter users jeered at Kramer’s bad luck, pointing out that he had bet on an unregulated, decentralized system that would be unable to help him.

“Man If only there had been some kind of Regulating authority in place that could like Insure your investments against theft and fraud,” wrote one user with the handle @anarchy_shark.

But in the end, an authority did come through. With the help of the buyers and the NFT platform OpenSea, Kramer was able to get back several of his NFTs. Five hours after his original post, he wrote, in a tweet that has also since been deleted, “Update.. All Apes are frozen,,. Waiting for opensea team to get in,,,lessons learned. Use a hard wallet…”

OpenSea’s involvement sparked major controversy, with some alleging that NFTs could not truly be decentralized if it had “frozen” some, rendering them unsellable on the platform. Others pointed out that OpenSea had only frozen user’s ability to interact with the NFT through that one site alone—they could still be bought and sold elsewhere.

Neither OpenSea nor Kramer responded to requests for comment.

Phishing scams have become more frequent as NFTs have increased in value. However, most savvy users can protect themselves by using hard wallet, also known as a cold wallet, which is physical and only connects to the internet when plugged in and engaged. Kramer had been using a so-called hot wallet, which is continuously connected to the internet and thus more vulnerable.

More common than phishing scams, however, is theft of a different kind. Some people have begun making NFTs of art that they did not create, an issue for which no easy fix has yet been developed.

update 2023/9/24

Zwei Jahre nach dem NFT-Hype sind 95 Prozent der Besitzurkunden wertlos

23.09.2023

23 Millionen Käufer sitzen auf wertlosen NFTs. Nur 5 Prozent weisen noch einen Wert auf, aber nur einen Bruchteil des Preises. Eine Erholung ist nicht in Sicht.

Eine aktuelle Studie von dappGambl stellt den NFT-Markt in Frage: Über 95 Prozent von 73.257 untersuchten NFT-Sammlungen haben eine Marktkapitalisierung von null Ether. Fast 23 Mio. Menschen halten diese wertlosen Assets. “Dies sollte ein Realitätscheck für den oftmals überhitzten NFT-Sektor sein,” mahnen die Forscher.

NFTs, oder “Non-fungible Tokens”, sind digitale Vermögenswerte auf einer Blockchain, üblicherweise Ethereum. Jeder NFT hat eine einzigartige Signatur und repräsentiert oft Kunst oder Sammelobjekte. Sie erlebten in den Jahren 2021 und 2022 einen Bullenmarkt mit monatlichen Handelsvolumina von bis zu 2,8 Mrd. Dollar.

Prominente wie Stephen Curry und Snoop Dogg trugen zur NFT-Euphorie bei, während Bitcoin nahe 70.000 Dollar notierte. Aktuell liegt der Preis für Bitcoin knapp über 27.000 Dollar. Der Bericht offenbart, dass 79 Prozent der NFTs unverkauft sind und der Überhang an Angebot die Nachfrage übersteigt.

Die Forscher konstatieren: “Ein Großteil des NFT-Marktes operiert auf Grundlage spekulativer Preisstrategien, weit entfernt von tatsächlichen Handelshistorien. Viele Verkäufer hoffen auf einen weiteren Boom, der jedoch ausbleiben könnte.”

https://www.faz.net/pro/d-economy/transformation/zwei-jahre-nach-dem-nft-hype-sind-95-prozent-der-besitzurkunden-wertlos-19195727.html

ここに載せたスクリーンショットは、すべて「好意によりクリエーティブ・コモン・センス」の文脈で、日本美術史の記録の為に発表致します。Creative Commons Attribution Noncommercial-NoDerivative Works. Photos: cccs courtesy creative common sense