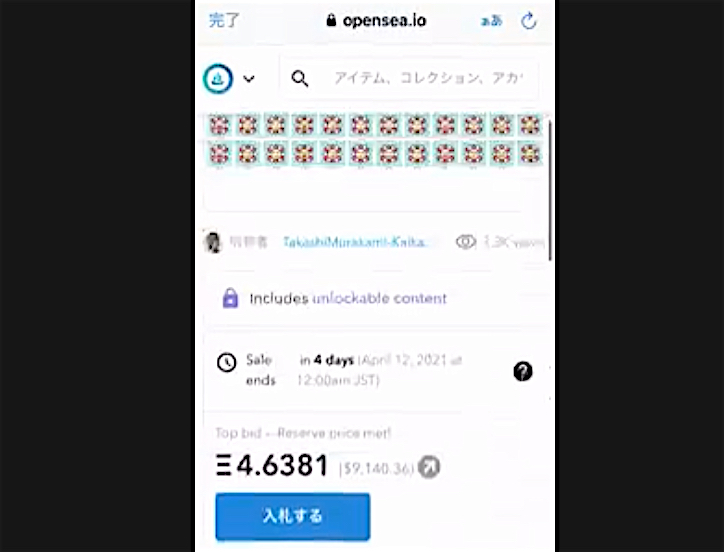

世界のNFT作品70%下落。今日の村上隆:すでに入札をしてくださっていた方々には誠に申し訳ないのですが、より便利に楽しく安心して私のNFT作品を楽しんで頂く為にも、今回の取り下げをご理解頂けますと幸いです。 NFTs prices linked to art down 70%. MURAKAMI Takashi, today: I sincerely apologize to those who have already put in their bids, but I hope you will understand the logic behind this withdrawal, the aim of which is to later allow you to enjoy my NFT works more conveniently and with peace of mind.

Tokyo, the 11th April, 2021.

NFT shows the lack of critical behavior amongst artists and wanna-be artists. It was just a matter of time, when Murakami realised, this is not going to work properly. Thank god, he pulled today the rip cord, shortly before the auction-deadline.

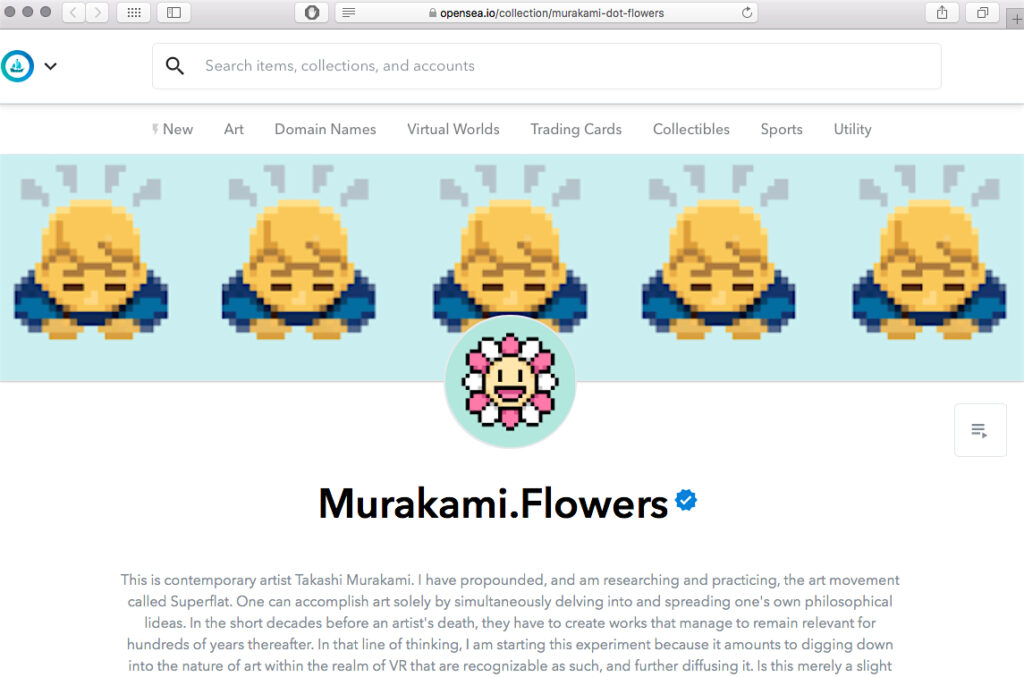

Check his digital marketplace @ opensea, apologising.

https://opensea.io/collection/murakami-dot-flowers

London-based NFT agency Lily & Piper: “A drop in value was inevitable. There has been an over-saturation of platforms and it’s getting hard to differentiate and navigate.”

see The Art Newspaper:

Sorry to burst your bubble: NFT prices slump 70%

https://www.theartnewspaper.com/news/sorry-to-burst-your-bubble-nft-prices-slump-70

‘It’s Whiplash’: After a Record-Setting Run, NFT Artwork Prices Have Plummeted Nearly 70 Percent in Four Weeks

Is this the bubble bursting—or is it merely a course correction?

https://news.artnet.com/market/nft-market-1957770

Conversation between curator Michelle Kuo and artist Seth Price on the subject. It turns out that both Price and Beeple use the same 3D movie-making program to create still imagery. “So it’s a use of this extremely complex tool in a very dumb way, and it can be interesting when you misuse a tool,” Price says. When it comes to the rise of NFTs, he argues that “the reason that art is used here is because it, itself, is a good tool to further the larger project, which is developing these new forms of trading, speculation, circulation. Art is just a useful idiot in this scenario.”

https://www.moma.org/magazine/articles/547

We’ll see if Takashi-kun will give it a new try. Stay tuned!

check these links, too:

村上隆とNFT:芸術家は、死ぬまでの短い数十年間で、その後何百年も対応可能な作品を作らねばなりません。(Part 1)(2021/3/30)

MURAKAMI Takashi thinks, to be remembered hundreds of years later, he has to join shitty NFT: “Murakami Flowers” for dumb NFT digital money speculators

quote:

In this sense, dear dumb “Murakami Flower” collector: don’t forget to pay taxes. If you bought a unit of Ether a few years ago for $100, and it’s now worth $1,800, your Tax Office considers Ether a capital asset. So if you use Ether or Bitcoin to purchase an art work by MURAKAMI Takashi with NFT, that means you “created a taxable event”. Stay happy with your Murakami Dotty Flowers!

Don’t forget: NFTs are NOT stored on the blockchain – there is only a link to a web address. And what is there can theoretically be deleted, changed or copied.

Btw, dear digital capital asset freak…, while cryptocurrency industry insiders promote the “democratized” benefits of digital assets, in truth, crypto concentrations of money and power match or surpass those in traditional financial markets. You’ve been controlled more than ever.

https://art-culture.world/articles/murakami-takashi-村上隆-nft-murakami-flowers/

Up-date version, Murakami’s new try:

村上隆とNFT:芸術家は、死ぬまでの短い数十年間で、その後何百年も対応可能な作品を作らねばなりません。(Part 2)(2022年1月)

MURAKAMI Takashi thinks, to be remembered hundreds of years later, he has to join shitty NFT: “Murakami Flowers” for dumb NFT digital money speculators (Part 2)

https://art-culture.world/articles/murakami-flower-2022/

クリスティーズ:ビープルのデジタル作品 NFT(非代替性トークン)「The First 5,000 Days 」69.3 Million 米国ドル (2021/3/12)

Beeple “The First 5,000 Days” NFT Fetches US$69.3 Million @ Christie’s

https://art-culture.world/articles/beeple-ビープル/

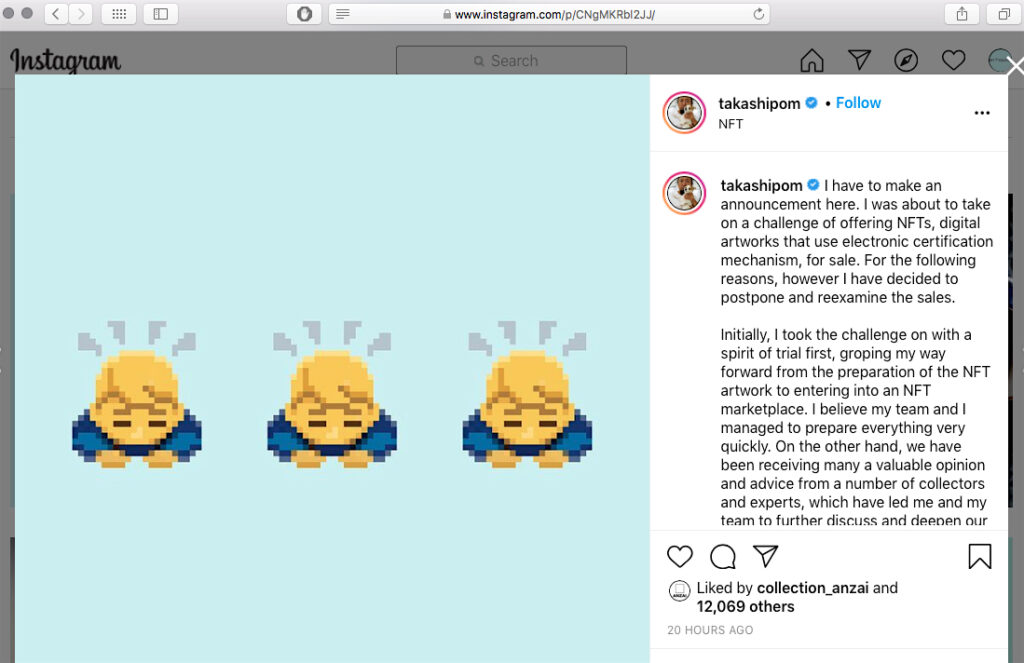

takashipom

皆様にお知らせがございます。

私はNFTという、電子証明の仕組みを使ったデジタルアートの販売に挑戦しようとしておりました。しかし、以下の理由でNFT作品の販売を延期、再検討する事に致しました。

full text in Japanese:

https://www.instagram.com/p/CNgMbgLlJXX/

takashipom

I have to make an announcement here. I was about to take on a challenge of offering NFTs, digital artworks that use electronic certification mechanism, for sale. For the following reasons, however I have decided to postpone and reexamine the sales.

full text in English:

https://www.instagram.com/p/CNgMKRbl2JJ/

About MURAKAMI Takashi, learn more via:

村上隆:「森ビルさんや、協賛のスポンサーさん達にはご迷惑をお掛けしております が、メディアへのインタヴュー一切をお断りしております。」(2021/3/3)

MURAKAMI Takashi Refuses To Give Any Press Interview (repost from the archive 過去サイト・アーカイブの再投稿 2015/10/16)

https://art-culture.world/articles/murakami-takashi-refuses-to-give-any-press-interview-村上隆/

森美術館前なう!日本一美術家、天才村上隆の超ダサい、米国産、金色うんこ自画像!爆笑!!(2020/11/20)

In Front of The Mori Art Museum, NOW! Japan’s No.1 Artist, Genius MURAKAMI Takashi’s, Made in America, Golden Bullshit Self-Portrait Sucks! ROFL!!

https://art-culture.world/articles/genius-murakami-takashi-天才村上隆/

日本の現代アーティスト・トップ 6(2020年)(2020/7/18)

Contemporary artists from Japan, Top 6 (2020)

https://art-culture.world/articles/contemporary-artists-from-japan-top-6-2020-日本の現代アーティスト・トップ-6-2020年/

米国ギャラリー Blum&Poeのアーティスト・リストから外された村上隆 (2019/4/23)

Takashi Murakami Had Been Erased From American Gallery Blum & Poe’s Artists’ List

https://art-culture.world/articles/takashi-murakami-blum-poe-村上隆/

今日のJapan Times。「村上隆:日本のアート・アウトサイダー、平成時代を定義した、’嫌われた’アーティスト 」。不幸な村上隆、、、(2019/3/14)

Today’s Japan Times. “Takashi Murakami: Japan’s art outsider. The ‘hated’ artist who defined the Heisei Era”. An Unhappy MURAKAMI Takashi…

https://art-culture.world/articles/takashi-murakami-japans-art-outsider-the-hated-artist-村上隆/

村上作品の価値?不幸な村上隆、、、(2018/11/16)

The Value of Murakami’s Works? An Unhappy MURAKAMI Takashi…

https://art-culture.world/articles/takashi-murakami-art-works-value/

日本のアート界を駄目にした男? 不幸な村上隆、、、(2018/10/19)

The Man Who Ruined The Japanese Art World? An Unhappy MURAKAMI Takashi…

https://art-culture.world/articles/takashi-murakami-kaikai-kiki-japanese-art-world/

up-date:

Law

A Curator Allegedly Minted Unauthorized NFTs of Art by Anish Kapoor and Others. Now, He May Get Slapped With Lawsuits

A dozen artists are said to be considering legal action.

Eileen Kinsella, November 23, 2021

Will artists go to war with Art Wars over unauthorized NFT sales?

Ben Moore, a London-based curator, is the founder of Art Wars, a long-running project consisting of an ongoing exhibition of life-size Star Wars stormtrooper helmets that have been custom-painted by artists, including Anish Kapoor, David Bailey, Jake and Dinos Chapman, and Mr. Brainwash. Now Moore has angered many of these artists by moving to sell NFTs derived from photographs of those originals on OpenSea, allegedly without their permission.

“For the first and only time, these iconic images, alongside a new set of interpretations from famous digital artists and our own in-house artists, will be made available as a collection of 1,138 unique and individual ArtWar NFTs. These will be randomly assigned to buyers of the initial mint,” according to a statement on the Art Wars website.

Moore did not immediately respond to Artnet News’s request for comment. Approximately a dozen artists are considering legal action against the project, according to the Financial Times.

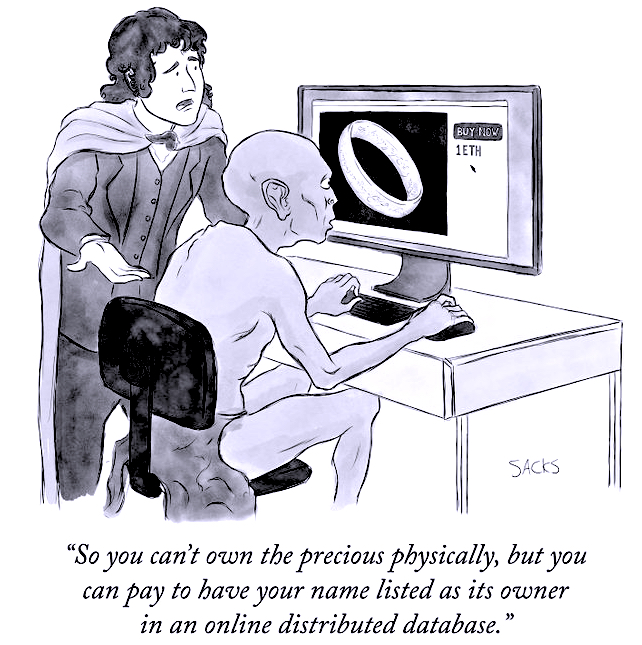

An NFT, or non-fungible token, is a unique digital token encrypted with an artist’s signature and individually identified on a blockchain, effectively verifying the rightful owner and authenticity of the creation. Since NFTs took the art world by storm in early 2020, they have also opened the floodgates for potential—and so far, hard-to-police—wrongdoing around issues of authenticity, copyright, and outright theft.

More than 1,600 ETH (close to $7 million) had been transferred since the collection of 1,138 images was put on sale on November 22, the FT reports. One NFT attributed to Kapoor was offered for 1,000 ETH ($4.3 million) but has since been removed from the site. Another work attributed to Bailey was priced at 120 ETH ($517,000).

OpenSea could not be reached for comment but said it had received a copyright infringement notice and complied with it. The Art Wars NFT page on OpenSea was taken down yesterday.

Asked for comment, Kapoor’s studio referred the query to the U.K.’s Design and Artists Copyright Society (DACS), which is handling media requests for the matter.

“DACS is making enquiries on behalf of a number of our artist members to ensure that their rights are upheld and protected,” representative Kate Rosser-Frost wrote in an email to Artnet News.

The DACS statement continued, “As the art market evolves with new and emerging technology such as NFTs, we must ensure that we protect both the creative, intellectual, and moral rights of artists. The minting of NFTs without artists’ permission has the potential to destroy how we as a society value creativity and within this, guarantee that artists are protected through existing intellectual property laws and mechanisms such as the Artist’s Resale Right.”

The same blockchain technology that makes NFTs possible, however, could also provide a solution. DACS noted that resale rights could be used to support artists making NFTs or who have given permission for NFTs of their work. “Crucially, Artist’s Resale Right does not just protect the creativity of the artist or their work, but it helps support artists’ ongoing practice and livelihoods, as well as ensuring that they have a continuing stake in the increasing value of their work. As people in the art market seek to utilize new technology available, we must ask ourselves, ‘How, in an age of NFTs, do we ensure that artists’ rights are maintained for artworks?’”

https://news.artnet.com/art-world/art-wars-unauthorized-nft-sales-2039341

Inside the NFT Rush: Gary Vaynerchuk, the NFT Scene’s Booster-in-Chief, Is Predicting ‘Carnage’—But No One Seems to Care

In the first of a series, our chief art critic embeds himself in an NFT conference in New York City.

Ben Davis, November 24, 2021

quote:

Truth be told, I am still making up my mind on NFTs, aka non-fungible tokens, the digital art phenomenon that has swept across my world like a wave of jolly orcs in the last eight months.

In the end, I realize, there may not be one final take on them, because there is not one issue at play, no single settled technology or protocol. That’s one of the things I took away from NFT.NYC, a three-day conference that came to town in the first week of November, along with its own associated circuit of Art Basel Miami Beach-style parties, with every configuration of A- to Z-list celebrity, brand, and creative media partaking.

On the one hand, I find it indisputable that the NFT/crypto-art space is heavily driven by FOMO, hype, get-rich-quick fantasies, strategic double-speak, and fake-it-til-you-make-it auto-hypnosis. On the other hand, much of the same applies to the worst of the “traditional” art world. Which of the two has the deeper deep end or the shallower shallow end is hard to say.

Personally, I like seeing long-suffering digital artists enjoy their moment. And, for all the silliness inherent in the idea of selling smart-contract-based ownership of jpgs, this idea is not, on reflection, so much sillier than some of the stranger forms in which conceptual art has come to be commercialized. NFT advocates can—and do—point this out by drawing on references from Marcel Duchamp’s Monte Carlo Bond to Sol LeWitt’s instructions-based art to Maurizio Cattelan’s duct-taped banana.

quote:

The event ends with a performance by spoken word artist and NFT advocate doc.PEACE. “This one’s for you, Gary Vee,” she says, before launching into an incantatory poem about her journey from being a girl wanting to be a self-published author, in a household where creativity was discouraged, to today:

fast-forward 20-odd years and to the world of non-fungible tokens

a world where creators create

a space where creativity is celebrated and handsomely rewarded

I said: a new world which celebrates creativity, and handsomely rewards it

a community who wakes up each day with “GM” and actually mean it

“Good Morning My Friends!”

There is a swell of scattered applause and people yell out “Good Morning!”

my word cannot be duplicated

it’s ironic really

I broke free from pharmacy

embraced my creativity

and found freedom

with NFTs

thank you

full text:

https://news.artnet.com/opinion/gary-vaynerchuk-the-nft-scenes-booster-in-chief-is-predicting-carnage-2037829

up-date 2022/1/21

on crypto art and NFTs, 0xcAb8, January 19th, 2022

…

quote:

Notice I am generally pointing to digital media—animations, generative art, photography, illustration, graphic design—I feel these digital tokens are not well suited to the authentication, distribution, and transfer of physical artworks such as an oil painting or a sculpture.

…

quote:

This unfortunately does not mean globally equitable: sales volume tends to concentrate toward artists from the west (often white male), perhaps for a range of reasons including access to hardware and education, language and technical barriers, popularity on social media, discrimination, and sales-centric web interfaces that continue to widen inequality.

…

quote:

However, on the other edge of the sword, a system with zero moderation leads to rampant spam, illicit content, “copyminting” (plagiarism), phishing, impersonation, and other problems. Open markets like Hic et Nunc and OpenSea are often forced to de-index and remove content that goes against their code of conduct. This would be like Google removing your website from its search results—your site is still present and functioning, but not easily discoverable. Moderation and indexing on these platforms is a massive challenge, essentially a game of whack-a-mole, leading many users to favour curated or established collections.

…

quote:

Other Concerns

It’s also worth highlighting some of the common critiques of these systems, as they are certainly far from perfect, and can present various issues for artists:

• Energy: Ethereum is currently associated with a high energy usage, steering artists toward smaller and less-developed networks like Tezos (where energy usage is negligible). This is likely to change in 2022 with Ethereum’s migration to Proof of Stake, which will reduce the energy usage by 99.95%.

• Fees: Ethereum fees can be prohibitive, sometimes hundreds of dollars to mint an artwork. This tends to push action onto alt- and side-chains like Tezos and Polygon (where fees are a fraction of a dollar). Scalability will likely improve in future versions of Ethereum, but this will take some years to fully develop and mature.

• Risk: there is an obvious element of risk, both for the artist and collector. A minted work might not sell, tokens might depreciate in value, and there are security risks associated with self-custody of private keys (i.e. if you accidentally share your private key online, you will likely lose all your funds).

• Quality: the complete lack of moderation on some platforms leads to a negative perception of the space, as the majority of content minted on markets like OpenSea is low quality or even downright spam, porn, and theft. Garish profile pictures, avatars, and digital collectibles are often thrown into the vast mixing pot of crypto art, and their high sales volumes have a tendency to capture mainstream attention.

• Speculation: the extremely high value in many of these markets is often driven by speculation, and can sometimes lead to FOMO-buying, botting, insider trading, pump-and-dump schemes. Given the sheer scale of these permissionless networks, it can be sometimes hard to separate the grift from the rest.

• Volatility: tokens may appreciate or depreciate in massive swings on a day-to-day basis; users are regularly encouraged to pull profits, hold stablecoins, and avoid holding any value they are not prepared to lose.

full text:

https://mirror.xyz/mattdesl.eth/eUrK8MrRfKFJYVKTwi5F4mCIBJEBOYkZ1qaAiDNblIs

up-date 2022/2/11

Crime

The Alleged Cyber Thief Accused of Laundering $4.5 Billion in Bitcoin Is, Yes, Also an Artist and NFT Collector

The self-proclaimed artist and rapper is said to have bought NFTs with the stolen cryptocurrency.

Sarah Cascone, February 9, 2022

quote:

The couple is believed to have used a variety of money-laundering techniques to conceal their transaction history as they moved billions of dollars. The DOJ contends they used false identities, programmed automated transactions, converted Bitcoin into other forms of virtual currency, deposited funds on darknet markets, and used business accounts to attempt to legitimize their financial activity.

“In a methodical and calculated scheme, the defendants allegedly laundered and disguised their vast fortune,” Jim Lee, chief of IRS-Criminal Investigation, said in a statement. “IRS-CI Cyber Crimes Unit special agents have once again unraveled a sophisticated laundering technique, enabling them to trace, access, and seize the stolen funds.”

The two face charges on money laundering conspiracy and conspiracy to defraud the United States, which together carry a maximum sentence of 25 years. They appeared in federal court following their arrest on Tuesday, where the judge ordered a $5 million bond for Lichtenstein and $3 million bond for Morgan.

full text:

https://news.artnet.com/art-world/artist-bitcoin-money-laundering-crime-2070240

up-date 2022/3/12

Financial Times 2022/3/11

The great NFT sell-off: has the digital collectibles craze hit its peak?

Value of digital tokens drops by almost 50 per cent, renewing doubts over hype-fuelled market

quotes:

But almost as rapidly, large portions of the market have begun to deteriorate, leaving novice investors with big losses and raising questions about the long term outlook for NFTs.

The average selling price of an NFT has dropped more than 48 per cent since a November peak to around $2,500 over the past two weeks, according to data from the website NonFungible.

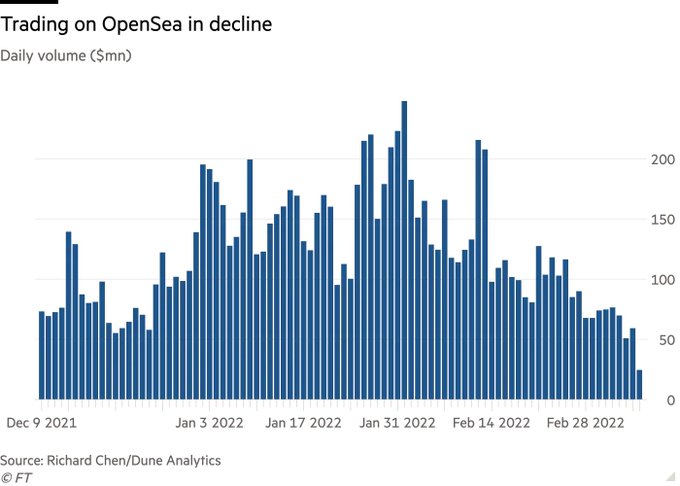

Daily trading volumes on OpenSea, the biggest marketplace for NFTs, have plummeted 80 per cent to roughly $50mn in March, just a month after they reached a record peak of $248mn in February.

quote:

Meanwhile, the number of accounts buying and selling NFTs on a weekly basis has fallen to about 194,000, according to NonFungible. The number of accounts hit a peak of 380,000 last November.

quote:

The market’s pullback has mirrored a broader sell-off in Ether, the dominant cryptocurrency used to purchase NFTs, which has fallen more than 40 per cent from an all-time high in November. Many projects in decentralised finance and other areas tied to ethereum have also plummeted in value.

quote:

Cracks have begun to show elsewhere in the high-end NFT market. Last month, the owner of more than 100 CryptoPunks with an estimated value of $20mn to $30mn suddenly decided to pull the lot from an auction at Sotheby’s. The owner said he decided to “hodl”, cryptocurrency slang for hanging on to an investment for the long term.

“Is this a pause before a resurgence in a month or two? I suspect so,” said Mark Chrystal, founder of Bored Capital Club, a collective that invests in Bored Apes. “I don’t think we are seeing the end of the NFT market, but perhaps we are seeing the end of the beginning.”

full text:

https://www.ft.com/content/46349496-790a-4223-8c65-d6a0bde897bc

Theft and Fraud Are Rampant in the ‘Wild West’ of NFTs. Here’s How Artists and Buyers Can Protect Themselves

Platforms are cracking down on the issue but creators believe the NFT community itself is the best tool in their arsenal.

Vivienne Chow, March 15, 2022

quote:

« OpenSea revealed that more than 80 percent of the items created with the platform’s free minting tool were “plagiarized works, fake collections, and spam.” »

full text:

https://news.artnet.com/news-pro/nft-theft-artists-self-protection-2082271

up-date 2022/4/21

CryptoPunks Pulled from February Sotheby’s Auction Were Used as Collateral for $8.3 M. Loan

April 20, 2022, artnews

At an evening sale in February held by Sotheby’s, the salesroom was shocked when a representative for the house announced that the night’s only lot had been pulled.

It turns out the bundle of 104 “CryptoPunks,” highly prized NFTs that often sell for millions, had instead been used to secure a loan for $8.3 million by the bundle’s owner, an anonymous figure who goes by 0x650d on Twitter.

The loan was made possible by NFTfi, an NFT-collateralized loan marketplace, and MetaStreet, an NFT liquidity scaling startup. “We reached out to 0x650d shortly after we heard that they pulled out of the Sotheby’s sale,” said Conor Moore, a co-founder of MetaStreet.

“He didn’t even know that this market really existed before we started talking,” said David Choi, another co-founder of MetaStreet who has a background in art history and traditional art financing. “I think the upside potential of the loan quickly became more apparent. He was really quite pleased to take this avenue rather than the sale, given the tax implications and things like that.”

While 0x650d isn’t the first to receive a large loan using NFTs as collateral, this is certainly the largest known loan of its kind. And the market for NFT loans only seems to be getting hotter.

According to NFTfi, the firm recently surpassed $100 million in loan volume since it launched in June 2020, with $70 million of that generated solely in 2022, as of April 14.

This is still an emerging market, however. The art lending business is currently valued at about $25 billion. Joe Charalambous, of the art financing firm TPC Art Finance, which provides traditional art-secured loans and has considered entering the NFT financing space, said that the demand for loans has been skyrocketing.

“We saw a large rise in requests and overall demand for art finance since Covid lockdowns began that has continued to the present,” Charalambous said. “We’ve also had requests for loans against what I suppose would be considered blue chip NFTs, CryptoPunks, and things like that. But we’d like to see more stability before we enter that market.”

Charalambous explained that at TPC Art Finance the firm looks closely at the price history of a given artwork or that of an artist on the secondary market. The older the work, the more information there is on how a work might perform on the market, though the firm will consider works that have only been on the market for a year.

The collected information is aimed at answering one, key question: “If we had to sell the collateral in a default situation, what do we think we would get for it at an auction on a typical day?” Charalambous said. However, he conceded that the judgement of a work’s value is often very subjective.

Choi and Moore, of MetaStreet, look at lending from a strictly quantitate point of view. “It’s less about provenance and more about data science,” Choi said.

Moore added, “There’s that joke that three months in crypto is a year in traditional markets. With CryptoPunks there’s typically 10 to 15 transactions a day and about $15 to $20 million worth of volume traded a week, and it’s all traceable.”

That means there is indeed a lot of data to comb through. “We’re able to track volatility and liquidity of different NFTs which informs what would be deemed credit worthy. You can get a great sense of real time pricing,” Moore said.

But even with all this data, the markets for NFTs, and the value of cryptocurrency in general, is notoriously fickle market.

“The term of this $8 million loan is 90 days,” said TPC Art Finance’s Charalambous of the 0x650d deal. “I think that speaks volumes. Investors might be comfortable with the short term valuation of NFTs but take a more conservative view on the market in general.”

https://www.artnews.com/art-news/news/cryptopunks-pulled-from-february-sothebys-auction-were-used-as-collateral-for-8-3-m-loan-1234625949/

More Than $100 Million Worth of NFTs Have Been Stolen in the Past Year as Crypto Scams Continue to Rise

Thieves are deploying increasingly sophisticated scams to gain access to collectors’ digital wallets.

Artnet News, August 25, 2022

https://news.artnet.com/market/rise-of-nft-thefts-report-2165338

up-date 2022/11/19

NFTs

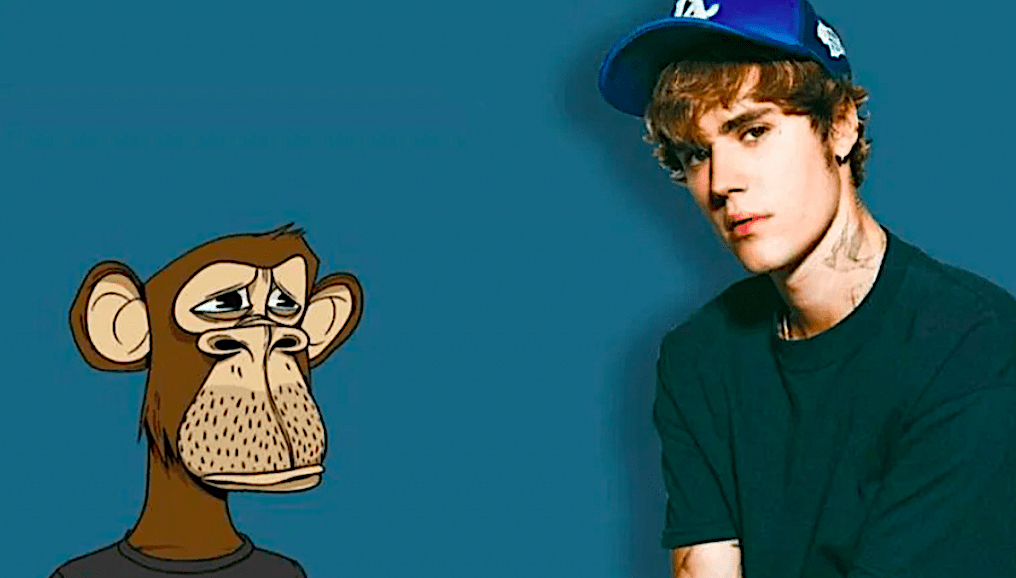

Justin Bieber’s $1.3 Million Bored Ape Plunges in Value to Just $70,000 as NFT Prices Continue Their Free Fall

Bieber’s is an unremarkable example.

Vittoria Benzine, November 18, 2022

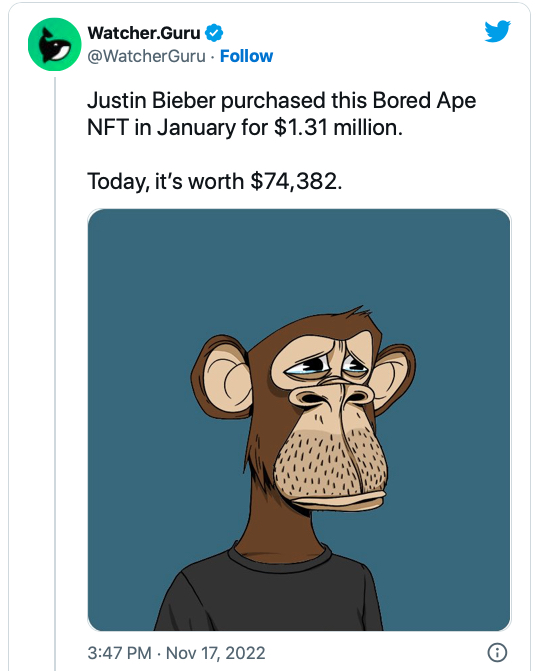

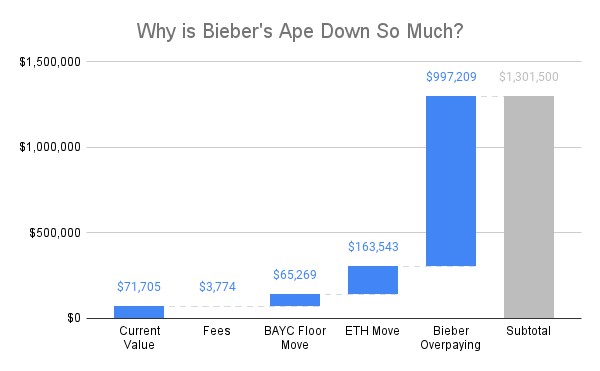

One of Justin Bieber’s Bored Apes, bought for $1.3 million in ETH this January, is likely now worth just $70,000.

That figure’s based on the current floor price, or lowest asking price, for any artwork in the Bored Ape Yacht Club’s collection of 10,000 utility-enabled PFP (profile picture) artworks. Bieber’s Ape pegs to that value because its variable traits and features (like eyes and outfit) are common among the collection—one of several critical indicators of value when it comes to BAYC NFTs.

The whole collection has a taken hit as of late. Yahoo Finance noted this week that BAYC’s floor price has fallen about a third since just the beginning of November, dipping below $60,000 for the second time this month on Monday, after peaking at $429,000 in April.

Still, out of 10,000 Bored Apes in existence, Bieber’s January acquisition ranks the 9,810th most rare. If he specifically didn’t own it, the piece would probably sell for floor price. Bieber’s involvement with BAYC coincided with crypto’s cultural and financial high water mark.

Some have wondered why Bieber even bought the otherwise unremarkable ape in the first place. “The common thought is that the specific traits spoke to him and lyrics of a recent song he had released,” a crypto expert known as Punk9059 told Artnet News. “He had released a song about being sad at the time. Everyone in the community knew it was an ‘outlier sale.’”

Punk9059 added that the true value of Bieber’s NFT was probably $300,000 when he bought it, meaning the market-driven value dip on this particular work might not be as bad as outlets are making it out to be.

“The idea of people paying for NFTs is very easy to want to sensationalize and dunk on,” Punk0959 continued. “The vast majority of people find it crazy. So articles that describe how down people are often go viral, especially when you mix in a celebrity.”

Another of this month’s biggest headlines was the surprise disappearance of FTX Ventures founder Sam Bankman-Fried’s $16 billion fortune—history’s largest wealth destruction event.

“NFT prices were hurt by the FTX collapse, but we’ve been on a multi-month trend where prices on profile-picture projects have been declining,” Punk0959 said. “[Bieber’s] wasn’t all that out-sized of a move.”

Interest in BAYC spiked this week too, increasing 135 percent to $6.5 million worth of Apes sold Tuesday, perhaps due to speculators buying the dip in hopes the Apes do rebound.

https://news.artnet.com/market/justin-biebers-bored-ape-value-plunges-2213196

update 2023/9/24

Zwei Jahre nach dem NFT-Hype sind 95 Prozent der Besitzurkunden wertlos

23.09.2023

23 Millionen Käufer sitzen auf wertlosen NFTs. Nur 5 Prozent weisen noch einen Wert auf, aber nur einen Bruchteil des Preises. Eine Erholung ist nicht in Sicht.

Eine aktuelle Studie von dappGambl stellt den NFT-Markt in Frage: Über 95 Prozent von 73.257 untersuchten NFT-Sammlungen haben eine Marktkapitalisierung von null Ether. Fast 23 Mio. Menschen halten diese wertlosen Assets. “Dies sollte ein Realitätscheck für den oftmals überhitzten NFT-Sektor sein,” mahnen die Forscher.

NFTs, oder “Non-fungible Tokens”, sind digitale Vermögenswerte auf einer Blockchain, üblicherweise Ethereum. Jeder NFT hat eine einzigartige Signatur und repräsentiert oft Kunst oder Sammelobjekte. Sie erlebten in den Jahren 2021 und 2022 einen Bullenmarkt mit monatlichen Handelsvolumina von bis zu 2,8 Mrd. Dollar.

Prominente wie Stephen Curry und Snoop Dogg trugen zur NFT-Euphorie bei, während Bitcoin nahe 70.000 Dollar notierte. Aktuell liegt der Preis für Bitcoin knapp über 27.000 Dollar. Der Bericht offenbart, dass 79 Prozent der NFTs unverkauft sind und der Überhang an Angebot die Nachfrage übersteigt.

Die Forscher konstatieren: “Ein Großteil des NFT-Marktes operiert auf Grundlage spekulativer Preisstrategien, weit entfernt von tatsächlichen Handelshistorien. Viele Verkäufer hoffen auf einen weiteren Boom, der jedoch ausbleiben könnte.”

https://www.faz.net/pro/d-economy/transformation/zwei-jahre-nach-dem-nft-hype-sind-95-prozent-der-besitzurkunden-wertlos-19195727.html

ここに載せた写真とスクリーンショットは、すべて「好意によりクリエーティブ・コモン・センス」の文脈で、日本美術史の記録の為に発表致します。

Creative Commons Attribution Noncommercial-NoDerivative Works

photos: cccs courtesy creative common sense