アートアドバイザーの裏話 Art Advisor’s Backstory

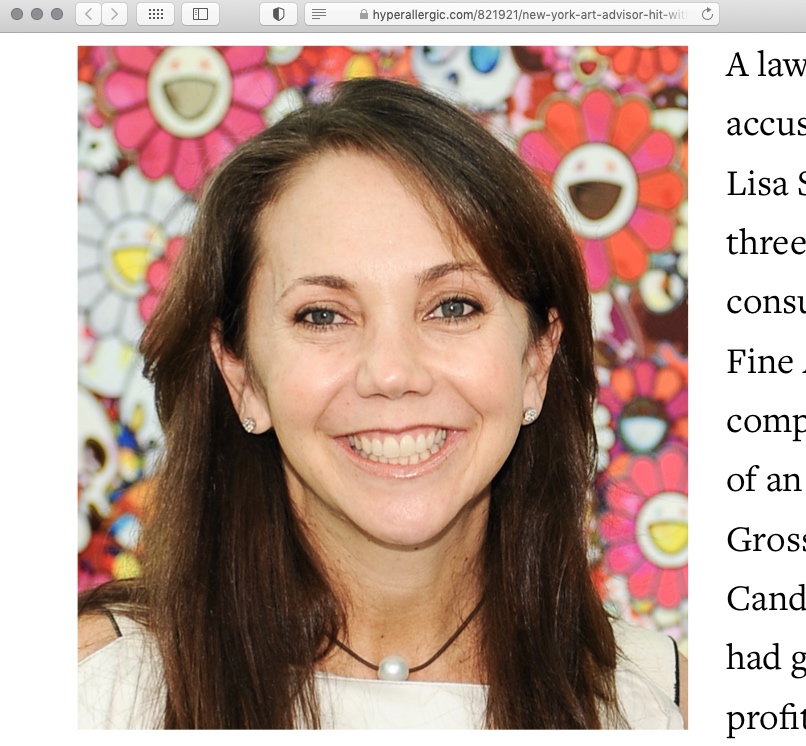

今日のグロバル現代アート・ニュースの中、非常に有名なアートアドバイザーとして仕事をなさる、1969年生まれ、Lisa Schiff リーザ・シッフ氏が大きな注目を浴びています。

ART+CULTUREにとって必要な話題でありながら、やはり、現代アートの全体像、アート業界を理解、分かるようにこちらに載せさせていただきます。日本の現代アート関係者に参考になる為にも。

昨年、ART+CULTUREでLisa Schiff氏をauthority・権威として紹介させて頂きました。

Lisa Schiff Advisory (Schiff Fine Art)

https://www.sfa-advisory.com

Financial Times, November 29, 2017:

“My main job is to make the art world transparent, to help empower collectors. It’s such a complex world, and very opaque. If you’re in it every day, it becomes second nature . . . . When people come in, they often leave quickly because they feel threatened, make mistakes, or they’re taken advantage of. So I’m trying to help people understand . . . and enjoy it. . . . It takes sitting down in their homes, spending time talking to them, getting a feel for what their aesthetic is, how important investment is. . . . The most important thing is really trying to make things transparent.”

Link_https://www.instagram.com/p/Cr10aC7MFT1/

Link_https://www.instagram.com/lisaschiff123/

引用元:

And listen please to the excellent answers, commentaries by art consultant Lisa Schiff (U.S.)

Geopolitics aside, the art world became broader, fundamentally no big changes. My impression is, that with the next ART BASEL edition, we’re back to normal.

We may even expect surprising, positive numbers sales-wise and a spike of visitors for this year.

Concerning the “fair value” of a work by an emerging artist, too much speculation is nowadays going on. Lisa Schiff says publicly, what most art specialists know and why they’re feeling annoyed:

“I don’t understand how people can pay up to 3 million dollars at auction for an artist under 30 who has never exhibited in a museum. Those reputations are not based on aesthetic quality but on investment bets and on word of mouth sharing of information. The highest price that it is acceptable to pay for a young artist is 25,000 dollars,”.

参考:

アート・バーゼル、成功への宿命 (アーティストたちによって裸にされたアート・バーゼル、さえも*) 2022年度

ART BASEL – Doomed To Succeed (ART BASEL Stripped Bare by Her Artists, Even*) 2022 version

https://art-culture.world/articles/art-basel-2022/

Lisa Schiff, art consultant about the prices of contemporary – Art Basel 2022

基本的に、アートアドバイザー、又は、アートコンサルタントはお客様 / クライアントがアートを買うアドバイスをして、海外やオークションで代理購入などをする人です。その他に、普通に作品を売買したり、

訴訟の全容より:

“Schiff regularly advised Barasch to sell certain works, and then re-allocate the proceeds into the purchase of one or more other artworks.”

キュラトリアル・プラクティス、アート業界やエリート社会のネットワークを作り上げたりなどをする事で、案外に甘い生活を持ち、贅沢な、楽な人生を過ごす方々であると言えます。彼らにとって、一番望んでいる、つまり一番儲けられるアート商品は「高い絵」。

アート界での金銭的な取引に関して、透明性は異質な概念に思えるかもしれませんが、アドバイザーとの関係は、クライアントが取引を確実に知ることができる場所の一つなのです。ほとんどのアドバイザーは、コミッションまたはリテイナー(月給制または年俸制)のどちらかで仕事をすることを喜んで検討します。また、コレクションのカタログ作成など、特定の種類のプロジェクトでは、時給で仕事をする人もいます。何が含まれるのか、条件や詳細について話し合い事です。アートフェアー、個人コレクション、アーティストのスタジオへの旅は、アドバイザーが手配しますが、どちらかが費用を負担する場合もあります。厳密に依頼された場合であっても、輸送、保険、購入前の美術品損失登録の調査などを行うために、追加料金を請求するアドバイザーもいます。一流ギャラリーから新作を購入する場合の一般的なコミッションは、価格の10%程度ですが、全体の予算や他の関係者の関与によって、大きく変動することがあります。どのような取引であれ、ギャラリーにアプローチする前に、クライアントとクライアントのアドバイザーが理解を深め、誤解を避けるためにギャラリーに条件を明確にすることが重要です。

訴訟の全容より:

“21. In this manner, Defendants cultivated a relationship of trust with Plaintiffs, as a result of which they came to manage all aspects of Barasch’s art collection, from purchases and sales of artworks, to framing, installation, transportation, handling and storage of artworks. Plaintiffs understood that Defendants often acquired artworks themselves, which were then sold to Defendants’ clients. As a standard practice, all funds for Barasch’s purchases and sales of artworks passed through Defendants’ accounts, rather than directly between Barasch and the sellers or purchasers of the artworks. To facilitate these transactions, Defendants requested and received from Barasch authorization and access to certain of Barasch’s credit card(s). In addition, Defendants were authorized to access, manage and transfer artworks in and out of storage accounts in Barasch’s name in a number of fine art storage facilities. Defendant Schiff sent Barasch lists of recommended artworks on which Defendants placed deposits for Barasch.”

その他に、Marc Spiegler “The problem with art advisors”(@ The Art Newspaper, Nr. 180, May 2007)を東京都現代美術館(MOT)の図書館で読んでください。

それから、米国のThe Association of Professional Art Advisors (APAA)のページへ:

https://www.artadvisors.org

Link_https://www.instagram.com/the_apaa/

さて、今日のLisa Schiff・リーザ・シッフ氏についての記事を紹介させて頂きます。

訴訟の全容へ:

SUPREME COURT OF THE STATE OF NEW YORK COUNTY OF NEW YORK

INDEX NO. 652287/2023

RECEIVED NYSCEF: 05/11/2023

CANDACE BARASCH and RICHARD GROSSMAN,

Plaintiffs,

-against-

LISA SCHIFF, SCHIFF FINE ART LLC,

SFA ADVISORY LLC, and DOES 1-10,

Defendants.

ニューヨークのアートアドバイザーが200万ドルの訴訟を起こされる

3人の顧客が、コンサルタントであるLisa Schiffが「贅沢なライフスタイル」の為に 「ねずみ講」(Ponzi scheme) を行っていたと訴えている。

昨日5月11日に起こされた訴訟では、ニューヨークのアートアドバイザーLisa Schiffが横領で告発され、彼女の顧客3人が、コンサルタントと彼女の会社Schiff Fine Arts(SFA)が、250万ドルの美術品の売却に対して十分な補償をしなかったと主張している。

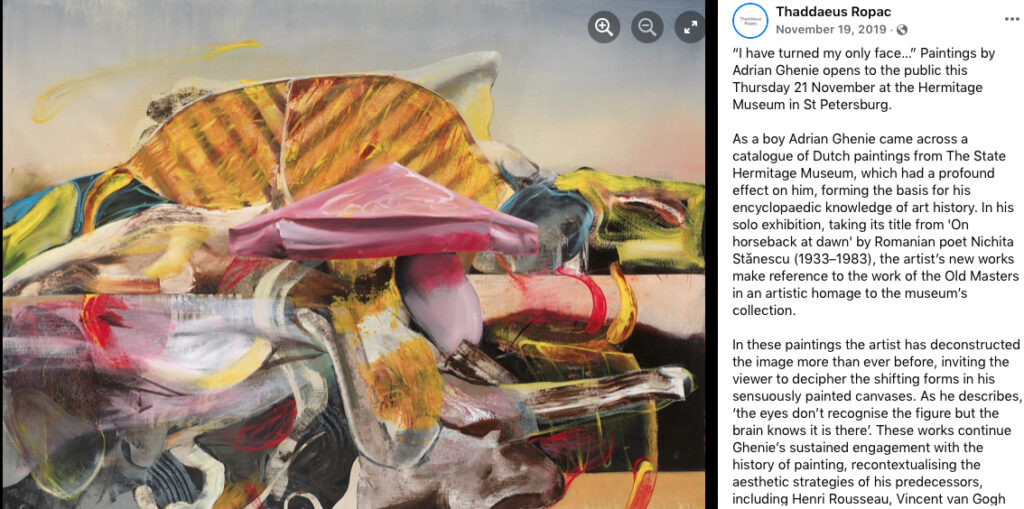

原告のRichard Grossmanと不動産相続人のCandace Baraschは、Schiffが今年の初めにAdrian Ghenieの絵画の共同販売で得た利益を分割して支払うことを保証したが、延長を要求しても契約を守らなかったと主張している。

Barasch、Grossman、および彼の配偶者は、Schiffがお金を持っていないことを認めた後、200万ドル以上の損害賠償を要求している。

Barasch、Grossman、Grossmanの無名の配偶者は、Adrian Ghenieの2019年の絵画「The Uncle 3」をめぐる共同所有権を持っていて、2021年にSchiffが取り仕切った取引である。

https://www.facebook.com/ThaddaeusRopac/photos/a.170756519621453/2842418995788512/?type=3

3人は、絵画の所有権をBaraschが50%、Grossmanとその配偶者が25%ずつ取得することで合意した。

訴訟によると、SchiffはGhenieの絵をBaraschとGrossmanのどちらにも届けさせず、デラウェア州 ( Delaware = 脱税行為の州 + Freeport art storage)の美術品保管庫に保管し、送料と梱包資材の費用を株主に請求していた。

訴訟の全容より:

“29. Upon completion of the sale, the Artwork was not delivered to any of the Plaintiffs individually. Instead, through Defendants, it was supposed to have been sent from storage at Crozier Fine Arts to Barasch’s art storage unit at Uovo in Delaware. However, instead of sending the Artwork to Uovo, Schiff caused the Artwork to be sent to Maquette Fine Art’s storage facility in Delaware, with Plaintiffs bearing the pro rata costs of packing and shipping the Artwork. While upon information and belief the Artwork was placed in a storage unit in Plaintiff Barasch’s name, on a day-to-day basis Defendant Schiff controlled the storage unit and what was in it.”

2022年11月、Schiffは彼らの代わりにサザビーズ香港 (Sotheby’s Hong Kong)を通じて10%の手数料でこの絵画の再販を仲介し、作品は12月から1月の間に250万ドルで個人売買された。

Schiffは1月中旬にBaraschとGrossmanにそれぞれ225,000ドルを送金し、約束の手数料250,000ドルを受け取った。

原告側の弁護士は、サザビーズに絵画が売れたことを確認し、Schiffが26日に残りの販売利益180万ドルをBaraschとGrossmanに中抜きで払い込むことを約束した。

この訴訟では、Schiffは香港のバイヤーからの遅延疑惑に対応する必要があるとして、当初の支払日から30日間の延長を要求していたとされている。

4月26日になると、SchiffはBaraschとGrossmanにさらに14日間の猶予を求め、再び香港のバイヤーを引き合いに出しながらも、彼らが購入から手を引くことはないと自信をのぞかせた。

Grossmanは、予想される90万ドルの利益の一部を義理の両親を介護付き住宅に入居させるために使うつもりだったので心配し始めたが、Schiffは5月初旬に「取り組んでいる」と言い、TEFAFアートフェアでの買収候補のための広範なデッキを送ったという。

先週5月8日に直接対決した後、SchiffがGrossmanの配偶者に「お金はない」「弁護士に連絡した方がいい」と言ったとされている。

訴訟では、Ghenie事件は「より大きなネズミ講の一部」(Ponzi scheme)であり、Schiffは「贅沢な生活」に資金を供給するために、ある顧客からお金を取って別の顧客に支払うと主張している。

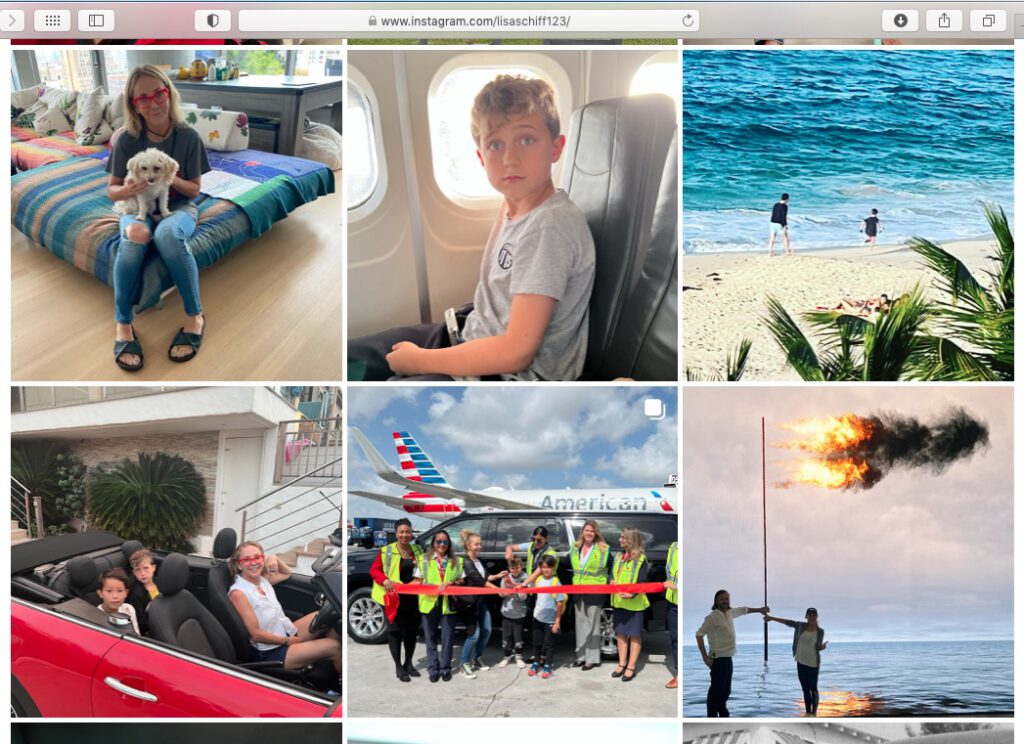

Baraschは、Schiffが自分のアパートに毎月25,000ドルを支払い、息子の私立学校の授業料は年間60,000ドル、その他の国内外の住居やオフィススペースは毎月数万ドルかかると話したと説明した。

また、Baraschは、Schiffがアートイベントへの合同旅行で、ファーストクラスの旅行、コンシェルジュやリムジンサービス、クチュールファッションやジュエリーに数万ドルを費やしていたことを語っている。

Barasch、Grossman、および彼の配偶者は、Schiffが作品売却益を生活資金として溶かしたと考え、Schiffの契約違反に対して、約205万ドルの損害賠償と利息、Schiffの手数料25万ドルの没収、弁護士費用の負担、さらに裁判所が任命する救済を要求している。

Original text:

2023/5/13

New York Art Advisor Hit With $2M Lawsuit

Three clients are accusing consultant Lisa Schiff of running a “Ponzi scheme” to fund her “lavish lifestyle.”

https://hyperallergic.com/821921/new-york-art-advisor-hit-with-2m-lawsuit/

Same topic:

Art Advisor Lisa Schiff Hit With ‘Ponzi Scheme’ Lawsuit After an Adrian Ghenie Art-Flipping Deal Goes Awry

Disgruntled former clients have pointed to “lavish” spending and accused Schiff of running a Ponzi scheme.

Eileen Kinsella, May 12, 2023

https://news.artnet.com/art-world/art-advisor-lisa-schiff-hit-with-lawsuit-art-flipping-deal-2300709

Art Adviser Lisa Schiff Accused of Leading ‘Ponzi Scheme’ in Lawsuit Over Adrian Ghenie Painting

Alex Greenberger, May 11, 2023

https://www.artnews.com/art-news/news/lisa-schiff-lawsuit-candace-carmel-barasch-adrian-ghenie-painting-1234667785/

up-date 2023/5/17

Lisa Schiff’s New York Advisory Appears to Have Closed Amid Lawsuit Over Alleged ‘Ponzi Scheme’

May 16, 2023

As of Tuesday, Lisa Schiff, a prominent art adviser, appears to have closed her New York firm SFA Advisory, which also operated a public gallery space, after a lawsuit was filed against her last week.

Richelle Rich, an artist who was to have a solo exhibition at SFA this June, wrote on Instagram Monday, “I’m sad to say that unexpectedly the gallery has closed. We will no doubt learn the whole story as things play out in the press, but for now I am left pretty devastated that 5 months of planning this show may come to nothing.”

Rich wrote that she had learned of the closure by text, and promised to find a way of mounting her canceled show in New York.

SFA has deactivated almost all of its website, and ARTnews was unable to reach a gallery representative. A spokesperson for Sutton PR said the firm was no longer working with SFA and directed ARTnews to a legal representative for Schiff without supplying contact information.

Last week, Schiff and SFA were sued by Richard Grossman and collector Candace Barasch, who alleged that she had defrauded them during the private sale of a $2.5 million Adrian Ghenie painting at Sotheby’s in either December or January. Grossman and Barasch claim that Schiff still owes them $1.8 million.

When pressed about the allegedly owed money, Schiff told Grossman “she did not have the money owed to Plaintiffs, and to call her attorney—and then walked away from him,” according to the lawsuit. He and Barasch are seeking $2 million in damages. Schiff has not yet responded to the lawsuit.

Barasch and Schiff had been close prior to the lawsuit, with Schiff even at one point labeling Barasch her “partner in crime.”

The lawsuit has made waves in New York, where Schiff is well-connected. The New York Times once labeled her “one of the better-known names” for collectors seeking guidance on purchases of art.

https://www.artnews.com/art-news/news/lisa-schiff-sfa-advisory-closes-lawsuit-1234668392

2023/5/17 up-date. I do honestly believe, that this kind of art related crime is typical for the New York art scene. I hereby do not want to censor any article because of copyright issues. It is more important for the readers of ART+CULTURE to have this kind of development documented unfiltered for the future of a healthy, transparent art industry, also in my country Japan. As most articles disappear from the internet, I, as a chronicler by chance (appearance of the ARTiT blog site), however my main profession as an artist is creating art works, feel obliged to counter this practise for the sake of art and the contemporary art workers.

ART+CULTURE is my page as an artist. No commercial or other financial aspects are involved. Strongly independent and a nonprofit work to improve the common good of society in some way.

Creative Commons Attribution Noncommercial-NoDerivative Works. Photos: cccs courtesy creative common sense

Art Adviser Lisa Schiff Faces Second Lawsuit Alleging Millions of Dollars in Fraudulent Sales

Lisa Schiff, an art adviser with deep connections to the upper echelons of the market, will now face a second lawsuit that alleges she defrauded a collector in the sales of artworks collectively worth millions of dollars.

Meanwhile, on Monday, Douglas J. Pick, a lawyer who specializes in bankruptcy, was assigned “for the business of winding up” SFA Advisory, Schiff’s New York–based firm. ARTnews reported on Tuesday that the firm, which also operates a gallery, appeared to have shuttered to the public.

In the new suit, Candace Carmel Barasch and her husband Michael claim that Schiff and SFA Advisory had redirected money earmarked for the purchases of artworks. Doing so, they allege, was a way “to fund Schiff’s lavish lifestyle, cover debts Defendants owed to other clients, or to consummate art purchases for other clients of Defendants.”

The Barasches allege that they remitted $6.6 million to Schiff and that, in multiple cases, they did not receive artworks from blue-chip galleries because Schiff and her firm had not transferred the funds as expected. Instead, Schiff and SFA used the money to “spoil themselves with luxury travel, shopping sprees, and the like, or to pay obligations owed to other clients, or to purchase artworks for other clients,” the lawsuit alleges.

The suit, filed on Wednesday in the Supreme Court of New York, is the second one that Barasch has filed against Schiff and her New York–based advisory. The first, from last week, named Richard Grossman as co-plaintiff and concerns alleged fraud by Schiff during the private sale of a $2.5 million Adrian Ghenie painting at Sotheby’s. Barasch and Grossman accuse Schiff of still owing them $1.8 million.

In the new suit, the Barasches, who have ranked on the ARTnews Top 200 Collectors list, claim that their relationship with Schiff came apart amid financial strife on the advisor’s part, marking a dramatic end to Candace’s close friendship with her.

According to the suit, Schiff admitted earlier this month to Candace that funds sent for the purchases of artworks had not been used to that effect.

The lawsuit reads, “On the morning of Monday, May 8, 2023, Schiff (who Candace has spoken with every day, multiple times a day, for many years) called Candace and admitted that monies which Plaintiffs had wired to Defendants for the purchase of artworks was gone; that Defendants had dug themselves into a large financial hole that they could not get out of; that this had been going on for many years; and that Schiff had considered filing for bankruptcy prior to the start of the COVID-19 pandemic, but did not do so because she was afraid of a criminal investigation.

“Schiff explained that she had intended to map out a plan to get Defendants out of this financial hole during her stay in a rehabilitation center in San Francisco, that she went to in January 2020 to treat an addiction,” it continues. “(She also mentioned that rehab cost over $100,000).”

The suit lays out an array of instances in which Schiff had allegedly not directed funds from the Barasches to blue-chip galleries for intended purchases. In some cases, Candace learned that the galleries had not received the money. In others, the gallery followed up with her, allegedly seeking unpaid sums.

According to the suit, in their May 8 conversation, Schiff admitted that she had not used Candace’s money to pay for a $390,000 Sarah Lucas sculpture from 2018 titled CASANOVA. That work was being sold by the New York–based Gladstone Gallery in 2020. In the lawsuit, the Barasches say that Candace followed up with the gallery and discovered that no money had been received.

That same gallery is said in the suit to have sold the Wangechi Mutu sculpture The Seated IV (2019), one of the pieces initially produced for the Metropolitan Museum of Art’s façade, for $650,000 in 2020. (A similar work appears in Mutu’s current New Museum survey.) When Candace followed up with Max Falkenstein, a senior partner at Gladstone, he allegedly told her that she still owed $252,000.

A range of other, similar sales with different galleries are also outlined in the suit—and the Barasches claim that they are not the only ones who experienced this. Claiming that they have “little to no chance of recovering the millions of dollars,” the Barasches are now seeking an injunction to be placed on Schiff.

Schiff’s legal representative did not respond to request for comment.

Her ‘Partner in Crime’

In the profiles of Schiff that have appeared in the media in recent years, she has described the market as an opaque space that she has been able to penetrate—and even make more transparent to others. A secondary figure in some of those stories was Candace Barasch, whom Schiff once described as her “partner in crime” in a New York Times profile. That profile also noted that the actor Leonardo DiCaprio has formerly been among Schiff’s clients.

Barasch states in the lawsuit that she and Schiff had been friends since roughly 2004. “Virtually immediately after Schiff and Candace met,” the suit says, “Schiff began cultivating a personal friendship with Candace which transcended their business relationship, to the point that Candace and her family considered Schiff like a member of the family.”

The two acted on a “continuing oral agreement,” the suit states. The Barasches “generally did not communicate directly with the artists and galleries (unless/until Candace visited them to see particular works), and would not know if something was amiss.” Instead, they left most of that work to Schiff.

“For more than a decade,” the suit goes on, “it appeared that Defendants faithfully did so – apparently, they didn’t.”

Allegations of Fraud

The Barasches are now alleging that sales Schiff was supposed to have been facilitating did not go as planned because of how the money was handled. These transactions involved works by well-known artists and up-and-coming talents, with their values sometimes set at well over $100,000 each, and were done through galleries of significant stature in the international scene.

Of all the works listed in the lawsuit, the most expensive is an unnamed Ernie Barnes painting that was being sold by New York’s Andrew Kreps Gallery, allegedly for $650,000. Because the sale appears to have been set up in November of last year, it came as Barnes’s market was red-hot following a surprise success at auction. Candace had wired $50,000 to Schiff, but Schiff had never paid out the deposit to Andrew Kreps Gallery, so the sale was canceled. Candace never got back the deposit money, according to the suit.

The New York gallery 47 Canal seems to have sold the Barasches Anicka Yi’s Kn£M§†R (2023), part of a recent series of paintings generated with the help of AI. Candace had wired $190,531.23 to Schiff Fine Art’s bank account, only to find out, according to the suit, that Schiff never paid the gallery.

Lauren Halsey’s RIMS “N” THANGS (2023) was up for sale by David Kordansky Gallery for $110,000, a sum that included Schiff’s 10 percent commission. The gallery, which has spaces in Los Angeles and New York, allegedly told Candace that it had not received the money either.

Alvaro Barrington’s Brazil (2021) was sold to the Barasches for just under $180,000 by London’s Sadie Coles HQ in 2022. The next year, the suit claims, Candace came to understand from the gallery that Schiff hadn’t paid out those funds either.

Other lower-tier transactions involved a $32,100 work by Andrea Bowers from Kauffman Repetto, a $48,000 Hayv Kahraman painting from Pilar Corrias, an $80,000 Mindy Shapero work from Nino Maier, four $25,000 paintings by Adrian Berg from Frestonian Gallery, Hadi Falapisheh artworks from Andrew Kreps Gallery worth $70,000, and a $10,000 Lewis Hammond painting from 47 Canal.

In at least one case, a transaction seems to have been successful—with a snare at the end. Candace had agreed to buy a Harminder Judge painting from Pace Gallery for just over $45,000, and the suit notes that the gallery did receive the payment, but Pace “is now unable to release” the work. “As the Gallery explained to Candace,” the suit says, “because the invoice for the Judge artwork was put in the name of Schiff Fine Art, Pace would need Schiff’s consent and full release in order to deliver the work to Candace.”

Wendy Lindstrom, a lawyer for the Barasches, hinted that there are possibly others who have faced similar situations with Schiff. In a statement, Lindstrom said, “Unfortunately, as the fraud is uncovered we are seeing a ripple effect throughout the art world. The victims appear to be widespread – artists, galleries and collectors.”

https://www.artnews.com/art-news/news/lisa-schiff-candace-barasch-lawsuit-sales-wangechi-mutu-sarah-lucas-1234668677

Up-date 2023, June 25

A guide to finding art advisers and avoiding the untrustworthy ones

In an unregulated industry, art advisory has been beset by controversies and legal wrangles

June 16, 2023

The news hit the art world like a bombshell. One of the most prominent art advisers in the business, Lisa Schiff, had been targeted by two explosive lawsuits brought by former clients — one also a close friend. The lawsuits accused Schiff of breach of contract, fraud and conspiracy, alleging that in her role as adviser she bilked clients out of millions of dollars on art deals. Among her clients was film star Leonardo DiCaprio, although that relationship apparently ended five years ago. But Schiff had also brokered deals with multiple clients for works by artists such as Wangechi Mutu, Sarah Lucas and Chloe Wise. The allegations — brought by her (now presumably former) friend, real-estate heir Candace Barasch, and lawyer Richard Grossman — charge that Schiff owes them $1.8mn over a painting by the Cluj school artist Adrian Ghenie. She allegedly bought the work on their behalf but never remitted the full profit when it was resold. A second lawsuit claims she advised clients to buy art and took payment for it but never passed those payments on to the galleries. She has started liquidating her business, according to court documents; she and her lawyer John Cahill did not respond to a request for comment on the cases. Unfortunately, this is by no means the first time art advisers have been involved in problems with their clients. But it provides a good moment to survey the risks of the trade — and work out how to find an adviser you can trust.

In 2015, one of Germany’s leading advisers, Helge Achenbach, went to prison after admitting defrauding clients out of at least €18mn. Among his super-wealthy clients were the late Aldi supermarket heir Berthold Albrecht and pharmaceutical entrepreneur Christian Boehringer. In court Achenbach admitted he had added additional mark-ups to art bought for his clients. More recently, adviser Angela Gulbenkian pleaded guilty in a London courtroom to defrauding a client over the sale of a £1.1mn Yayoi Kusama sculpture. “It’s a total Wild West out there,” says Harry Smith, chair of the London and New York advisory company Gurr Johns. “Due to the opacity of the art market, the client may well not know the true price of the work of art they are advised to buy. The opportunity to lose money is greater in the art world than in virtually any other field except perhaps horseracing.” Yet many collectors do use advisers, both to scan all that’s available — they can travel around the world to biennales, fairs and exhibitions when often the client is too busy to do so — and to gain access to the most coveted artworks. An adviser will also help with conservation, storage, insurance and inventorying, as well as helping the client focus on how to shape the collection; they can resell for the client, though this brings risks of a conflict of interest.

Finding a reliable, trustworthy and reputable adviser is the problem. In the trade, people talk cuttingly about “Gmail art advisers”, well-connected but inexperienced newbies who set up shop with just an email account and no proper structure behind them. “Do your due diligence, don’t use an attractive young person you just met at a cocktail party or your spouse’s best friend,” advises Smith. Recommendations tend to be word of mouth, but you can always check their reputation with your contacts at a gallery, auction house or museum. “Before appointing someone, speak to collectors you trust, dealers you trust,” says the established dealer and adviser Emily Tsingou. “You should not be focusing on someone who just analyses price data. And you need to know what you want, you need to find an art adviser who is not putting together collections that are similar to each other.” So how much does it cost? It depends on the negotiation between client and adviser, and can vary from a percentage fee per transaction to a yearly retainer. This can hinge on the amount the collector wants to devote to art — in general the higher the sum, the lower the percentage. On transactions between £20,000 to £1mn it might be 10 per cent; less for higher prices. A retainer varies on how much work the adviser does, but could be in the range of £25,000 to £75,000 per year. A hybrid solution might be a retainer plus a small commission, perhaps 5 per cent, on purchases. “Working with great consultants who look after a few clients can be very rewarding and save a lot of time,” says Toby Clarke of Vigo Gallery. “A major problem from the dealers’ point of view is advisers who flip. For instance, recently an adviser [who also owned a gallery] from New York begged me to sell him a Jordy Kerwick work, saying it was for a New York doctor. So I did, and then lo and behold it appeared six weeks later in a South Korean auction selling at three times the price. This doesn’t help to trust new advisers.” The problem is that there is no qualification to become an adviser. In the US, there is the Association of Professional Art Advisors, with a code of ethics and stringent entry requirements. However, few countries have such an association, so it is up to the client to spot red flags when seeking an adviser. “Stay away from anyone promising great returns,” advises Clark, while Smith emphasises: “Check the reputation of the person: quite a few so-called advisers don’t last very long — they go off the rails.” Recent history, sadly, seems to bear this out.

https://www.ft.com/content/50887c55-08ec-4ffd-848c-5f8262fc3cda

Comment:

What Is the Biggest Challenge to the Art Advisory Industry? Fraud or Scaling?

In the wake of the accusations that Lisa Schiff was using client funds for personal expenses, the big question for the art industry is whether that will cause art collectors to view advisors with suspicion or even a threat. That seems to be the thinking behind this FT “guide to finding an art adviser” which offers to help collectors avoid the shady ones. The story raises an interesting question about just what the role of an art advisor is and how important advisors are to a growing art market.

Let’s start with the FT, though. The newspaper seems to think inexperienced art advisors with few credentials or clients are the problem. One of the final comments in the piece comes from gallerist Toby Clarke who suggests wary would-be collectors do a reputation check of any advisor they engage. He warns, “quite a few so-called advisers don’t last very long — they go off the rails.”

The gallerist’s advice isn’t actually correct, though. The art advisors who have gotten themselves and their clients into serious trouble—Schiff, Angela Gulbenkian, Helge Achenbach, all named in the FT piece, as well as, Yves Bouvier who is mysteriously left out of the piece—were all long-lasting figures in the art trade. In many cases, the clients they bilked were long-standing ones who were too trusting and lax in their dealings. The damage an unscrupulous art advisor can do seems to be directly proportional to the amount of time—and trust—they can build with a client.

The other problem with the FT story is its conception of what art advisors do, who hires them and why. The FT tells you not to hire someone attractive and chatty you happen to meet at a cocktail party. (Do they really think that’s how advisors who do the bulk of transactions acquire clients?) The FT spoke to other dealers and advisors who say: don’t just hire someone to analyze prices; don’t hire someone who will make your collection look like another collectors’; don’t hire advisors who are really just flippers (well, that’s more of a dealer’s complaint than a client’s—but the funny thing is that the dealer who raises the complaint uses Jordy Kerwick—an artist with a freewheeling market and no dealer controlling it—as an example of an artist who was flipped unconscionably.)

The problem here is that the advice won’t really protect anyone from losing millions to an unscrupulous advisor. Those who have gotten themselves in trouble committed fraud. Bouvier seems to have engaged in questionable behavior but nothing that his angry client’s lawyers have been able to prove in a courtroom yet. Most of these frauds would have been avoided by tightening up the art collector’s own sloppy business practices.

Beyond how to recognize the red flags of fraud, the bigger issue is figuring out who qualifies as an art advisor and what role they play in the art market. After all, that varies widely from client to client, advisor to advisor.

Art collecting is really more of a scavenger hunt than it is a retail business. Some art advisors act like curators or tastemakers for their clients; others act more like real estate agents executing transactions (a few seem to dabble in both art and real estate in a way that makes you wonder why it doesn’t happen more.) Some art advisors are employed for relatively brief collecting windows that last a few months to several years; others have what seem like lifetime engagements. Some art dealers have a gallery for the purpose of their reputation but are really just advisors (that’s where they make their money); some advisors are really just dealers, holding stock in any manner of private arrangements. Some collectors act as advisors too.

Advisors to well-known high-volume collectors might act as gatekeepers to their clients’ time and attention, while some of those new to collecting will hire an advisor simply for their access to galleries and artists.

Seeing how advisors run through the market like a red thread, it’s a bit of mystery that advisory firms haven’t grown in size. Art advisors today are something like agents were in Hollywood in the 1970s or early 80s. It seems like a business ripe for growth. Where is the ICM or CAA of art advisors? Sotheby’s gave it a shot with Art Agency, Partners and Gagosian just hired a few up-and-comers for their advisory arm. Some long-lived partnerships are adding a younger generation of advisors but mostly the business is built around sole practitioners and partnerships. There are good economic reasons for that. But one would imagine that all of those treasure-hunt reasons collectors go to an advisor—finding the right piece from the right far-flung place—would be enhanced by scale.

Over the last two decades, first the auction houses and then almost a dozen galleries have grown into global concerns. Will that happen with art advisory firm or are there reasons it cannot? Those seem like bigger questions than whether your art advisor is going to run off with your money because you didn’t retain control of the work.

Up-date 2023/7/25

quotes:

Barasch and two co-investors are seeking the return of $1.8 million, or $900,000 each, that they claim is the remainder owed on the $2.5 million sale of a work by sought-after Romanian painter Adrian Ghenie that was brokered by Schiff. Barasch’s co-investors and co-plaintiffs are Richard Grossman and his spouse, who was not named in the complaint, but is known to be veteran art dealer Adam Sheffer.

Another, separate lawsuit involves Barasch, alongside her husband Michael, and trusts established on behalf of their children as plaintiffs.

Following the discovery of the missing Ghenie proceeds in early May, Barasch says she found information concerning at least a dozen other art transactions where money she paid is missing or unaccounted for, or where works have either been only partially paid for, or not paid for, or are being held in Schiff’s name and cannot be released to Barasch despite her requests.

…

In response to the assertion by Schiff and her attorney that the Baraschs saw a positive return of over $10 million due to Schiff’s support and facilitation of art transactions over the course of roughly two decades, they point out that Schiff would have made a commission of $1 million on those sales (ten percent), as well as that Barasch almost always used those proceeds to buy more art.

It continues: “Essentially, Defendants’ argument is that theft is acceptable if it is from wealthy people. That is not the law.”

…

The memo outlines a June 2019 vacation to Mykonos, Greece, to which Schiff allegedly traveled by helicopter, stayed at a private villa with a driver on call 24/7, and rented a private yacht for a day. Meanwhile, in New York, they allege she undertook a ten-year lease for a two-story Tribeca storefront, that was renovated to the tune of over $1 million, including to install custom finishes. “These were Ms. Schiff’s decisions,” the memo reads.

full text @

https://news.artnet.com/art-world/candace-barasch-lisa-schiff-ongoing-legal-feud-2340249

Lawsuits

Eye-opening filings in Lisa Schiff lawsuit reveal dozens of new claims and hundreds of missing works

The embattled art adviser is facing two lawsuits accusing her of running a “Ponzi scheme” and defrauding her clients

24 August 2023

Documents recently submitted as evidence in two lawsuits filed against the embattled adviser Lisa Schiff and her business SFA Advisory reveal the extent of the inventory of works in her possession—including those that are considered “missing” by the prosecution. They also detail as-yet unreported claims against Schiff from around 40 individuals and businesses, some worth millions of dollars. The documents are dated to 11 August, and came to public attention after they were published today (24 August) by the art market industry newsletter The Baer Faxt.

Schiff is being accused of wrongly diverting money from the sales of clients’ artworks, conversion, fraud and breach of contract, among other crimes. She is also facing allegations that she was running a “Ponzi scheme” to fund her “lavish lifestyle”.

One document lists 894 works in Schiff’s inventory (deemed in her possession), worth more than $3.1m in total. The list has been compiled by the New York appraisers and advisory group Winston Art Group—described, perhaps pointedly, in court documents as a “highly respected art advisory business”.

Among the scores of artists whose works are embroiled in the scandal are major market stars such as Damien Hirst and Michael Armitage. The vast majority of the 894 works are in art storage facilities, such as UOVO in New York, DAX in Massachusetts and Lockson in Seacaucus, New Jersey. A number of design objects not attributed to any artists are also listed as being held in the DAX storage facility.

Among the galleries listed as holding parts of Schiff’s inventory are Bortolami—which has a 2022 painting by the Japanese artist Koichi Sato—Karma and Canada Gallery in New York, and High Art in Paris. The auction house Phillips is also listed as holding some 20 works, probably in its offsite storage facilities. A 2016 sculpture by Jasmine Thomas-Girvan is listed as “repaired by Zwirner”. No spokesperson at any of these galleries was available for comment by the time of publication.

A spokesperson for Phillips said the auction house has provided information to parties involved in the Schiff lawsuits, but did not elaborate. The spokesperson added: “Phillips always maintain the confidentiality of consignors and buyers unless they expressly direct us otherwise or if we are required to provide that information under applicable law.” Another document states that 108 works considered to be in Schiff’s possession are “missing”, amounting to a total of more than $1.1m in value. This list includes works “with potential third-party claimants”, the document reads. Among these items listed are a Zippo lighter work by Hirst and a canvas by the late Virgil Abloh.

A third document provides a fuller picture of the magnitude of the case against Schiff. While it was known that Schiff’s former client and close friend of many years Candace Barasch was seeking at least $2.5m, plus interest and damages, over a number of art purchases that were not fully completed, the document lists around 50 unsecured claims, some worth almost $1m each. High-profile art business professionals seeking claims include Sotheby’s head of private sales David Schrader, the Stephen Friedman senior director Mira Dimotrova and the artist Seffa Klein, the latter of whom is seeking $506,200. The collector Richard Grossman, who was named in an earlier court hearing, is seeking $2.3m.

According to court documents from May, Schiff is cooperating with federal and state authorities investigating her business dealings, and has been working to liquidate her advisory firm to pay creditors. Schiff’s lawyer John Cahill could not be reached for comment.

https://www.theartnewspaper.com/2023/08/24/lisa-schiff-court-documents-dozens-new-claims-hundreds-missing-works-sfa-advisory

That 29-page PDF link is here for those who want to see the details

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=WH2w20SN2vSf4/dAOuAeWA==

その他に、こちらのリンクもご参考へ:

有名なアート・フリッパー前澤友作の新アート・コレクション @ ゲーテ雑誌2023年4号

Famous art flipper MAEZAWA Yusaku and his new art collection @ Magazine GOETHE April 2023

https://art-culture.world/articles/maezawa-yusaku-art-collection/

Hedge fund titan Israel Englander pays 1 billion US$ to ex-wife and photographer Caryl, who left him for art dealer Dominique Lévy

New York’s High Society + its Art Scene: Prestige, Sex, Collectors and Money…

https://art-culture.world/articles/dominique-levy/

Prominent Collector and Dealer Adam Lindemann Arrested

New York Art World

https://art-culture.world/articles/adam-lindemann-arrested/

五木田智央のニューヨークのアートディーラー、メアリー・ブーンは刑務所に30ヶ月間

GOKITA Tomoo’s New York Art Dealer Mary Boone sentenced to 30 Months in Prison

https://art-culture.world/articles/gokita-tomoos-new-york-art-dealer-mary-boone-sentenced-to-30-months-in-prison/

2024/10/18 Up-date

Law & Politics

Disgraced Art Advisor Lisa Schiff Pleads Guilty to $6.5 Million Fraud

The power player used “stolen money to fund a lavish lifestyle,” according to a U.S. Attorney.

artnet news, October 17, 2024

quotes:

She said that between 2018 and May 2023, she lied to clients about selling and buying art on their behalf and that she misused proceeds from those transactions. She choked up and became emotional as she read. Afterward, Judge Oetken asked whether she knew that her actions were against the law. Schiff responded that she did.

Schiff “defrauded at least 12 clients, one artist, the estate of another artist, and one gallery, collectively, of at least approximately $6.5 million,” according to a news release from the United States Attorney for the Southern District of New York.

“For years,” U.S. Attorney Damian Williams said in statement, “Lisa Schiff breached the trust of her art advisory clients by lying to them and diverting millions of dollars her clients had entrusted to her. Instead of using client funds as promised, Schiff used the stolen money to fund a lavish lifestyle.”

Schiff is currently free on $20,000 bail and is restricted to staying inside the Southern District of New York for the next three months; she will be sentenced on January 17. The maximum penalty for wire fraud is 20 years.

As part of her plea deal, Schiff agreed with prosecutors to guidelines that will ask the judge to sentence her to between 41 months and 51 months. She must also pay restitution and forfeit $6.4 million, which represents the sum of the proceeds traceable to the fraud.

…

Schiff was a well-regarded advisor and auction house expert for more than two decades, and developed a reputation as a savvy market observer. In May 2023, she was hit with a lawsuit by two former clients, real-estate heiress Candace Barasch and lawyer Richard Grossman, alleging that Schiff owed them a total of $1.8 million, or $900,000 each, related to the sale of a painting by Adrian Ghenie. That suit, filed in a New York court, included claims of breach of contract, fraud, and conspiracy, among other allegations.

Schiff quickly shuttered her SFA Advisory office and showroom in Tribeca, and soon after left her space at Cromwell Place in London.

Days after that initial lawsuit, Barasch filed a second claim againt Schiff, saying that she owed at least $2.5 million plus interest and damages for a series of art purchases that Schiff was meant to facilitate that she never completed or only partially completed.

That second suit alleged a pattern: Schiff would tell Barasch of paintings that were available by in-demand contemporary artists with rising markets, get her permission to acquire them, take full or partial payment, and then, in most cases, fail to complete the purchases.

Full text:

https://news.artnet.com/art-world/lisa-schiff-pleads-guilty-to-wire-fraud-2554622

2025/2/21 up-date:

A-list art dealer’s incredible fall from grace after scamming $6.4m

An art adviser to the stars who scammed her elite friends out of $6.4million to fund her high-flying lifestyle has opened up about her newfound misery – as she faces 20 years behind bars.

19 February 2025

Lisa Schiff boasted Leonardo DiCaprio and a real estate heiress among her high profile clients, before her entire scheme unraveled in 2023 when it was revealed she had been pocketing cash intended to purchase million-dollar paintings.

She herself lived a life of luxury, renting a $25,000-a-month TriBeCa loft, taking private helicopter journeys and enamoring her wealthy clients with $32,000 shopping sprees at Loewe in Paris.

Speaking from her new two-bed apartment in Stuyvesant Town, where her rent is paid for by her parents, Schiff told the New York Times she was miserable even at the peak of her scam.

‘I was miserable in that helicopter. I was miserable in Loewe in my fancy outfit. At the end, I thought that I was going to have a stroke,’ she said.

‘I was a fake, a fraud every day.’

At the time, she didn’t consider herself a criminal. It was a thought she couldn’t allow herself to have, even as she pocketed millions of dollars from her unsuspecting friends.

She was buying and selling luxury artworks on behalf of her clients, and built a reputation for exquisite tastes – often identifying up and coming artists right before their value truly exploded.

Schiff had plied her trade at Phillips auction house in the 1990s and went on to become the director of an Upper East Side gallery before launching her own business in 2002.

‘It just got so big and I got so scared. I have a kid and I was just like, ”I can’t be a criminal”,’ she said. ‘I didn’t allow myself to even think that I was doing criminal behavior.’

Now facing 20 years behind bars, she has had to create a contingency plan for her son should she receive the maximum sentence. She said he will move in with her brother.

She declared bankruptcy and has switched front row seats at art shows for meetings with Alcoholics and Debtors Anonymous, writing and rewriting apology letters to her victims which her lawyer has instructed her not to send.

The art collection she spent years painstakingly acquiring for herself is being liquidated in an effort to reimburse up to a dozen victims some of their lost cash.

Her scam came crashing down in 2023, when she turned herself into authorities. By that time, she had defrauded her clients – some of whom she considered her ‘closest friends’ and had named godparents to her son – a total of $6.4million.

In October 2024, she pleaded guilty in Manhattan’s federal court.

Prosecutors said she ran what could effectively be described as an art Ponzi scheme beginning as early as 2018.

In all, 55 artworks were involved. She would divert her client’s profits from a sale of their art collection, or payments they’d made to purchase a piece, into her own personal or business accounts.

Then, she would tell clients that their art had not yet been sold, or that the art was on its way.

By the time she confessed to several of her clients, prosecutors said she ‘could no longer conceal her scheme due to mounting debts.’

Schiff is due to be sentenced on March 19.

Wendy Lindstrom, a lawyer representing seven of Schiff’s defrauded clients, told the Times that the art adviser is not remorseful.

‘Any attempt by Lisa Schiff to portray herself as remorseful is disingenuous at best,’ she said.

https://www.dailymail.co.uk/news/article-14411393/lisa-schiff-art-adviser-stealing-millions-clients.html