アートマーケットと現代アート・フリッパーについて Art Market and Art Flippers

フランスから、今日のアートマーケット・ニュース。

The Contemporary Art Market report 2018

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2018

簡単で説明しますと、美術品市場調査会社アートプライス (artprice) は早い段階で、中国のアートマーケットも調査しまして、artnet (https://www.artnet.com/price-database/) より細く、正しい情報を発表しています。

注意していただきたいのは、現代アーティストのプラクティスが幅が広くて、ペインティングの分野はマイノリティであると言えます。

ところが、投機好きなアート (Flip Art)の存在を忘れてはいけません。アート・フリッパー (Art Flipper)には、絵画/タブローが「便利な」、使いやすい、アートディーリングの商品です。

中国のアーティストに関して、ほとんどの人たちが「絵画オークションの値段」しか意識していません。中国のアートマーケットはギャンブルに近い世界です。

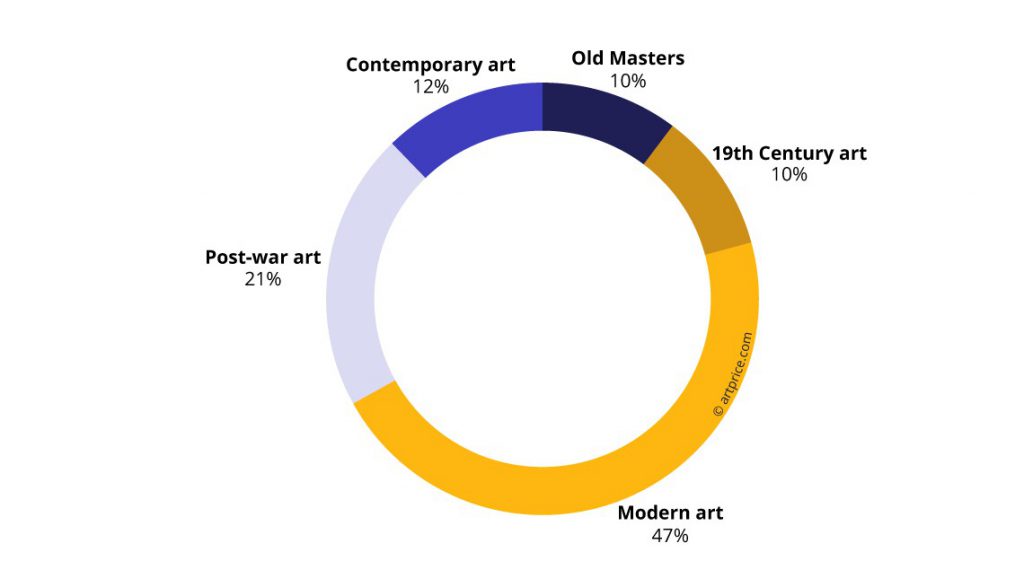

Artprice会社により、グローバル化されたアートマーケットの中、12% だけは現代アートであると説明されています。

しかし、よく見れば、ほとんどのデータは、オークション化された絵画の値段についての統計です。

私の意見ですが、日本では、アートマーケットがほとんど存在せず、現在と言えるのは、「フランス人」 レオナール・フジタ と 「元アメリカン・アーティスト」 草間彌生 だけ一番ホットなアーティストたちでございます。

As a reference for art lovers, who want to know what some contemporary art flippers practice, and why they focus mostly on painting via auction houses in New York.

The sensitive Japanese art market seems to expand, which should be welcomed. However, Japanese have not forgotten the bubble period with a high grade of fake art news and speculative art operators.

In the context of the speculative art market, I recommend you my following entries:

(1)

Mark Bradford + Kerry James Marshall: ‘Black Art’ for American Art Flippers

https://art-culture.world/articles/mark-bradford-kerry-james-marshall-black-art-for-american-art-flippers/

(2)

前澤友作の米国アーティスト・ダーリン、マーク・グロッチャンの作品:クリスティーズのロンドン・オークションで下落

MAEZAWA Yusaku’s American Artist Darling Mark Grotjahn @ Christie’s London & Lévy Gorvy : Sharp Depreciation

https://art-culture.world/articles/maezawa-yusaku-mark-grotjahn-christies/

(3)

ARTnews の「トップ200コレクターズ」」2018

THE TOP 200 COLLECTORS (ARTnews 2018)

https://art-culture.world/articles/the-top-200-collectors-artnews-2018/

(4)

シミュラークルから物語的な知覚アートまで:展覧会の画像一覧

From Simulacra to Narrative Perception Art : Exhibition Images

https://art-culture.world/articles/from-simulacra-to-narrative-perception-art-exhibition-images/

(5)

日本の現代アーティスト・トップ 92 (2017年)

Contemporary artists from Japan, Top 92 (2017)

https://art-culture.world/articles/contemporary-artists-from-japan-top-92-2017/

(6)

ジョアン・ミッチェルのアート・ディーラーが突然変更に:「このアート界はとても野蛮になった」/ (+ ポンピドゥー・センター・メッス画像)

In the context of recent changes by Joan Mitchell’s art dealers: : “This art world has become so uncivilized” // (+ pics from the Centre Pompidou-Metz)

https://art-culture.world/articles/joan-mitchells-art-dealers-problem-this-art-world-has-become-so-uncivilized/

(7)

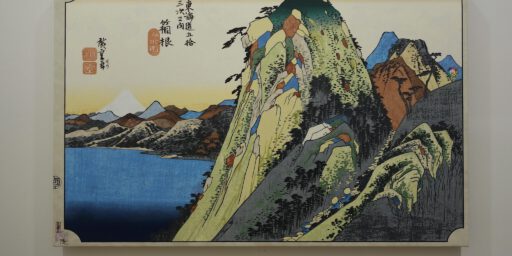

藤田嗣治・Léonard Foujitaの作品との出会い

Encountering the works by Léonard Tsuguharu Foujita

https://art-culture.world/articles/encountering-the-works-by-léonard-tsuguharu-foujita-1/

(8)

スイスの「ハウザー&ワース」が香港に新スペースオープン:「マーク・ブラッドフォード個展」、東京にギャラリー進出も間近?

Hauser & Wirth opens with Mark Bradford in Hong Kong, next will be Tokyo?

https://art-culture.world/articles/hauser-wirth-opens-with-mark-bradford-in-hong-kong-next-will-be-tokyo/

up-date:

(9)

“Bribed” journalism at Wall Street Journal: Gagosian pushing up Grotjahn for U.S. Art Flippers, 6 days before the exhibition

https://art-culture.world/articles/gagosian-grotjahn-for-u-s-art-flippers/

(10)

村上作品の価値?不幸な村上隆、、、

The Value of Murakami’s Works? An Unhappy MURAKAMI Takashi…

https://art-culture.world/articles/takashi-murakami-art-works-value/

北京・X Museumの共同設立者、黄勖夫 (マイケル・ホゥアン Michael Xufu Huang) が現代アート・フリッパー (aka MOTHERFUCKER) であるという事実

Michael Xufu Huang 黄勖夫, co-founder of Beijing’s X Museum, is an Art Flipper (aka MOTHERFUCKER)

https://art-culture.world/articles/michael-xufu-huang/

「貧乏臭さ」の象徴:村上隆、ドラえもん、藤子・F・不二雄、ガゴシアン。アート・フリッパー:2020作を2021年4月のオークションへ

Symbol of “Shabbiness”: MURAKAMI Takashi, Doraemon, Fujiko Fujio, Gagosian. Art Flipper: Work of 2020 Selling at April 2021 Auction

https://art-culture.world/articles/takashi-murakami-doraemon-fujiko-fujio-ドラえもん/

2018/10/16 up-date:

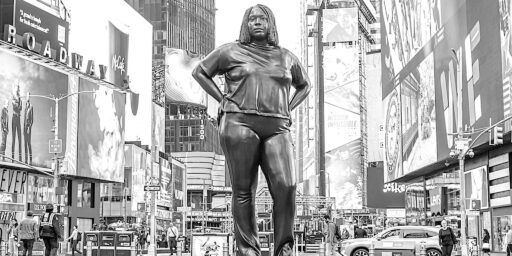

Is This the Victory Lap We Were Hoping For? Why We Must Keep Women and Artists of Color From Becoming the Next Victims of Market Speculation

Artists like Avery Singer and Njideka Akunyili Crosby are deserving of rising prices, but should they be at auction?

Lisa Schiff, October 12, 2018

A shift has taken place in the media in recent years wherein talk of the art market has almost completely supplanted talk of art itself. Art-as-investment, price indices, predictions, statistics, and graphs are the new norm for framing art-world discussions. Large sums of money are reported as trading and, although there is little understanding of how these numbers are achieved or guaranteed, a new breed of buyer has entered the market focused solely on a false perception of liquidity. The result is that we see intense bumps in prices for short periods of time, without any substantive data backing them. The spikes can be so high that a free fall feels inevitable.

…

I don’t think the work of artists this young should be coming to auction at all, nor should there be any resale situation involving prices so high above their primary markets. A healthier situation is a long, slow burn with real context and institutional support.

…

Could it be the result of the calculating profit drive of a few men of privilege? I can’t answer that, but I know some in the game.

https://news.artnet.com/market/lisa-schiff-on-women-artists-market-speculation-1369453

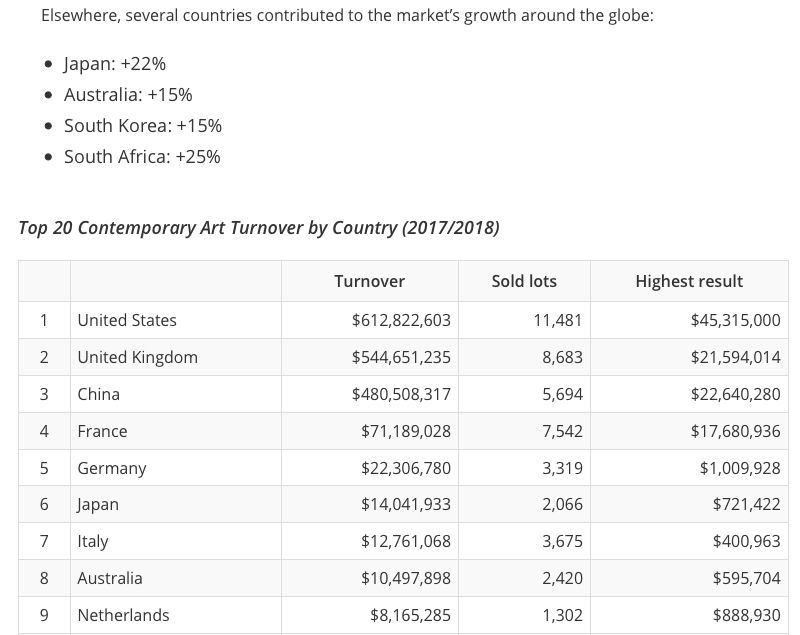

Top 20 Contemporary Art Turnover by Country (2017/2018)

Nr. 6 Japan, turnover: $14,041,933, sold lots: 2,066

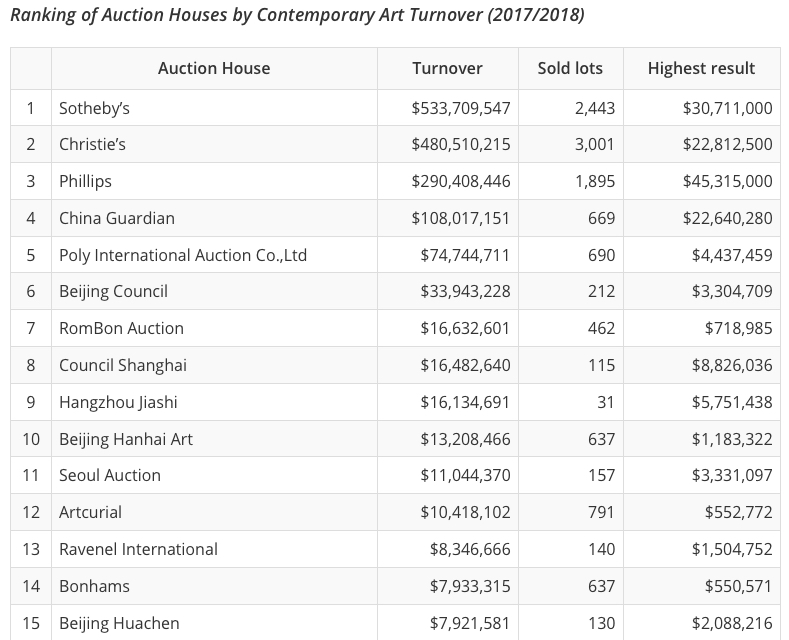

Ranking of Auction Houses by Contemporary Art Turnover (2017/2018)

Japanese Inland Art Market, Contemporary Art Turnover

Nr. 16 Mainichi Auction: $7,191,513

Nr. 21 SBI Art: $5,269,302

Auction House Turnover

1 Sotheby’s $533,709,547

2 Christie’s $480,510,215

3 Phillips $290,408,446

4 China Guardian $108,017,151

5 Poly International Auction Co.,Ltd $74,744,711

6 Beijing Council $33,943,228

7 RomBon Auction $16,632,601

8 Council Shanghai $16,482,640

9 Hangzhou Jiashi $16,134,691

10 Beijing Hanhai Art $13,208,466

11 Seoul Auction $11,044,370

12 Artcurial $10,418,102

13 Ravenel International $8,346,666

14 Bonhams $7,933,315

15 Beijing Huachen $7,921,581

16 Mainichi Auction $7,191,513

17 Zhong Cheng Auctions $6,953,902

18 Xiling Yinshe Auction $6,473,963

19 Grisebach $5,978,695

20 Joe Jubilee Beijing $5,425,734

21 SBI Art $5,269,302

22 Dorotheum $5,067,786

23 Ketterer Kunst $4,952,890

24 K-Auction $4,859,824

25 Heritage Auctions $4,408,149

© Artprice.com

Top 10 下落アーティスト Decreasing Auction Revenue (2017/18 vs. 2016/17)

Artist 2017/18 versus 2016/17

1 Keith HARING (1958-1990) $24,331,489 vs $35,006,680 -30%

2 ZENG Fanzhi (1964) $20,282,825 vs $31,099,780 -35%

3 Anselm KIEFER (1945) $15,211,978 vs $23,999,435 -37%

4 Adrian GHENIE (1977) $11,228,881 vs $28,287,718 -60%

5 Mark GROTJAHN (1968) $9,744,810 vs $39,046,320 -75%

6 Thomas SCHÜTTE (1954) $8,883,570 vs $14,926,572 -40%

7 Sean SCULLY (1945) $7,427,785 vs $11,971,151 -38%

8 LUO Zhongli (1948) $4,568,456 vs $9,803,167 -53%

9 AI Weiwei (1957) $3,702,757 vs $7,082,723 -48%

10 Mike KELLEY (1954-2012) $3,613,359 vs $5,980,107 -40%

© Artprice.com

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2018/artists-prices

2018/11/13 update:

Guarantees: the next big art market scandal?

Third-party auction deals have made some people very rich—but they may be bad for the market in the long run

ANNA BRADY, with additional reporting by ANNY SHAW

12th November 2018 10:38 GMT

(quotes:)

Follow the money

The extensive use of third-party guarantees is just one sign of the “increasing financialisation” of the art market, says Georgina Adam, editor-at-large of The Art Newspaper and the author of Dark Side of the Boom. “I do think it is worrying… they can reduce the work of art to a purely speculative instrument, and some of the third parties have no real interest in the art—added to which, the deals are hardly transparent.” Although auction houses “run a pretty clean ship”, according to Kenny Schachter, a collector, art dealer and journalist, he adds: “What’s pretty unregulated is what these idiots are doing in the room among themselves.”

…

One collector, who guarantees around four works a year for an amount “in the tens of millions”, says that funds would be better off protecting the masses than policing an elite market. “I think, in the art world, everyone deserves what they get. These are super-wealthy people playing a game largely fueled by ego and their own conceit about how clever they are at trading in art.”

Increasingly sophisticated

Guarantees have become increasingly sophisticated. “Some of it is so convoluted that I have a hard time understanding the basic elements because there are so many variations of the guarantee,” Schachter says. These guarantees cannot be seen as formulaic because they relate to the motivations of buyers and sellers, and to market conditions, says Tom Mayou of the London-based advisory firm Beaumont Nathan. Adding to the confusion is the fact that the terms “irrevocable bid” (used by Sotheby’s) and “third-party guarantee” (Christie’s) are essentially the same thing, but are used interchangeably.

Schachter, who also guarantees works, says that there are “only a handful of people who guarantee works at $20m to $30m or more”. The Mugrabi and the Nahmad families are reportedly among them. It was the Nahmad family who apparently gave the highest ever third-party guarantee, at $150m, for Modigliani’s Nu couché (sur le côté gauche) (1917), which sold at Sotheby’s New York for $157.2m in May. So, as Schachter says, you have to know the market “because you’re up against the Mugrabis and the Nahmads… you can’t come in there foolhardy and think you’re going to walk away with a fat profit”.

The London-based dealer Inigo Philbrick offers around 20 to 25 third-party guarantees a year on works by artists such as Rudolf Stingel, Christopher Wool, Mike Kelley, Richard Prince and Wade Guyton. “For me, the best outcome of a guarantee is that you make a lot of money [without buying the work]. Say it’s a million dollars that you’ve risked, then you’d want to make $100,000 to $150,000 as your fee,” he says. “The second-best outcome is that you get a work you were happy to buy at a price you were happy to own it at. The second-worst outcome is that it sells on one bid and you make $5,000, having put in all this effort to negotiate a deal. [And] the worst outcome is the sort of guarantee you do purely for financial speculation and end up with a painting you don’t want to own.”

…

Yet Adam Chinn, the chief operating officer at Sotheby’s, disagrees that guarantees are conflicting. “You may make the argument that there’s an inequality of information [between bidders], but I don’t think there’s a conflict of interest,” he says. Collectors today are more financially sophisticated, Chinn says, so “if I [the collector] want to buy object A, it makes sense for me to back object A, because if I don’t get it, I get paid, and if I do get it, I wanted to buy object A anyway”. Chinn believes that, in this way, guarantees have shifted from an almost wholesale market to being retail.

…

“Guarantees are like those ‘no money down, get rich quick’ ads,” Schachter says. “There’s no other speculative vehicle that affords you the upside with only having to pay in the case of a losing scenario.”

Imbalance of information

Last-minute third-party guarantees are also on the rise, with some clients waiting for a catalogue to arrive before combing it for lots to back. Such guarantees are announced in one quick burst just before an auction starts, which increases opacity, the dealer Nicholas Maclean of Eykyn Maclean says. This “rush of information at the beginning of the sale [is something that] many people miss”, he says. “They should be announced lot by lot.”

If a third-party guarantor buys a work, they receive a “financing fee” from the auction house and therefore pay less for the work than any competitors. Other bidders have no idea who is bidding on behalf of the third party—a bone of contention for Maclean, who suggests that “the auctioneer should be the one carrying out the bid for the guarantor, or it should be announced which member of staff is bidding on their behalf. It would be more transparent, particularly to new buyers unaware of the intricacies.”

He cites one problematic scenario. “If, hypothetically, a dealer sees a client who announces they’re going to bid on a painting, the next day the dealer could call the auction house and ask to guarantee it. The temptation might then be for the guarantor to get on the telephone and bid that person up.”

Auction houses put the onus on guarantors to disclose to their clients that they have a financial interest in a lot. But it is unclear whether this always happens, particularly when last-minute salesroom announcements make it impossible for bidders to question their advisers, says Doug Woodham, the managing partner of Art Fiduciary Advisors and the former president of Christie’s for the Americas. “For all they know, the person they asked to bid on their behalf may now have a financial interest in that very lot,” he says. Woodham suggests that collectors have formal agreements with their advisers to prevent this. “But unfortunately, there is no way for collectors to independently confirm their advisers’ actions because the identities of third-party guarantors are not disclosed by auction houses,” he says.

…

Propping up the market?

Although guarantees have been the subject of criticism for inflating prices, it is hard to imagine returning to a market without them. “When you look at the performance of an artist, you cannot ignore whether or not some of his or her works were covered by third-party guarantees, because this is going to affect the prices,” Bourron says. “If you sell your work without a guarantee, you cannot expect to have the same performance.”

Schachter likens auctions with heavily guaranteed lots selling on one bid to the backer to “a dog and pony show… they’re bringing out these paintings that are, in effect, pre-transacted”. At a conference in April, Amy Cappellazzo, the chairman of fine art at Sotheby’s, seemed to suggest that auctions could become obsolete, because “by the time [the sale] happens, everything that was spontaneous

and interesting has already happened”.

Manufacturing a new price level for an artist by giving an artificially high third-party guarantee is possible, but costly to maintain. “Manufacturing prices at auction is expensive; you have to pay a lot of money to the auction house,” Philbrick says. “The market is often too savvy for that. Just because one work sells for X amount, it doesn’t mean that everyone is going to start buying for that amount.”

Although it is currently dominant, the auction market for post-war and contemporary art is only around 20 years old. Only when those with vested interests in artists who regularly appear at auction with third-party guarantees (such as Basquiat, Warhol and Richter) retire or die, or when tastes inevitably change, will these multi-million prices be revealed as being built on firm foundations—or on stilts.

How auction guarantees work

Guarantees ensure that a work is pre-sold at a minimum amount, either backed by the auction house itself (house guarantee) or by a third party, who receives some of the upside should the work sell for more (typically 20%-30% of the overage above the guarantee, although this can be as low as 10% or as high as 50%). The more risk a third party takes on, the higher the potential reward.

https://www.theartnewspaper.com/news/guarantees-the-next-big-art-market-scandal

AMM 2018/11/19 up-date:

“Late in Sotheby’s Contemporary Evening sale, Alberto Mugrabi jumped into the bidding on a white Warhol shadow painting topping another bid in the room but chopping it unexpectedly to $1.175m, visibly annoying auctioneer Oliver Barker.

The next night it was Larry Gagosian’s turn to be annoyed as he was seen buying to two different Warhol’s in the $5m range. On the second Warhol of the night, Gagosian got visibly annoyed when Christie’s auctioneer eked out another bid just as Gagosian thought the work had been bought. Nonetheless, the dealer topped the bid and bought the work.”

2018/11/23 up-date:

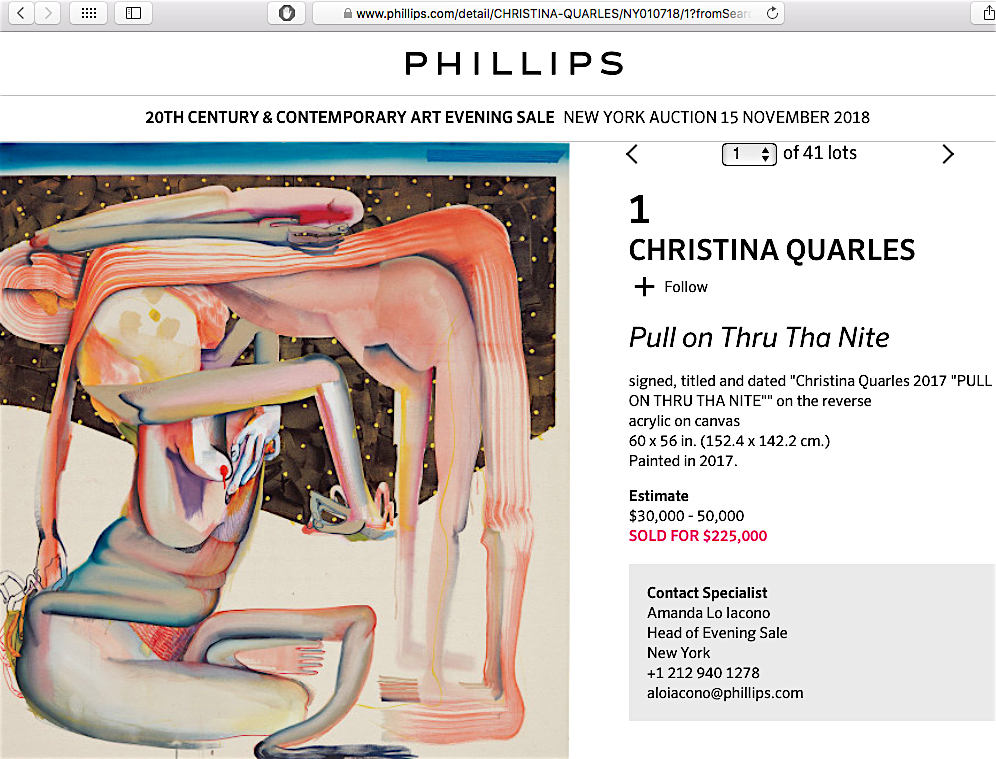

Artist Christina Quarrels (33) joins the Art Flipper speculators.

20TH CENTURY & CONTEMPORARY ART EVENING SALE

NEW YORK AUCTION 15 NOVEMBER 2018

CHRISTINA QUARLES

Pull on Thru Tha Nite

signed, titled and dated “Christina Quarles 2017 “PULL ON THRU THA NITE”” on the reverse

acrylic on canvas

60 x 56 in. (152.4 x 142.2 cm.)

Painted in 2017.

Estimate

$30,000 – 50,000

SOLD FOR $225,000

Provenance

David Castillo Gallery, Miami

Private Collection

Exhibited

Miami, David Castillo Gallery, Baby, I Want Yew To Know All Tha Folks I Am, December 4, 2017 – January 31, 2018

https://www.phillips.com/detail/CHRISTINA-QUARLES/NY010718/1

2018/12/7 up-date:

In debt we trust: the rise of art-secured lending

The rapid growth in the number of loan providers, from private banks to specialist lenders, could transform the art market’s relationship with the financial markets

The Art Newspaper, GEORGINA ADAM, 6th December 2018

…

“You will probably find that many of the US-based names in Artnews’s top 200 collectors list have borrowed against their art holdings,” Beard says.

While precise figures are difficult to obtain, according to a number of players in the market the vast bulk—in excess of 80%—of the art-secured lending business is in the US.

And it is a buoyant sector: “Our client base in the US is strong and growing,” says Suzanne Gyorgy, the head of Citi Private Bank’s Art Advisory and Finance. “Most notable is the increase in the size of the art loans. Ten to 15 years ago, typical art loan facilities were in the tens of millions; today it’s increasingly common to offer art loans facilities in the hundreds of millions.” And while the US is strong, Gyorgy says, “Business is growing dramatically in Asia and Latin America as well.”

…

She adds: “Our financing offers another option for people to monetise their offshore assets.”

…

Almost all of the firms will lend against 40% to 50% of the appraised value of the artwork; some will take possession, others not. In the US, Uniform Commercial Code (UCC) filings identify works of art with a lien against them, and in many cases this means that the borrower can continue to enjoy their artwork and not see it crated off into storage. Elsewhere in the world, where no UCC exists, lenders generally want to hold the art until the loan is paid off.

UCC filings are publicly available, and a quick browse through some of the lenders reveals a wide spread of owners who have leveraged works. The Turkish trader Yomi Rodrik, for example, has borrowed against nine works by the likes of Rudolf Stingel, Anselm Kiefer, Takashi Murakami and Jean Dubuffet from Athena Fine Art Financing, launched three years ago by Carlyle Group with $280m in funding (but now seeking a buyer). Omanut Holdings borrowed against 25 works, including Keith Haring, Mark Grotjahn and KAWS, from TPC Art Finance. Art dealers who have taken loans—among them Pace, Mitchell-Innes and Nash, Kasmin and Gagosian—can also be found in the filings.

…

However, some borrowers may be entering too enthusiastically into loan agreements. This year there have been cases of overleveraging, for example the US art dealer Anatole Shagalov, who has taken loans against art but has allegedly defaulted on some purchases. An outlier, perhaps, but the consequence of what some see as a very frothy art market.

more at, full text:

https://www.theartnewspaper.com/analysis/in-debt-we-trust-the-rise-of-art-secured-lending

up-date:

Price guarantees are common at art auctions

But their record value is distorting the art market

Economist, 2018/12/13

(quote:)

Since then they (auction houses) have moved some risk to third parties, who place an “irrevocable bid” at a predetermined price. If there is no higher bid, the guarantor wins the auction; if there is, the guarantor takes a share of the price above the agreed bid.

Guarantees mean buyers are lured by early interest in the piece. Sellers are reassured that there is no risk of a no-sale, which could depress a work’s future value. Auction houses like them, because they help snare trophy works. But they can also distort auctions. Anonymous guarantors are in a privileged position compared with other bidders in the room, who know only that there is a guarantee but not who has made it, or how much it is. If enough leave what they see as a tilted playing field, the auction ends up being a “private sale in public”, with a single bidder.

Since it may never be known if the buyer was the guarantor, and hence if the stated price was the true one, price records become blurred.

…

more, full text:

https://www.economist.com/finance-and-economics/2018/12/15/price-guarantees-are-common-at-art-auctions

朝日新聞、2019年1月24日

折々のことば

鷲田 清一 1355

市場経済のなかで生きている人間は……すべて市場で投機家としてふるまわざるをえない

岩井克人

投機家とは、自らが必要とするものを買うのでも生産するのでもなく、「短期的な値上がり益のみを目的に」売り買いする人。市場価格はそこでは「実体的な錨」を失い、あやふやな情報や噂で乱高下し、ひどく不安定になる。消費者も生産者もこれに沿って消費を計画し、仕入れや在庫調整をせざるをえず、この不安定さを免れない。経済学者の 『二十一世紀の資本主義論』から。

up-date 2022/1/21

A Turf War Between South Korea’s Galleries and Auction Houses Heats Up as a Trade Organization Warns of a ‘Collapsing’ of Market Order

…

quote:

The Korean Galleries Association first released a salvo more than two weeks ago alleging that K Auction and Seoul Auction had been violating a “gentleman’s agreement” that was reached by both sides in 2007, under which the auction houses agreed to refrain from holding certain sales that would be seen as competitive and harmful to galleries.

But the association says the houses have nonetheless been holding “excessive auctions” and consigning work directly from artists, which is against the rules.

…

quote:

In a survey conducted by the group in the second half of 2020, 70 percent of members reported that they had “experienced or heard of damage from auctions.” Their main complaints were that the houses hindered the growth of young artists through direct sales, encouraged speculation, and devalued artists, according to the statement.

The trade association’s auction will not publish the sale’s consignments, nor allow the public to view it unless invited by a member gallery.

full text:

https://news.artnet.com/market/korean-gallery-association-auction-house-2062019

Korean Galleries and Auction Houses May Finally Be Coming to an Agreement After a Long-Simmering Turf War

South Korean galleries have fought back against the auction houses’ aggressive tactics by holding their own closed-door sale.

Eileen Kinsella & Vivienne Chow, January 28, 2022

quote:

While the association’s allegations against the auction houses may be understandable, insiders of Seoul’s art world said both the galleries and the auction houses are responsible for the fall out, which will eventually hurt the local art scene, especially the career development of young, emerging artists.

Some Seoul-based art professionals, who spoke on the condition of anonymity, told Artnet News that the spat between galleries and auction houses is a reflection of an overheated market in South Korea. This comes from a surge in new buyers who have little experience in the art world and who tend to buy art from auctions.

While it is not illegal for auction houses to consign directly from artists, noted the insiders, the nature of the auction business and the frequency of the sales, both physical and online, are not conducive for artists’ career development.

At the same time, some found it “odd” for galleries to stage their own auction, especially one that is a closed-door event accessible only to members of the Galleries Association. And the question of whether galleries have themselves offered enough support for artists’ development is also debatable, the insiders noted. Some artists who couldn’t get the kind of support they needed from galleries saw collaborating with auction houses as a career boost, without realizing that it could be damaging to their market in the long-run.

Up-date 2022/6/20:

Yesterday a one-page feature about German art dealer Daniel Buchholz in the Neue Zürcher Zeitung caught my eye. Amongst his successfully practicing artists are names like veteran Eva Genzken, who taught him a lot about being an art worker in the global art industry. Besides prominent photographer Wolfgang Tillmans, Anne Imhof, who in 2017 won the Venice Golden Lion for her artistic practice in the German Pavillion, stands out with an eclectic out-put, as actually conservative oil painting (à la Gerhard Richter?) seems to be her latest “approach” in conquering the art market. (see attached pic)

Daniel Buchholz emphasised in the article, that caring of his artistic protégés includes advice, storage and the creation of an archive, as well as the maintenance of their secondary market – something through support purchases at auctions, which is rarely talked about.

Nota bene: “through support purchases at auctions”.

I have never read such a “taboo-sentence” from another art dealer in the world. In this regard, we have to give applause to Buchholz for being straight forward while showing a fine, honest attitude. One reason, why he is highly respected in the German art scene.

Quote from:

アート・バーゼル、成功への宿命 (アーティストたちによって裸にされたアート・バーゼル、さえも*) 2022年度

ART BASEL – Doomed To Succeed (ART BASEL Stripped Bare by Her Artists, Even*) 2022 version

https://art-culture.world/articles/art-basel-2022/

Up-date 2024/7/6

For my dear ART+CULTURE readers may I filter out the following quote, as it explains in detail how “flipping” art works is being practiced.

Quote:

“Philbrick had a close-knit group of friends and supporters he regularly traded with who were steadily driving up prices from one deal to the next. Often it was “secondary market” works (what car dealerships might call “pre-owned”), since galleries in various ways make it difficult to buy works of coveted “primary market” art (art that has not been previously sold, sometimes hot off the easel) by giving early access to their established collectors. These are people trusted not to flip the art and instead play along to the subtle and incremental holding game lest its value shoot up unsustainably quickly and then deflate. In practice, this often means that only insiders can reliably make money in an art market.

Sometimes you’d have to do clever things to get access. Philbrick would use a network of art advisers and proxies — even actual actors playing an art-interested version of their recognizable selves to starstruck gallerists — to buy works that might not be for sale directly to him, only to flip them.”

Full text @

MAR. 16, 2020. The Art World’s Mini-Madoff and Me Boozy nights and high-stakes art trades with Inigo Philbrick.

By Kenny Schachter

https://www.vulture.com/2020/03/inigo-philbrick-art-dealer.html

In this context, the following quote, taken from artnet news pro “Intelligence Report” Fall 2022, might be of interest, too.

Quote:

Although Oliver, 32, is far from a household name, her solo shows have all sold out and her auction sales have generated $436,504 since 2020, according to the Artnet Price Database. About a third of the 95 lots by Oliver at auction have been offered at Japan’s SBI Art Auction, dubbed by Garcia Gil “the House of Flippers.” (A representative for SBI said they were unfamiliar with this moniker, and that clients frequently refer to them as “the House of the Trendsetter.”)

“We cannot stop the flippers in Japan,” Garcia Gil recalled telling Oliver. “Instead of trying to fight them, let’s join them. I’d rather take you to a global auction. If I position you within an art movement, everyone wins.”

Art world darling, cool Kenny Schachter @ Art Basel

アート界の寵児、クール ケニー・シャクター @ アート・バーゼル

https://art-culture.world/articles/kenny-schachter/