にっぽんのアートコレクター「パチンコ王・岡田和生」 Japanese Art Collector "King of Pachinko OKADA Kazuo"

私自身の経験から、一部の日本のアートディーラーがギャンブルに資金を費やしていることを知っています。日本のギャンブル界は、一部ヤクザ、裏社会や水商売と結びついています。したがって、ギャンブル業界で勝ち組となった者たちがアートコレクターとなり、日本のアートディーラーから美術品を購入するのも当然のことでしょう。

日本の美術雑誌はこの事実を意図的に隠蔽し、日本の美術メディアは日本の賭博文化に関する報道を検閲しています。また、美術収集家である岡田和生氏に関する報道も皆無です。岡田氏は日本のパチンコ・スロットマシン製造で富を築いた人物であり、「パチンコ王」とも呼ばれています。

簡単に言えば、大都市の駅には必ずパチンコ店が立地し、そこで違法な金儲けが行われ、地方では、パチンコ店が唯一の娯楽場所になっていることも少なくありません。

簡単に言えば、日本人はギャンブルが大好きなのです。「貧者の遊び」であるパチンコが、ヤクザや朝鮮半島(北部を含む)と経済的につながりを持っていることは周知の事実であります。

2013年10月4日、岡田和生氏が収集した東洋美術・日本美術コレクションを展示するため、70億円を投じて「岡田美術館」が設立されました。コレクションは古代から近代に至る日本・中国・韓国の陶磁器を中心に、日本美術の収蔵品は主に近世・近代日本画を特色としています。

同館所蔵の主要作品の一部は、岡田氏に対する「法的判決の履行」のため、2025年11月22日にサザビーズ香港にて売却される予定であります。

From my own experience, I know that some Japanese art dealers spend their money on gambling. Japanese gambling is partly linked to the Yakuza, the Japanese underworld and ‘Mizu-shobai’. It is therefore obvious that some people on the winning side in the gambling industry also become art collectors and purchase works of art from Japanese art dealers. Japanese art magazines deliberately conceal this fact. The Japanese art media censors reports on the Japanese culture of gambling.

There are also no reports on the art collector OKADA Kazuo. Okada became rich by manufacturing Japanese Pachinko and slot machines. He is also called the ‘King of Pachinko’.

To put it bluntly, Pachinko parlours are located at every train station in large cities, from where money can be earned illegally. In rural areas, they are often the only place for entertainment.

To put it bluntly: Japanese people love gambling. It’s well known that the “poor man’s game” of Pachinko has some economic ties to the Yakuza and the Korean peninsula (including the northern part).

On October 4, 2013, the “Okada Museum of Art” was established at a cost of 7 billion yen to exhibit the Oriental and Japanese art collection assembled by OKADA Kazuo. The collection centers on ceramics from Japan, China, and Korea spanning ancient to modern times, while the Japanese art holdings primarily feature Japanese paintings from the early modern and modern periods.

Some of the major works in the museum’s collection are to be sold at Sotheby’s Hong Kong on 22 November 2025 to “satisfy a legal judgment” against Okada.

Masterpieces of Asian Art from the Okada Museum of Art

(岡田美術館所蔵 アジア美術の多くの傑作)

Live Sale 22 November 2025|10:00 HKT

Sotheby’s is honoured to present Masterpieces of Asian Art from the Okada Museum of Art, an extraordinary private collection showcasing the breadth of East Asian art, with world class masterpieces from across China, Japan and Korea’s art history. Featuring altogether 125 lots, this sale includes over 70 pieces of Chinese ceramics and works of art spanning late Shang ritual bronzes to Qing imperial porcelain, alongside more than 50 Japanese screens, paintings, and Korean ceramics. The exceptional curation of the collection was carefully guided by Kochukyo Co., Ltd, the century-old legendary Tokyo-based dealership.

Highlights of the collection include a magnificent and exceptionally rare Qianlong doucai and famille-rose ‘Eight Treasures’ vase, tianqiuping, an extremely rare and large Northern Song Ru guanyao bowl, and an exceedingly rare Ming dynasty Chenghua blue and white ‘day lily’ palace bowl—all three unquestionably rank among the rarest and most desirable of all Chinese ceramics.

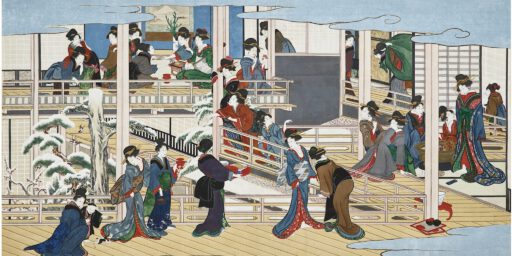

Japanese masterpieces include a pair of 16th century (Muromachi period) six-panel screens by Kano Motonobu, Birds and Flowers of the Four Seasons, and one of the most iconic images in art history, The Great Wave off the Coast of Kanagawa by Katsushika Hokusai. Adding to the richness of the collection is a 13th century (Goryeo dynasty) large slip-inlaid celadon-glazed ‘floral’ kundika vase.

Covering many of the peaks of East Asian art history, these masterpieces embody the profound creativity and cultural exchange that have shaped Asian art for over a millennium, while reflecting a timeless aesthetic that stands the test of time.

蘇富比榮幸呈獻「岡田美術館藏亞洲藝術珍品」,此非凡私人珍藏橫貫東亞藝術長河,匯聚中、日、韓三國的頂尖藝萃。全場共125件拍品,涵蓋逾70件中國陶瓷及藝術品,上起商代晚期青銅禮器,下迄清代御瓷;以及50余幅日本屏風、繪畫與高麗朝鮮陶瓷。此系列大部分藏品由東京百年傳奇古董商壺中居株式會社精心甄選而成。

焦點拍品包括一件瑰麗絕倫的清乾隆闘彩加粉彩描金纏枝蓮八吉祥紋天球瓶、一件極為珍罕的北宋汝窰天青釉洗,以及一件堪稱稀世之珍的明成化青花萱草紋宮盌,三者無疑位列中國陶瓷史上至罕至珍之作。日本藝術傑作則包含室町時代(16世紀)狩野元信《四季花鳥圖》六曲屏風一對,以及藝術史上最具標志性的圖像之一,日本江戶時代 (1831 – 1833年)葛飾北齋之《神奈川沖浪里》。更有一件高麗王朝(13世紀)青釉團嵌花紋凈瓶,為此珍藏添色。

這些藝術瑰寶跨越東亞美術史多座高峰,既體現塑造亞洲藝術千年來的深厚創造力與文化交流,亦彰顯歷久彌新的永恒美學。

Exhibition | 預展

28 October – 21 November 2025 (Viewing by appointment only 1 – 13 November)

2025年10月28日-11月21日(11月1日-13日需預約觀展)

SPECIAL NOTE

The Property has been consigned to us for sale by an agent of the court appointed receivers over the shares of Okada Fine Art Limited, pursuant to that certain court order of the High Court of Hong Kong stamped 24 October 2023, and that certain court order of the High Court of Hong Kong stamped 29 April 2025.

For assistance with bidding and registration, please contact:

bids.hongkong@sothebys.com

+852 2524 8121

For all sale enquiries please contact:

CHINESE WORKS OF ART

Nicolas Chow | Nicolas.Chow@sothebys.com | +852 2822 8128

Chairman, Asia, Chairman and Worldwide Head of Asian Art

Carrie Li | Carrie.Li@sothebys.com | +852 2822 8155

Senior Director, Asia, Deputy Chairman of Chinese Works of Art

Xibo Wang | Xibo.Wang@sothebys.com | +852 2822 5582

Director, Head of Department, Chinese Works of Art

Cristine Li | Cristine.Li@sothebys.com | +852 2822 8122

Director, Specialist, Chinese Works of Art

Rubie Fong | Rubie.Fong@sothebys.com | +852 2822 9037

Specialist, Chinese Works of Art

Keason Tang | Keason.Tang@sothebys.com | +852 2822 9027

Deputy Director, Head of Mid-Season Sales, Chinese Works of Art

Xiaoye Yang | Xiaoye.Yang@sothebys.com | +852 2822 8135

Cataloguer, Chinese Works of Art

Beijing

Sonya Wu | Sonya.Wu@sothebys.com | +86 10 5082 5873

Deputy Director, Specialist, Chinese Works of Art

Shanghai

Norbu Peng | Norbu.Peng@sothebys.com | +86 21 6288 1995

Deputy Director, Specialist, Chinese Works of Art

Taipei

Ching Yi Huang | Chingyi.Huang@sothebys.com | +886 2 2757 6689

Deputy Director, Specialist, Chinese Works of Art

Tokyo

Koji Asada | Koji.Asada@sothebys.com | + 81 3 4590 0640

Client Service Manager, Chinese Works of Art

JAPANESE WORKS OF ART

Mark Hinton | mark.hinton.consultant@sothebys.com | +44 207 293 6537

Consultant, Japanese Works of Art

Jon Adjetey | jon.adjetey.consultant@sothebys.com | +44 207 293 6325

Consultant, Japanese Works of Art

SALE NUMBER

HK1632

美の殿堂 岡田美術館

清らかな山河をめぐって20もの温泉街が集まる国際的観光地・箱根。

その一つ、小涌谷(こわくだに)温泉は、

湯本駅から芦ノ湖に通じる国道一号線の半ばに位置しています。

2013年秋、東洋の美の結晶が一堂に会する大きな美術館が、ここに誕生しました。

小涌谷は、江戸時代、小地獄と呼ばれ、噴煙上る荒野でした。

この地が生まれ変わったのは明治10年代のこと。

実業家たちによって温泉場が開かれ、風情ある旅館やホテルが建造されるようになったのです。

美術館は、明治時代に存在した欧米人向けのホテル「開化亭」の跡地(約6,300m2)に建設。

全5階から成る建物の延べ床面積は約7,700m2で、展示面積は約5,000m2にも及びます。

この広い会場に、日本・中国・韓国を中心とする古代から現代までの美術品が展示されています。

古くから日本で受け継がれてきた美術品を大切に守り、

美と出会う楽しさを分かち合い、次代に伝え遺したい、との願いから、美術館が構想されました。

そして、日本とアジアの文化を世界に発信し、広く文化の創造に貢献することを使命としています。

岡田美術館は、この箱根の地より、皆様に「楽しい!」をお届けしてまいります。

https://www.okada-museum.com/about/

A palace of fine arts Okada Museum of Arts

Hakone is an international and popular tourist destination

with as many as 20 hot spring clusters nestled among

the verdant mountains and pristine rivers. Kowakudani (Kowakidani)

hot springs are located midway between Yumoto Station and

Lake Ashinoko on the Japan National Highway Route No.1.

In autumn 2013, a great museum housing many exquisite Eastern treasures and collections opened.

In the Edo period, Kowakudani was called “small hell hole”,

in recognition of its smoking wastelands. The ten years between 1877 and 1887

were to see the start of the area’s regeneration as a hot spring spa.

A group of far-sighted entrepreneurs created a hot spring spa and resort,

complete with both elegant Japanese-style and Western-style hotels.

The Okada Museum of Art was constructed on the site of the old Kaikatei hotel built in the Meiji period for Westerners.

Covering some 6,300 m2 and with a total floor area of about 7,700 m2 ,

the Museum has an impressive exhibition space of around 5,000 m2 .

This spacious building mainly exhibits Japanese, Chinese,

and Korean works of art ranging from ancient times through to the present age.

https://www.okada-museum.com/en/about/

今日のおまけ today’s bonus:

Japan’s Okada Museum of Art is selling works from its collection because its founder, Kazuo Okada, needs to settle a $50 million legal bill that stems from his long-running feud with casino magnate Steve Wynn. Okada, an 83-year-old billionaire, is the former chairman of Tokyo-based Universal Entertainment Corp.

Decades ago, Wynn and Okada became friends and founded the Las Vegas-based hotel-casino operator Wynn Resorts together in 2002. However, relations soured a few years later when they accused one another of questionable payments to public officials in Asia. In 2012, Okada was ousted as Wynn Resorts’ vice-chairman, and the company redeemed Universal Entertainment Corp’s 20 percent stake in the business at a discount. The latter disputed the redemption amount in court, and Okada eventually prevailed in 2018, reaching an out-of-court settlement in which Wynn and Wynn Resorts agreed to pay $2.6 billion.

When Okada’s law firm, Bartlit Beck, sent him its $50 million bill, though, he claimed it was too hefty. The firm successfully pursued it in a binding court arbitration, and Okada now needs to pay.

Quote from 2018:

On the opening day of Art Basel I saw two times Steve Wynn with entourage, strolling around. The “elbow incident” with Picasso’s “Le Rêve” is a famous, precarious story about art sale.

May I hereby attach the pics & articles.

The $40-Million Elbow

By Nick Paumgarten, 2006/10/23 New Yorker

You might have seen “Le Rêve,” Picasso’s 1932 portrait of his mistress, Marie-Thérèse Walter, in your college art-history textbook. The painting is owned by Steve Wynn, the casino magnate and collector of masterpieces. He acquired it in a private sale in 2001 from an anonymous collector, who had bought it at auction in 1997 for $48.4 million. Recently, Wynn decided that he’d like to sell it, along with several other museum-quality paintings that he owns. A friend of his, the hedge-fund mogul and avid collector Steven Cohen, had coveted “Le Rêve” for years, so he and Wynn and their intermediaries worked out a deal. Cohen agreed to pay a hundred and thirty-nine million dollars for it, the highest known price ever paid for a work of art.

A few weeks ago, on a Thursday, a representative of Cohen’s came from California to inspect the painting. She removed it from the wall, took it out of its frame, and confirmed that it was in excellent shape. On Friday, she wrote her condition report, and so, according to their contract, the deal was done. All that was left was the actual exchange of money and art.

That weekend, Wynn had some friends visiting from New York—David and Mary Boies, Nora Ephron and Nick Pileggi, Louise Grunwald, and Barbara Walters. They were staying, as they often do, at his hotel and casino, the Wynn Las Vegas. As they had dinner together on Friday night, Wynn told them about the sale. “The girls said, ‘We’ve got to see it tomorrow,’ ” Wynn recalled last week. “So I said, ‘I’ll be working tomorrow. Just come on up to the office.’ ” (He had recently moved “Le Rêve” there from the hotel lobby.)

The guests came at five-thirty, and Wynn ushered them in. On the wall to his left and right were several paintings, including a Matisse, a Renoir, and “Le Rêve.” The other three walls were glass, looking out onto an enclosed garden. He began to tell the story of the Picasso’s provenance. As he talked, he had his back to the picture. He was wearing jeans and a golf shirt. Wynn suffers from an eye disease, retinitis pigmentosa, which affects his peripheral vision and therefore, occasionally, his interaction with proximate objects, and, without realizing it, he backed up a step or two as he talked. “So then I made a gesture with my right hand,” Wynn said, “and my right elbow hit the picture. It punctured the picture.” There was a distinct ripping sound. Wynn turned around and saw, on Marie-Thérèse Walter’s left forearm, in the lower-right quadrant of the painting, “a slight puncture, a two-inch tear. We all just stopped. I said, ‘I can’t believe I just did that. Oh, shit. Oh, man.’”

Wynn turned around again. He put his pinkie in the hole and observed that a flap of canvas had been pushed back. He told his guests, “Well, I’m glad I did it and not you.” He said that he’d have to call Cohen and William Acquavella, his dealer in New York, to tell them that the deal was off. Then he resumed talking about his paintings, almost, but not quite, as though he hadn’t just delivered what one of the guests would later call, in an impromptu stab at actuarial math, a “forty-million-dollar elbow.”

A few hours later, they all met for dinner, and Wynn was in a cheerful mood. “My feeling was, It’s a picture, it’s my picture, we’ll fix it. Nobody got sick or died. It’s a picture. It took Picasso five hours to paint it.” Mary Boies ordered a six-litre bottle of Bordeaux, and when it was empty she had everyone sign the label, to commemorate the calamitous afternoon. Wynn signed it “Mary, it’s all about scale—Steve.” Everyone had agreed to take what one participant called a “vow of silence.” (The vow lasted a week, until someone leaked the rudiments of the story to the Post.)

The next day, Wynn finally reached his dealer, and told him, “Bill, I think I’m going to ruin your day.” The first word out of Acquavella’s mouth was “Nooo!” Later that week, Wynn’s wife, Elaine, took the painting to New York in Wynn’s jet, where she and “Le Rêve” were met by an armored truck. Cohen met them at Acquavella’s gallery, on East Seventy-ninth Street, and he agreed that the deal was off until the full extent of the damage could be ascertained. The contract, at any rate, was void.

The painting wound up in the hands of an art restorer, who has told Wynn that when he’s done with it, in six or eight weeks, you won’t be able to tell that Wynn’s elbow passed through Marie-Thérèse Walter’s left forearm.

Last Friday, when Wynn’s alarm went off, at 7 a.m., his wife turned to him in bed and said, “I consider this whole thing to be a sign of fate. Please don’t sell the picture.” Later that morning, Wynn called Cohen and told him that he wanted to keep the painting, after all.

https://www.newyorker.com/magazine/2006/10/23/the-40-million-elbow

——

Years After The Elbow Incident, Steve Wynn Sells Picasso’s ‘Le Rêve’ For $155 Million

NPR, March 26, 2013

Steve Wynn has finally parted with “Le Rêve,” a painting of Pablo Picasso’s mistress Marie-Thérèse Walter.

Wynn sold “The Dream” to Steven Cohen, who owns the hedge fund SAC Capital, for a cool $155 million.

The Financial Times reports that SAC Capital just paid $614 million to settle accusations of insider trading. The paper adds that this private art sale could be a record.

“Christies said the highest price for a Picasso sold at auction was $106.5m, set in May 2010 when the auction house sold Picasso’s ‘Nude, Green Leaves and Bust,’ painted in 1932, the same year as ‘Le Rêve’ and also depicting Picasso’s muse Marie-Thérèse Walter,” the Times reports.

If you remember, Cohen had agreed to buy the painting for $139 million back in 2006. But as NPR explained, when the Las Vegas casino magnate and art collector was saying goodbye, “he accidentally whacked the masterpiece with his elbow, leaving a silver dollar-sized hole and scuttling the deal.”

Bloomberg reports that the restoration may well have been part of the deal.

“The restoration seems to be factored into the price,” Beverly Schreiber Jacoby, valuation specialist and president of New York-based BSJ Fine Art, told Bloomberg. “If you didn’t know that it has been damaged, you would not see it. It’s superbly restored.”

https://www.npr.org/sections/thetwo-way/2013/03/26/175412881/years-after-the-elbow-incident-steve-wynn-sells-picassos-le-r-ve-for-155-million

https://art-culture.world/reviews/art-basel-stripped-bare-by-her-artists-even/

The Story Behind The Nasty Feud Between Steve Wynn And Kazuo Okada

Feb 23, 2012

It’s been all over the news — Steve Wynn is fighting his best friend, Kazuo Okada (the man who helped him take share in Macao), for control of Wynn Casino Ltd.

Okada was Chair of Wynn Ltd and had a 20% stake in the company until this weekend. On Saturday the board moved to buy Okada out of the company at a 30% discount.

The question is, why are they so upset with each other?

We can only go on the accusations that Wynn and Okada are throwing at each other publicly (which mainly involve bribery), but since this is a 12 year-old friendship/business partnership, you can bet there are things going on behind the scenes.

Okada breathed new life into Wynn’s career in 2000 when he invested $260 million in Wynn Resorts.

They “immediately” had an affinity for one another, Okada said.

In 2006, Wynn and Okada opened their first casino together in Macau.

Combined with a second casino built a year later, Wynn Resorts now gets 70 percent of its revenue out of Macau.

In a company legal document from 2006 referenced “the spirit of friendship and cooperation that exists between” the pair.

As late as 2008, Wynn could write, “I love Kazuo Okada as much as any man that I’ve ever met in my life.”

Steve Wynn

“He’s my partner and my friend. And there is hardly anything that I won’t do for him.”

Okada has his own company Universal Entertainment Corporation. The Wynn board compliance committee started looking into their work in the Philippines around that time.

After an investigation, board eventually decided against the project in February 2011.

William Jefferson freezer cash bribes

Board member and former Nevada Governor Bob Miller told the Wall Street Journal that Okada suggested giving Philippine officials gifts to advance the project at a board meeting around that time. (From the WSJ):

Mr. Okada suggested at a board meeting that in Asia it is customary to provide gifts to officials through intermediaries, Mr. Miller said.

“It was frankly a shock to many board members to hear someone suggest that would be acceptable or even legal behavior,” Mr. Miller said.

But Okada said Wynn was bribing people too.

Casino China Macau

Okada filed a lawsuit in January alleging Wynn Resorts improper payments to a private University in Macao. The lawsuit prompted an inquiry by the SEC.

There’s more: In a memo leaked to Reuters, Wynn said Okada was directly competing with him by developing the casino in the Philippines.

Plus, since Okada owned 20% of the company, he said he planned to change the board in his favor.

A week ago, Reuters reported that Okada had also planned to nominate four Wynn Resorts director candidates. That would have given him substantial control of the board.

Note: Wynn only owns about 10% of the company.

But Wynn moved first. On Saturday, the board confronted Okada about bribing regulators in the Philippines.

They alleged that Okada paid authorities $110,000 at Wynn casinos.

“We have to make sure our reputation is pristine and our product will speak for itself,” Wynn Chief Financial Officer Matt Maddox said.

Wynn hired former FBI director Louis B. Freeh to investigate Okada’s dealings with gambling regulators in the Philippines.

The board moved to forcibly buy Okada out of the company.

Here are the terms of his buy-out (from the WSJ):

After deciding Mr. Okada was “unsuitable,” Wynn Resorts bought out his $2.77 billion stake in Wynn, in exchange for a promise to pay Mr. Okada $1.9 billion in 10 years. The payment is a 30% discount to the market value of his stake, not including the cost of the 10-year waiting period. The promissory note pays 2% annual interest.

Okada has vowed to take legal action against the board for its takeover.

Wynn does have a clause (dating back to 2002) that allows the board to vote out shareholders it considers unsuitable. It was the first casino company to adopt such a measure.

According to the Wall Street Journal, however, it is common for boards to buy shareholders out if they come under scrutiny of regulating authorities. It is uncommon for them to preempt those authorities.

Wynn is pressing on with his action against Okada, though, so expect a Vegas boxing style legal battle.

Wynn plans to produce documents alleging that Kazuo Okada may have violated the U.S. Foreign Corrupt Practices Act by bribing overseas regulators, Reuters reports.

“I’ll give you a one liner: Can you spell litigation?” said Joseph Grundfest, a professor of law and business at Stanford University and former Securities and Exchange Commissioner (from the WSJ).

Universal’s independent Governance Committee calls for greater separation from Okada family dispute

5 Mar 2025

A Governance Committee formed by Japan’s Universal Entertainment Corp (UEC) for the purpose of advising on the company’s governance structure and compliance processes has recommended greater separation from parent company Okada Holdings Ltd due to an ongoing Okada family dispute.

Reducing the impact of the major shareholder was one of seven recommendations from the Governance Committee put to UEC’s Board of Directors last week.

It states, “The dispute over the control of Okada Holdings Limited, the holding company that owns approximately 70% of UEC’s shares, has not been resolved. The dispute should be separated from the business management of UEC.”

Okada Holdings is entirely owned by the Okada family but is controlled by UEC’s Representative Director and President Tomohiro Okada thanks to his 53.27% stake, while his estranged father Kazuo Okada holds the majority of the remaining stake.

UEC decided to form the Governance Committee – comprising two non-executive directors and an external auditor – last September in an effort to avoid the sort of compliance breaches that have led to the ousting of former chairmen Kazuo Okada and Jun Fujimoto in recent years.

However, just how effective the recommendations will be remains to be seen given that one of the seven simply states, “Reduction of the Number of Lawsuits”.

UEC itself, in making the seven recommendations public, said there also appear to be “some factual errors” surrounding the assumptions of the recommendations “and the grounds for the findings are unclear”, adding that Tomohiro Okada has questioned these issues to the Governance Committee without response.

UEC said some of the recommendations are “conclusory” and “do not necessarily represent an accurate understanding of UEC’s problems” but that it takes them seriously anyway.

The other recommendations include formulation of a medium-to-long-term business plan, improved Human Resources measures such as establishment of a new HR department separate from the existing Administration Department, and establishment of a to ensure appropriate report and communication from key executives in both Japan and overseas.

UEC is a leading developer of pachinko and pachislot machines and is also the parent company of Philippine integrated resort Okada Manila.

https://asgam.com/2025/03/05/universals-independent-governance-committee-calls-for-greater-separation-from-okada-family-dispute/

Universal Entertainment: Untangling from the Okada Family Drama

March 5, 2025

Universal Entertainment Corp (UEC), the Japanese company behind the iconic Okada Manila and a major player in the pachinko industry is facing a bit of an identity crisis. Or maybe more accurately, a family drama crisis. An independent Governance Committee, tasked with cleaning up UEC’s governance structure, has called for a greater separation from parent company Okada Holdings Ltd. Why? You guessed it: the ongoing, seemingly never-ending Okada family dispute.

Okada Family Feud: A Cloud Over UEC

The heart of the issue is a power struggle within the Okada family, who own Okada Holdings. This holding company, in turn, controls roughly 70% of UEC’s shares. The battle is primarily between Kazuo Okada, the patriarch, and his son, Tomohiro Okada, who currently controls Okada Holdings through his 53.27% stake. With Kazuo holding a significant chunk of the remaining shares, it’s a recipe for ongoing conflict.

The Governance Committee is worried that this dispute is casting a shadow over UEC’s business and potentially exposing it to compliance risks. They’re saying: “Guys, sort out your family issues, but keep it away from our company.” The committee stressed, “The dispute over the control of Okada Holdings Limited…has not been resolved. The dispute should be separated from the business management of UEC.”

It’s an understandable concern, considering UEC’s history. In recent years, compliance breaches linked to the Okada family have led to the ousting of former chairmen Kazuo Okada and Jun Fujimoto. The company wants to avoid a repeat of those messy situations.

The Governance Committee’s Prescription: Five Steps to Independence

To address these concerns, the Governance Committee has laid out five key recommendations for UEC’s Board of Directors. These aren’t just vague suggestions; they’re concrete steps aimed at strengthening UEC’s governance and reducing the influence of the Okada family dispute:

1 Reduce the Impact of the Major Shareholder: This is the big one. The committee wants to minimize the influence of Okada Holdings on UEC’s day-to-day operations.

2 Formulate a Medium-to-Long-Term Business Plan: A clear and strategic business plan will help UEC stay focused on its goals, regardless of the family drama.

3 Improve Human Resources Measures: This includes creating a new HR department separate from the existing Administration Department, which should improve employee morale and efficiency.

4 Establish a Reporting System: Ensuring clear and consistent communication from key executives in both Japan and overseas is essential for transparency and accountability.

5 Reduce the Number of Lawsuits: This is a bit of a head-scratcher, but it suggests that UEC has been bogged down in legal battles, likely related to the Okada family dispute

Is Anyone Listening? UEC’s Response

So, how has UEC responded to these recommendations? It’s a bit of a mixed bag. While the company says it takes the recommendations seriously, it also raised some concerns about their accuracy.

UEC pointed out that there appear to be “some factual errors” in the recommendations and that the grounds for the findings are unclear. They also noted that Tomohiro Okada has questioned these issues without receiving a response.

It sounds like there might be some tension between the Governance Committee and UEC’s management. It remains to be seen how effectively these recommendations will be implemented.

The Future of Okada Manila

What does all this mean for Okada Manila, UEC’s integrated resort in the Philippines? The good news is that the resort seems to be operating smoothly despite the ongoing family drama. However, a stable and well-governed parent company is essential for the long-term success of any business.

If UEC can successfully implement the Governance Committee’s recommendations and distance itself from the Okada family dispute, it should create a more stable and predictable environment for Okada Manila, allowing it to focus on its core business: providing entertainment and generating revenue. The bottom line is that for Okada Manila to truly thrive, UEC needs to get its house in order. The first step is acknowledging there’s a problem and acting decisively to fix it. Whether they will, time will tell.

https://www.igamingtoday.com/universal-entertainment-untangling-from-the-okada-family-drama/