Most beloved meme of the day: GameStonk ゲームストンク

These 2 for sure pic.twitter.com/WCUtWy70cz

— The puppy of Wallstreet (@king_Ceezuss) January 29, 2021

This is the funniest video I’ve seen this week

😂😂😂😭😭😭🥴🥴🥴 pic.twitter.com/D9WxIWtx6h— MajinMaury (@iMaury2009) January 29, 2021

The Silicon Valley Start-Up That Caused Wall Street Chaos

Robinhood pitched itself to investors as the antithesis of Wall Street. It didn’t say that it also entirely relies on Wall Street. This past week, the two realities collided.

Jan. 30, 2021

Baiju Bhatt + Vladimir Tenev, Robinhood co-founders, R-office in Palo Alto

The online trading app Robinhood became a cultural phenomenon and a Silicon Valley darling with a promise to wrest the stock market away from Wall Street’s traditional gatekeepers and “let the people trade” — making it as easy to put millions of dollars at risk as it is to summon an Uber.

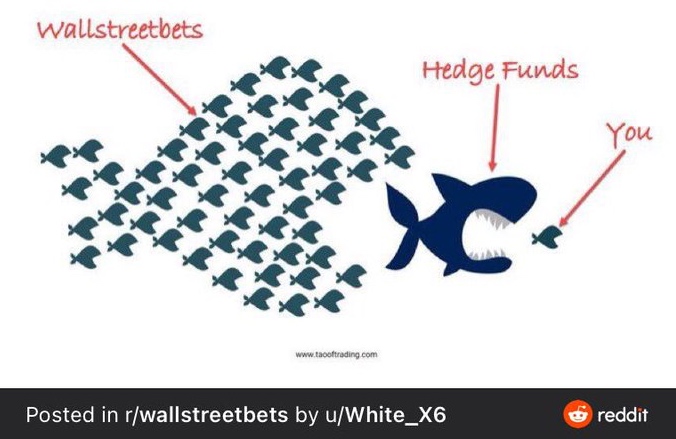

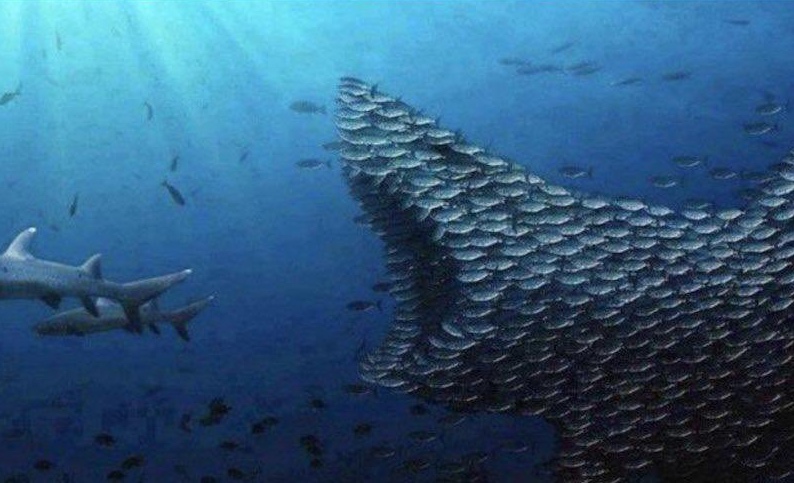

This past week, in the middle of a market frenzy pitting amateur traders against hedge fund bigwigs, that veneer began to chip. As it turned out, Robinhood was at the mercy of the very industry it had vowed to upend.

The frenzy morphed into a crisis when legions of armchair investors on Robinhood, who had been buying up options and shares of GameStop, a video game retailer, enlarged those bets and also began making big trades in other stocks, including AMC Entertainment.

As the trading mania grew, the financial system’s risk reduction mechanisms — managed by obscure entities at the center of the stock market called clearinghouses — kicked in on Thursday, forcing Robinhood to find emergency cash to continue to be able to trade. It had to stop customers from buying a number of heavily traded stocks and draw on a more than $500 million bank line of credit. On Thursday night, the company also took an emergency infusion of more than $1 billion from its existing investors.

A high-flying start-up suddenly looked a lot like an overwhelmed, creaky company.

“From a marketing standpoint they position themselves as new, innovative, cool,” said Peter Weiler, the co-chief executive of the brokerage and trading firm Abel Noser. “What I think everyone is missing is, when you peel the onion back they are just a heavily regulated business.”

Robinhood’s distress follows a familiar narrative: A Silicon Valley company that promised to disrupt an industry ends up being overcome by the forces it unleashed and has to be reined in by regulators, or in this case, the industry it promised to change. Its arc is not all that different from Facebook and Google, which changed the ways in which billions of people socialize and search for information, but are now caught in the cross hairs of lawmakers and an angry public.

“They were trying to change the rules of the road without understanding how the road was paved and without any respect for the existing guard rails,” said Chris Nagy, a former trading executive at TD Ameritrade and the co-founder of the Healthy Markets Association, a nonprofit that seeks to educate market participants. “It ended up creating risk for their customers and systemic risk for the market more broadly.”

The fiasco will almost certainly have consequences for the company. The Securities and Exchange Commission said on Friday that it would closely review any actions that may “disadvantage investors or otherwise unduly inhibit their ability to trade certain securities.” Lawmakers on both sides of the aisle called for hearings over complaints that customers were shut out of trades.

After Robinhood limited some trading on Thursday and the price of the stock plunged, furious users flooded online app stores with vitriolic reviews, with some accusing Robinhood of doing the bidding of Wall Street. Others sued the company for the losses they sustained. Robinhood’s continuing vulnerability, even after raising $1 billion, became clear on Friday when it restricted trading in more than 50 stocks.

“It was not because we wanted to stop people from buying these stocks,” Robinhood said in a blog post on Friday night. Rather, the start-up said, it restricted buying in volatile stocks so that it could “comfortably” meet deposit requirements imposed by its clearinghouses, which it noted had increased tenfold during the week.

Dealbook: An examination of the major business and policy headlines and the power brokers who shape them.

None of this seems to be slowing down its growth. Even as Robinhood’s actions angered existing customers, it was winning new ones. The app was downloaded more than 177,000 times on Thursday, twice the daily download rate over the previous week, according to Apptopia, a data provider, and it had 2.7 million daily active users on its mobile app that day, its highest ever. That’s more than its rivals — Schwab, TD Ameritrade, E*Trade, Fidelity and Webull — combined.

All Growth, Few Guardrails

Controversy is not new for Robinhood.

The two Stanford classmates who created the company in 2013 said from the beginning that their focus was on “democratizing finance” by making trading available to anyone. To do so, the Menlo Park, Calif., company has repeatedly employed a classic Silicon Valley formula of user-friendly software, brash marketing and a disregard for existing rules and institutions.

Online brokers had traditionally charged around $10 for every trade, but Robinhood said that customers of its phone app could trade for free. The move drew in hordes of young investors.

In building its business, the company disregarded academic research showing how frequent, frictionless trading generally does not lead to good financial outcomes for investors. The risks to customers became clear last summer when a 20-year-old college student’s suicide note blamed a six-figure trading loss for his death.

Robinhood also popularized options trading among novices. An option is generally cheaper than buying a stock outright, but has the potential to lead to much bigger and faster gains and losses, which is why regulators and brokers have traditionally restricted trading in these financial contracts to more sophisticated traders.

Robinhood’s marketing, meanwhile, papered over the fact that its business model, and the free trading, were paid for by selling customer’s orders to Wall Street firms in a system known as “payment for order flow.” Big trading firms like Citadel Securities and Virtu Financial give Robinhood a small fee each time they buy or sell for its customers, typically a fraction of a penny per share. These trading firms make money, in turn, by pocketing the difference, known as the “spread,” between the buy and sell price on any given stock trade, and the more trades they handle, the greater their potential revenue. Many other online brokers rely on a similar system, but Robinhood has negotiated to collect significantly more for each trade than other online brokers, The Times has found.

The mismatch between Robinhood’s marketing and the underlying mechanics led to a $65 million fine from the S.E.C. last month. The agency said that Robinhood had misled customers about how it was paid by Wall Street firms for passing along customer trades.

Robinhood has also run afoul of regulators as it rushed to release new products. In December 2018, the company said it would offer a checking and savings account that would be insured by the Securities Investor Protection Corporation, or S.I.P.C., which protects investors when a brokerage firm fails.

But S.I.P.C.’s then-chief executive said he hadn’t heard about Robinhood’s plan, and he pointed out that the S.I.P.C. doesn’t protect plain-vanilla savings accounts — that would be the job of the Federal Deposit Insurance Corporation. It took almost a year for Robinhood to reintroduce the product, saying in a blog post that it “made mistakes” with its earlier announcement.

“They went in trying to make big splashes and they often had to get reeled back in,” said Scott Smith, a brokerage analyst at the financial firm Cerulli Associates.

The Clash With Wall Street

Robinhood’s ambitions and amateurism collided in recent weeks as small investors, many of them on a mission to challenge the dominance of Wall Street, used its free trades to push up the stock of GameStop and other companies. Rampant speculation on options contracts helped drive the rise of GameStop’s shares from about $20 on Jan. 12 to nearly $500 on Thursday — a rally that forced Robinhood to hit the brakes on its own customers.

One institution that tripped up Robinhood this past week is a clearinghouse called the Depository Trust & Clearing Corporation. Owned by its member financial institutions including Robinhood, the D.T.C.C. clears and settles most stock trading, essentially making sure that the money and the shares end up in the right hands. (Options trades are cleared by another entity.)

But the D.T.C.C.’s role is more than just clerical. Clearinghouses are supposed to help insulate a particular market from extreme risks, by making sure that if a single financial player goes broke, it doesn’t create contagion. To do its job, the D.T.C.C. requires its members to keep a cushion of cash that can be put toward stabilizing the system if needed. And when stocks are swinging wildly or there’s a flurry of trading, the size of the cushion it demands from each member — known as a margin call — can grow on short notice.

That’s what happened on Thursday morning. The D.T.C.C. notified its member firms that the total cushion, which was then $26 billion, needed to grow to $33.5 billion — within hours. Because Robinhood customers were responsible for so much trading, Robinhood was responsible for footing a significant portion of the bill.

The D.T.C.C.’s demand is not negotiable. A firm that can’t meet its margin call is effectively out of the stock trading business because D.T.C.C. won’t clear its trades any more. “If you can’t clear a trade, you can’t trade a trade,” said Robert Greifeld, the former chief executive of Nasdaq and current chairman of Virtu Financial. “You’re off the island. You’re banished.”

For veteran players like Citadel Securities and JPMorgan Chase, generating additional hundreds of millions of dollars on short notice was not a problem. But for a start-up like Robinhood, it was a mad scramble.

While it cobbled together the needed cash from its credit line and investors, Robinhood limited customers from buying GameStop, AMC and other shares. Allowing its investors to sell these volatile stocks — but not buy them — reduced its risk level and helped it meet requirements for additional cash, Robinhood said in its blog post.

Ultimately, the company succeeded in pulling together roughly $1 billion from some of its existing investors, including the venture firms Sequoia Capital and Ribbit Capital. As a sweetener, Robinhood issued special shares to those investors that will give them a better deal when the company goes public, as early as this year.

But the quick deal left more than one observer scratching their heads.

“How does an online broker find itself in need of an overnight infusion of a billion dollars?” asked Roger McNamee, a longtime investor who co-founded the private-equity firm Elevation Partners. “There’s something about this that says somebody is really scared about what’s going on.”

https://www.nytimes.com/2021/01/30/business/robinhood-wall-street-gamestop.html

Melvin Capital ends month with over $8 billion in assets after investors added cash: source

BOSTON (Reuters) – Melvin Capital, the hedge fund at the center of the GameStop drama, lost 53% in January but received commitments for fresh cash from investors in the last days of the month, a source familiar with the fund said on Sunday.

Melvin ended January with more than $8 billion in assets after having started the year with roughly $12.5 billion, the source said.

…

Hedge funds Point72 Asset Management and Citadel gave a $2.75 billion capital infusion to Melvin Capital earlier in the week, enabling it to close out that position with a large loss.

Citadel’s hedge funds, along with founder Ken Griffin and firm partners, put $2 billion into Melvin. The funds lost less than 1% in January on their Melvin position and are down 3% overall for the month, a person familiar with the matter said on Sunday.

アップデート

Steve Cohen’s Point72 Raises $1.5 Billion After Melvin Capital Infusion

(Bloomberg) — Steve Cohen’s Point72 Asset Management has opened to new cash and raised more than $1.5 billion in commitments in a matter of days, according to people familiar with the matter.

The move comes after the hedge fund provided $750 million in emergency cash to Gabe Plotkin’s Melvin Capital, which was struggling with GameStop Corp. and other short bets gone sour. Citadel’s hedge funds, along with founder Ken Griffin and his firm’s partners, put $2 billion into Melvin. By the end of last month, Melvin sunk 53% after retail investors banded together online to push up the prices of GameStop and other popular targets of short-sellers.

Point72 is raising the fresh cash because it sees investment opportunities in the market, one of the people said, asking not to be identified because the information isn’t public. The firm had about $18.9 billion in assets as of October.

The hedge fund fell about 9% in January, the people said. Before its recent cash injection, Point72 had about $1 billion invested in Melvin. A spokeswoman for the Stamford, Connecticut-based firm declined to comment.

Point72 has suffered a nearly 15% loss this year due to the sudden surge in shares of GameStop, the New York Times reported last week.

と-1963年生まれ、カルチュア・エンタテインメントの中西一雄社長-2024年の写真-512x256.jpg)