前澤友作、今日、「アートは自由だ。」 Yusaku Maezawa today’s Twitter posting “Art is liberty.”

MAEZAWA Yusaku 前澤友作 seems to be a free man of choice. He even has the guts to show the middle finger (aka famous マウリツィオ・カテラン Maurizio Cattelan’s work in front of Milan’s stock exchange) to his banks, namely, UBS ユービーエス グループ from Switzerland and ART BASEL アート・バーゼル sponsor (famous for illegally laundering money)

UBS Hit With Record Penalty After Money-Laundering Conviction

Bloomberg, February 20, 2019

A French judge has handed UBS Group AG a fine and damages of 4.5 billion euros ($5.1 billion), the largest penalty ever meted out to a Swiss bank, after it was found guilty of helping conceal its French clients’ assets.

https://www.bloomberg.com/news/articles/2019-02-20/switzerland-s-greatest-hits-a-brief-history-of-swiss-bank-fines

and Japanese NOMURA HOLDINGS 野村ホールディングス, which is deep in the red because of mismanagement.

Nomura suffers biggest loss in a decade, hit by big write-off

CNBC JAN 31 2019

https://www.cnbc.com/2019/01/31/nomura-suffers-biggest-loss-in-a-decade-hit-by-big-write-off.html

Other banks like conservative Japanese MIZUHO FINANCIAL Group みずほフィナンシャルグループ (A mega bank which encourages nuclear power through TEPCO (Tokyo Electric Power Co. = responsible for lying to the public about / covering up the “Fukushima” nuke melt down) as one of its top 10 major shareholders)

https://www4.tepco.co.jp/en/corpinfo/illustrated/accounting/major-shareholders-e.html

and Swiss Julius Baer Group ジュリアスベア銀行 (also famous for money laundering)

Former Julius Baer Executive Pleads Guilty to Money Laundering,AUG 22, 2018

https://www.swissinfo.ch/eng/former-julius-baer-executive-pleads-guilty-to-money-laundering/44344632

are scared to loose all the money they lent to Mr. Maezawa, too.

Maezawa, who owns 36 percent of ZOZO’s outstanding shares (which lost 50% of their value in one year), according to data compiled by Bloomberg, has steadily increased the amount of his stock holdings pledged as collateral in loan agreements to the banks mentioned above. The ratio was 88 percent in February, according to regulatory filings with the nation’s financial watchdog.

The coming months will be fun to watch. Maezawa cashes in some private money through his (not very convincing) art collection, because he actually is forced to do it.

https://twitter.com/yousuck2020/status/1124563586850836480

SOTHEBY’S CONTEMPORARY ART EVENING AUCTION

16 MAY 2019 | 7:00 PM EDT

NEW YORK

Andy Warhol

FLOWERS

Estimate 1,500,000 — 2,000,000 USD

signed and dated 64 on the overlap

acrylic and silkscreen ink on canvas

24 by 24 in. 61 by 61 cm.

up-date:

LOT SOLD. 5,674,250 USD

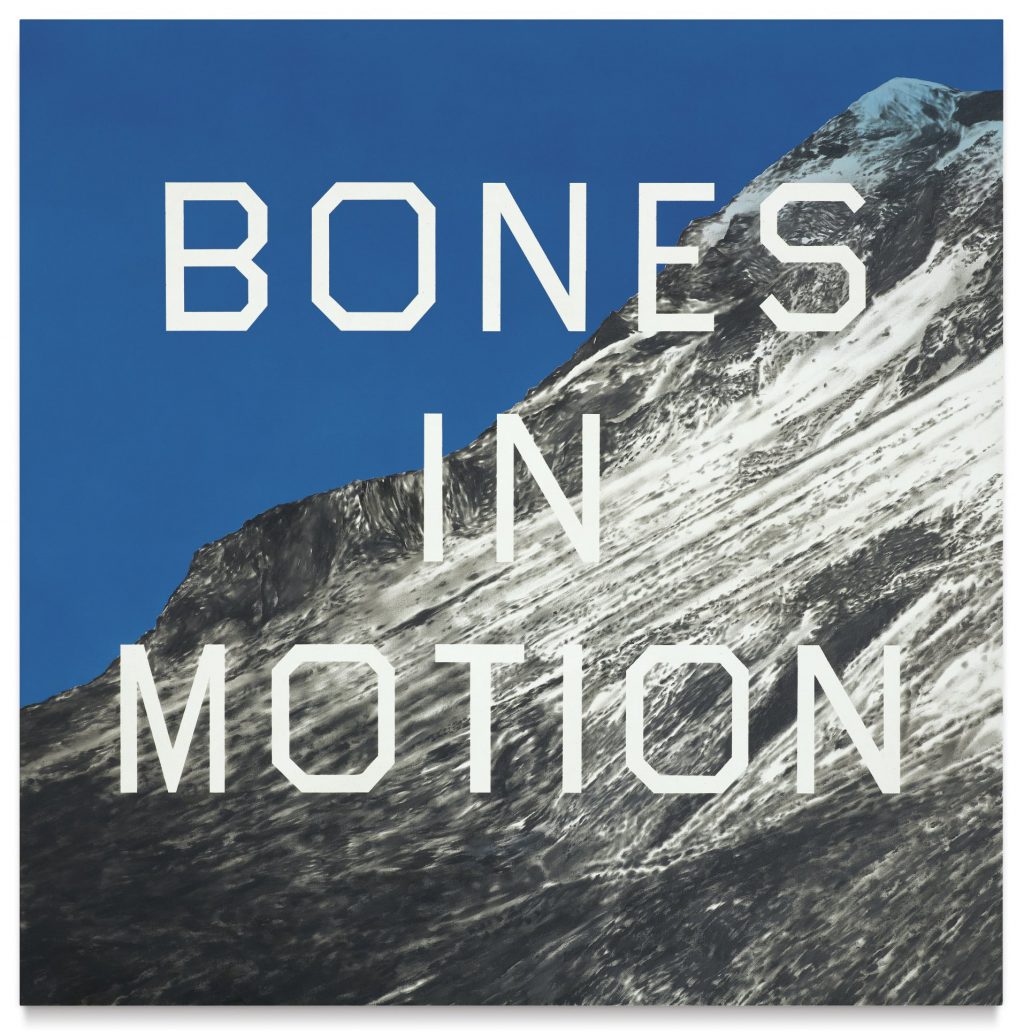

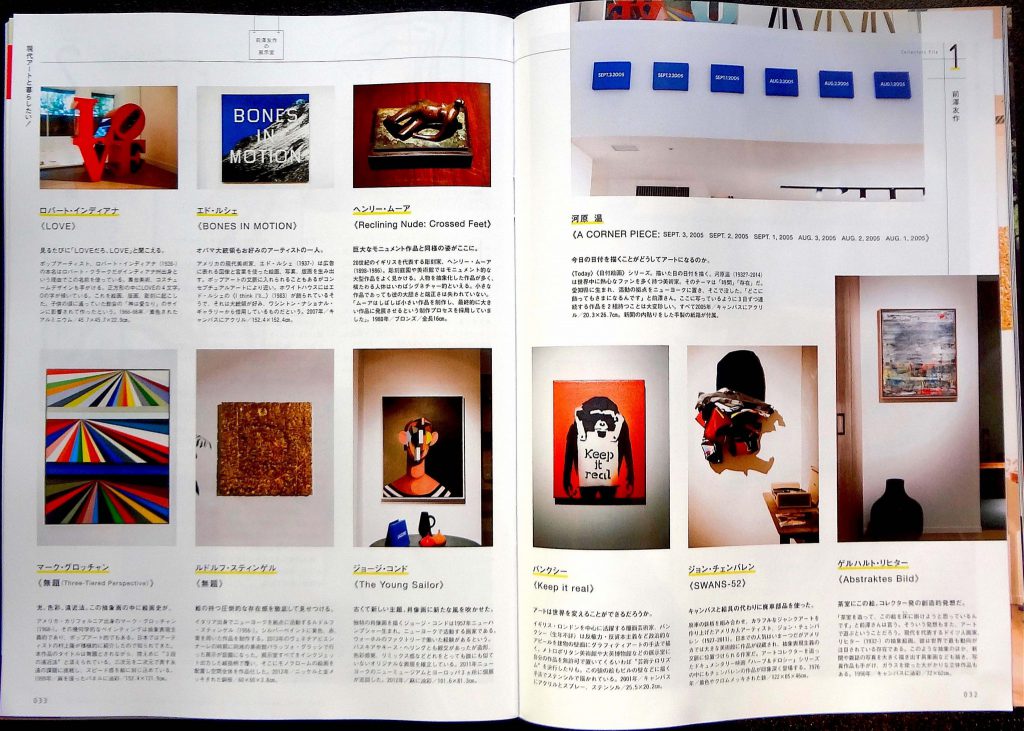

Ed Ruscha

BONES IN MOTION

Estimate 2,000,000 — 3,000,000 USD

signed and dated 2007 on the reverse

acrylic on canvas

60 by 60 in. 152.4 by 152.4 cm.

up-date:

LOT SOLD. 2,420,000 USD

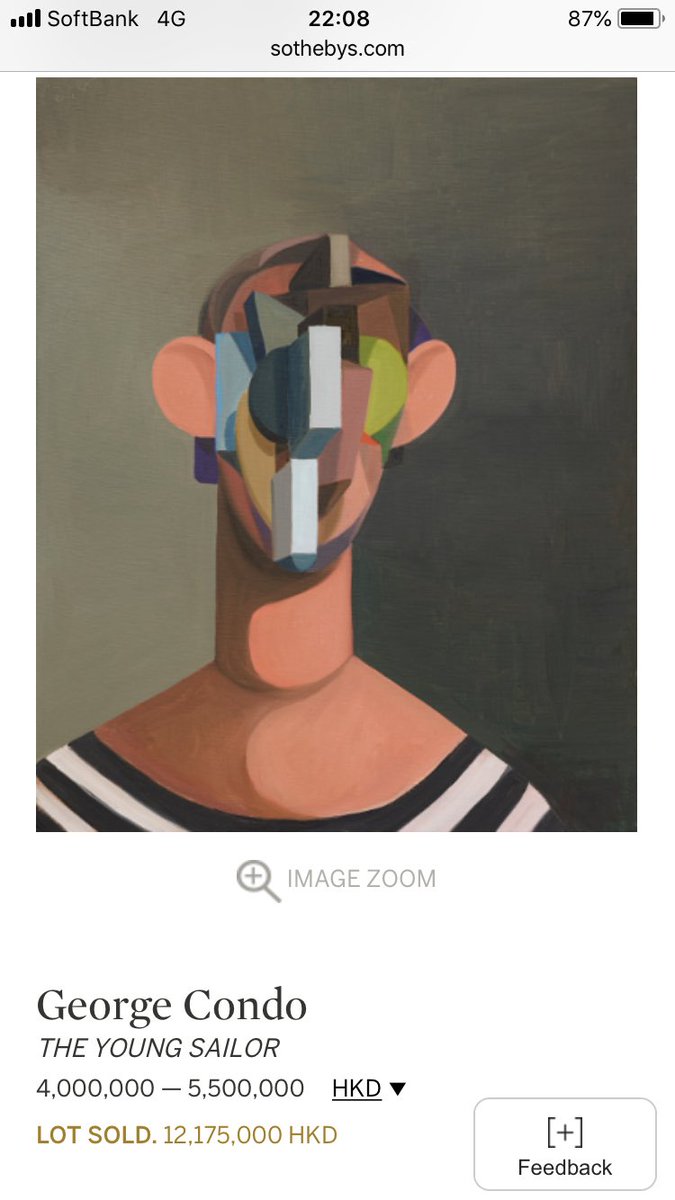

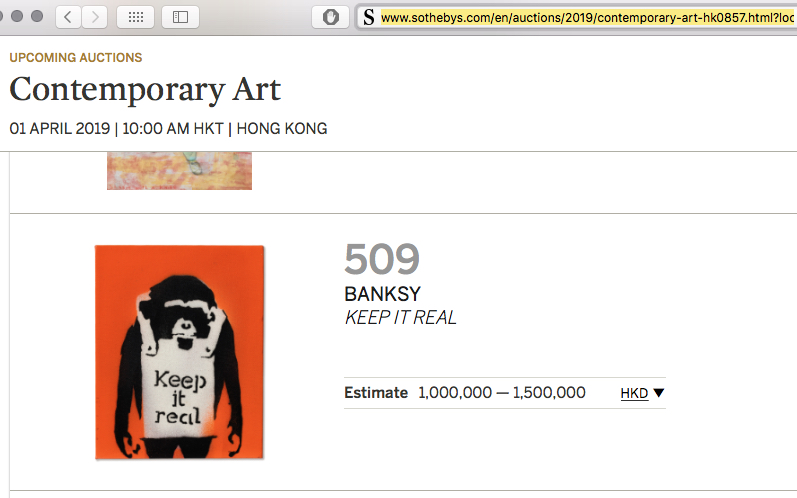

Contemporary Art Evening Sale, Sotheby’s Hongkong, 1 April 2019

MAEZAWA Yusaku collection George Condo “The Young Sailor” 2012

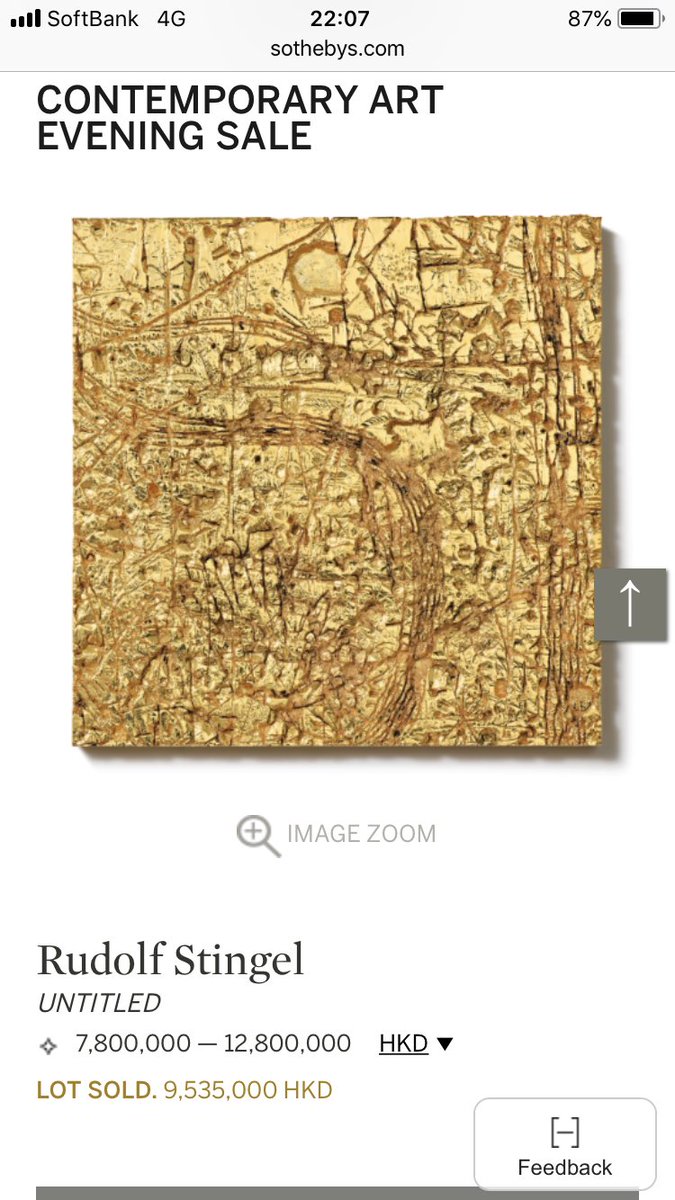

Contemporary Art Evening Sale, Sotheby’s Hongkong, 1 April 2019

MAEZAWA Yusaku collection Rudolf Stingel work

http://www.sothebys.com/en/auctions/2019/contemporary-art-hk0857.html?locale=en

If he succeeds in turning around his company ZOZO Inc. 株式会社ZOZO,

https://corp.zozo.com/ir-info/

he will have the last laugh.

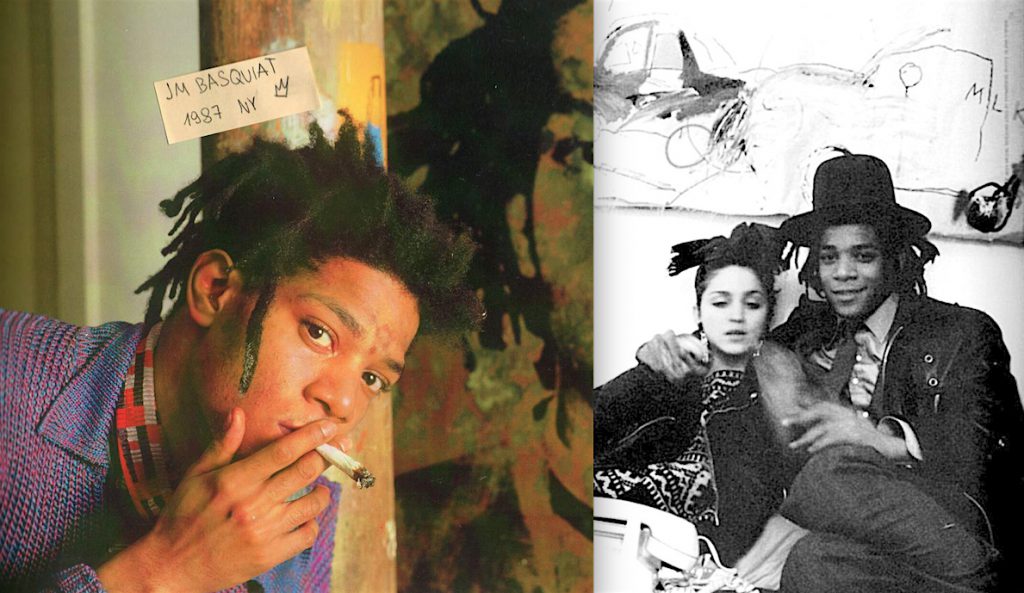

I feel obviously entertained by his artistic practice, laissez-faire attitude in public for quite a long time. Life goes on, with and without money. Enjoy your art as much as possible you can, Maezawa-san. Probably you had much fun in doing some kind of art dealing (antique Japanese pottery?) with Japanese global art star MURAKAMI Takashi 村上隆, too.

日本のアート界を駄目にした男? 不幸な村上隆、、、

The Man Who Ruined The Japanese Art World? An Unhappy MURAKAMI Takashi…

https://art-culture.world/articles/takashi-murakami-kaikai-kiki-japanese-art-world/

Yusaku Maezawa (MZ) 前澤友作 @yousuck2020

村上隆さん。会社見学、物流センター見学からのお食事。楽しかった。

11:34 PM – 8 Dec 2016

https://twitter.com/yousuck2020/status/806869602785333249

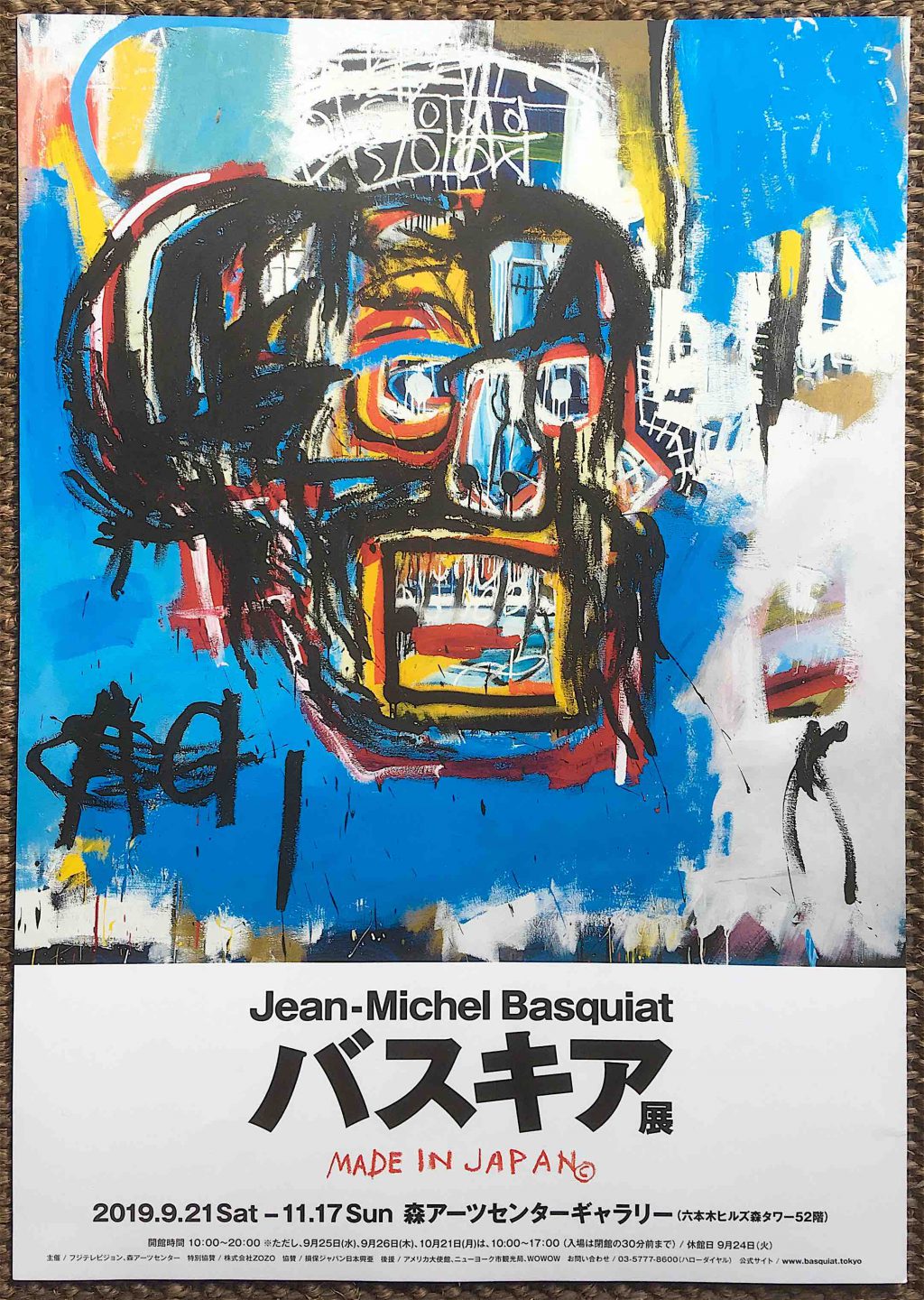

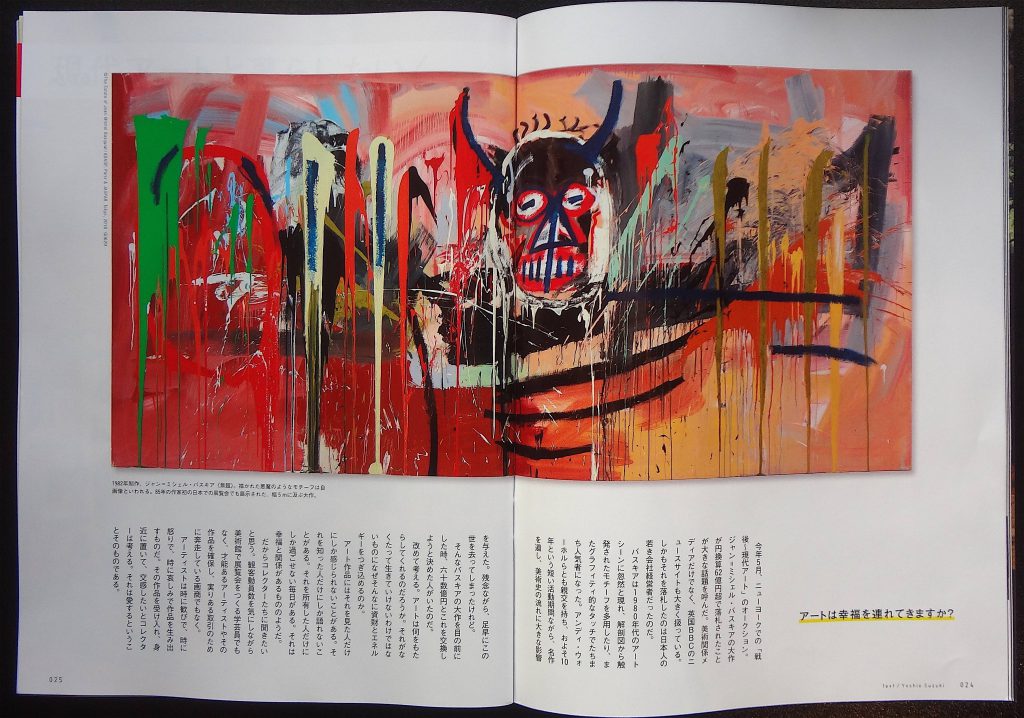

The Mori Arts Center Gallery 森アーツセンターギャラリー, belonging to the Mori Museum 森美術館 (which also has no sufficient money for a serious, historical, cutting edge art collection), is waiting for your two Basquiats, to cash in some money, too.

Let’s see, if Mr. Maezawa will sell his Basquiats just right after the exhibition at the Mori Arts Center Gallery. That would be scandalous, not only in the context of the global art world, but also for the “Japanese Council of Art Museums” 全国美術館会議

http://www.zenbi.jp

and for the “International Council of Museums” (ICOM) 国際博物館会議

https://icom.museum/en/, too.

Tokyo, 令和元年 Japanese Imperial Era Reiwa 1, May 8th

Mario A

https://twitter.com/yousuck2020/status/1125880298284052481

https://www.artagenda.jp/exhibition/detail/3508

https://macg.roppongihills.com/en/news/keyword/cat6/index.html

https://bijutsutecho.com/magazine/news/exhibition/19613

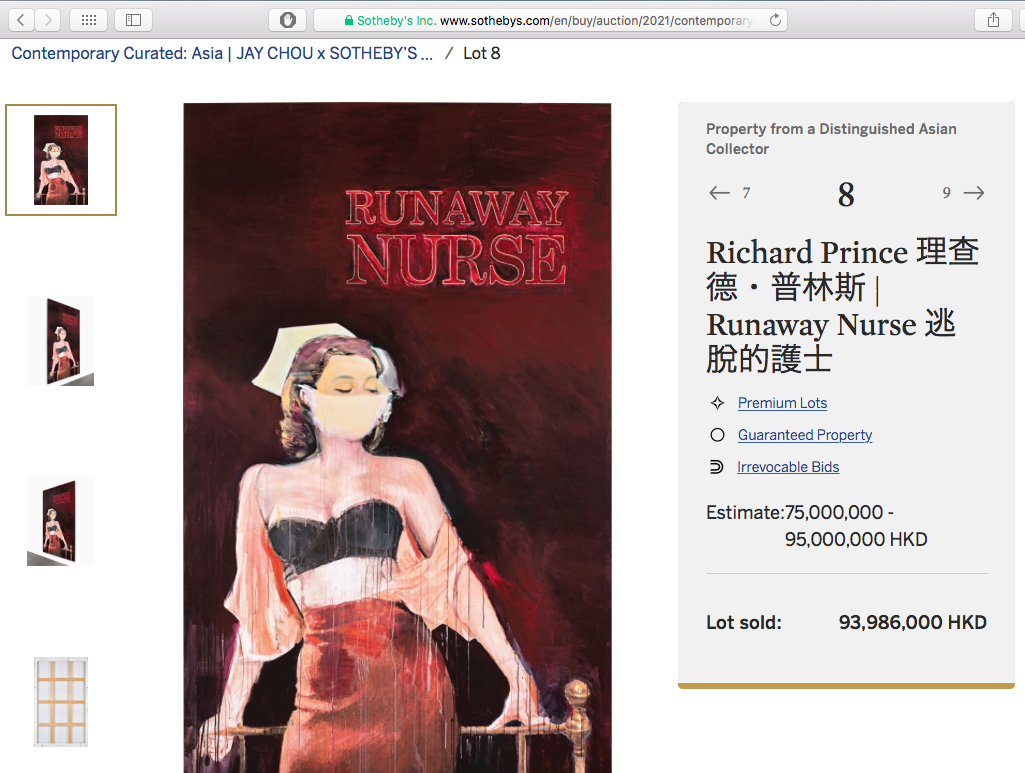

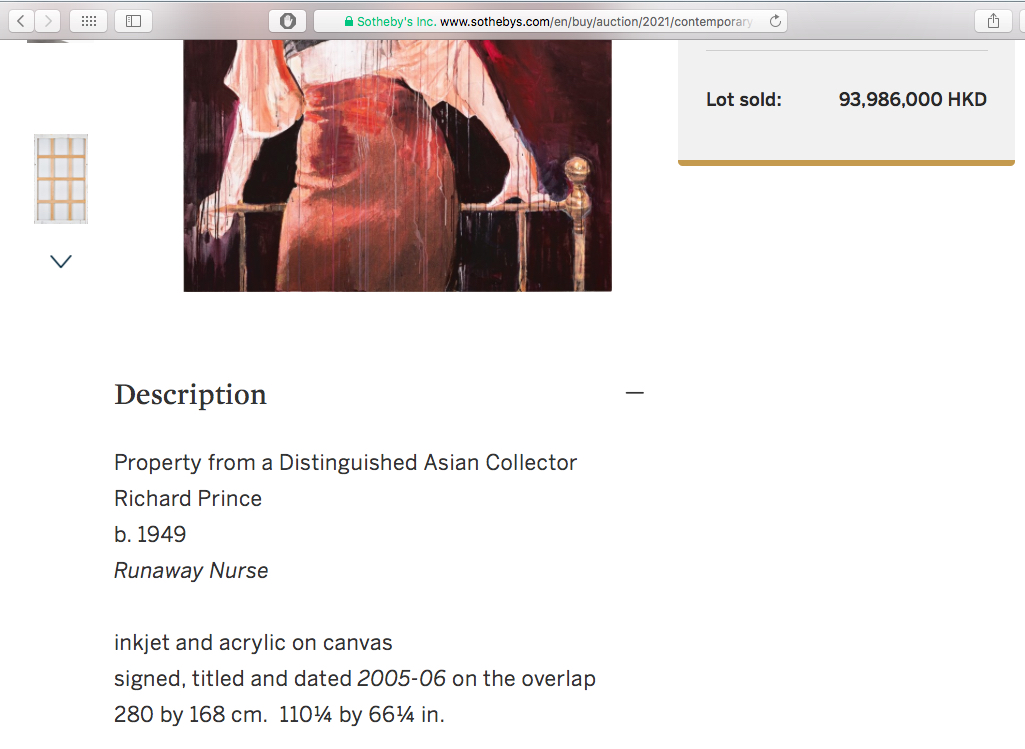

up-date: Prince work sold in June 2021, see:

Sotheby’s Harsh Reshuffle: After Amy Cappellazzo and Kevin Ching, Next Prominent Figure TERASE Yuki Bites the Dust

サザビーズのコンテンポラリーアート部門アジア地区部長・寺瀬由紀氏を巡って

https://art-culture.world/articles/terase-yuki-寺瀬由紀/

Compare my former entries:

前澤友作コレクションですが、これで終わりか?

Is this the end of the ‘MAEZAWA Yusaku Collection’?

https://art-culture.world/articles/end-of-the-maezawa-yusaku-collection/

サザビーズとクリスティーズのオークションに夢中になっている前澤友作

MAEZAWA Yusaku, crazy about auctions at Sotheby’s and Christie’s

https://art-culture.world/articles/maezawa-yusaku-crazy-about-auctions-at-sothebys-and-christies/

前澤友作の米国アーティスト・ダーリン、マーク・グロッチャンの作品:クリスティーズのロンドン・オークションで下落

MAEZAWA Yusaku’s American Artist Darling Mark Grotjahn @ Christie’s London & Lévy Gorvy : Sharp Depreciation

https://art-culture.world/articles/maezawa-yusaku-mark-grotjahn-christies/

ARTnews の「トップ200コレクターズ」」2018

THE TOP 200 COLLECTORS (ARTnews 2018)

https://art-culture.world/articles/the-top-200-collectors-artnews-2018/

野村ホールディングスが、東京ではなく中国の上海で「賞金100万米国ドル(約1億1000万円)の野村アートアワード」をアピール

Nomura Holdings appeals with a ‘US$ 1 Million Nomura Art Award’ not in Tokyo but in China’s Shanghai

https://art-culture.world/articles/nomura-art-award-nomura-holdings/

up-date, as a reference:

‘Portuguese Saatchi’ in hot water over alleged €1bn debt

30th May 2019

The vast modern and contemporary art collection of José “Joe” Berardo, the Madeira-born collector once dubbed the “Portuguese Saatchi”, is at stake after three Portuguese banks filed a lawsuit to recover debts from the businessman totalling almost €1bn.

Berardo’s 900-strong collection—comprising major works by Pablo Picasso, Nan Goldin and Francis Bacon—is on show at the Centro Cultural de Belém in Lisbon as part of a private-public partnership with the Portuguese government. It is one of the most visited museums in Portugal.

In April, three banks filed a lawsuit to recover debts from the entrepreneur totalling €962m. The banks—Caixa Geral de Depósitos (CGD), Novo Banco and BCP—had previously tried to seize a portion of Berardo’s collection after he allegedly defaulted on repayments.

The recent controversy prompted the Portuguese parliament to hold an inquiry that involved summoning Berardo to an open question session. In the hearing on 10 May, the businessman insisted that he “has no debts” and stressed that his only capital asset is a garage in Funchal, Madeira. His comments enflamed the Portuguese Prime Minister António Costa who was “shocked” by the entrepreneur’s attitude, according to local reports.

Berardo, who is the chairman of the holding company Metalgest, began taking out loans in the late 2000s; the bank CGD lent the entrepreneur around €400m (€350m to the José Berardo Foundation and €50m to Metalgest).

The three banks began legal proceedings in 2017 in a bid to seize 75% of Berardo’s collection, which was pledged as collateral. The art holdings are owned and managed by a company known as the Berardo Collection Association.

After the proceedings stalled, all parties tried to reach an agreement in January but the negotiations broke down. The latest lawsuit filed in April seeking €962m names José Berardo and three associated companies: the José Berardo Foundation, Metalgest—Sociedade de Gestão, Sgps, SA and Moagens Associadas, SA. “The legal strategy is to prove that Berardo is the beneficiary of the associated companies [and therefore liable],” according to the local news website Expatica. It is unclear if the banks will pursue Berardo’s collection under the new lawsuit.

Berardo’s lawyer, André Gomes, did not respond to requests for comment. CGD also declined to comment. A spokesman for BCP says that the bank does not comment on matters involving customer relationships.

Meanwhile, the Portuguese state is tied up in a deal with Berardo over his collection. In 2006, the businessman signed an agreement with the Portuguese government to loan art from his collection on a long-term basis to the Belém Cultural Center in Lisbon; the section of the building housing the works is known as the Museu Coleção Berardo, one of the most visited museums in Portugal.

The deal was renewed in 2017 giving the Portuguese government the option to purchase works from the collection until the agreements ends in late 2022. “While this contract is still in force, the Berardo Collection Association may not sell cultural goods,” the Portuguese Ministry of Culture says in a statement. The government subsequently pays a subsidy to the Berardo Foundation, which goes towards operational expenses at the Museu Coleção Berardo. The culture ministry declined to comment further.

https://www.theartnewspaper.com/news/portuguese-saatchi-in-hot-water-over-alleged-eur1bn-debt

2019/9/11 up-date:

Yahoo Japan to buy Zozo for 400 bil. yen, Maezawa steps down

September 12, 2019

Yahoo Japan Corp. said Thursday it will make online fashion retailer Zozo Inc. a subsidiary for about 400 billion yen ($3.7 billion) in a friendly takeover.

The operator of the Zozotown clothing store said it has appointed Kotaro Sawada as chief executive officer to replace Yusaku Maezawa, a charismatic entrepreneur who chose to step down.

The acquisition comes with Yahoo intending to make online sales a part of its growth strategy, allowing it to nip at the heels of U.S. giant Amazon.com Inc. and Japan’s Rakuten Inc.

Yahoo’s online sales are expected to surpass 2.6 trillion yen after taking a stake in Zozo.

Yahoo will start a takeover bid at 2,620 yen per share as early as early October, while setting a 50.1 percent cap on the purchase of shares in Zozo. Maezawa has agreed to sell a 30 percent stake in the company, leaving him holding 7 percent of Zozo.

“I will take a new path, leaving Zozo to a new president,” he said in a tweet.

The announcement pushed the share price of the online apparel retailer up 15.1 percent at the end of Thursday morning trading at 2,492 yen on the Tokyo Stock Exchange.

Maezawa, considered an unconventional entrepreneur, is set to become in 2023 the first person to travel to the Moon since the Apollo program ended in 1972.

He is booked to be the first private passenger to orbit the Moon in a Big Falcon Rocket spaceship being developed by Space X, the space transportation firm of U.S. tech billionaire Elon Musk.

Maezawa established Start Today, the precursor of Zozo, in 1998 and changed the company name last October. It posted a group net profit of 15.99 billion yen on sales of 118.4 billion yen in fiscal 2018 that ended March.

2019/9/21 up-date:

ZOZO前澤氏「どうしても宇宙に行きたい」–涙ながらに語った退任への思い

山川晶之 (編集部)2019年09月12日 21時56分

https://japan.cnet.com/article/35142623/

2019/11/18 up-date:

ヤフー ZOZOの株式買い付け終了 子会社に

2019年11月14日 12時40分

…

quote:

その結果が14日公表され、Zホールディングスは、ZOZOの株式の50.1%を取得し、13日付けで子会社化したということです。株式の取得金額は4007億円余りでした。

このTOBでは、ZOZOの創業者で、今回の買収を機に社長を退いた前澤友作前社長も一定の株式の売却に応じ、前澤氏の保有比率は、それまでの36%余りから、17%余りに下がりました。

Zホールディングスは、ネット通販の分野で国内トップを目指すという目標を掲げていて、ZOZOの買収で若い世代の利用者を取り込み、ライバルのアマゾンや楽天に追いつきたい考えです。

https://www3.nhk.or.jp/news/html/20191114/k10012177171000.html

ここに載せた写真とスクリーンショットは、すべて「好意によりクリエーティブ・コモン・センス」の文脈で、日本美術史の記録の為に発表致します。

Creative Commons Attribution Noncommercial-NoDerivative Works

photos: cccs courtesy creative common sense

2024/6/1 up-date:

Japanese billionaire Maezawa ‘dearMoon’ mission cancels moon flyby

Statement says decision was unavoidable, without providing details

TOKYO (Reuters) — Japanese billionaire Yusaku Maezawa has cancelled his “dearMoon” mission, which the project said was to have been the first private flight around the moon, the mission announced on Saturday.

The team had originally aimed to make the circumlunar flight, with celebrities on board, by the end of last year but that became “unfeasible,” the mission said in a statement on its website.

“Without clear schedule certainty in the near-term, it is with a heavy heart that Maezawa made the unavoidable decision to cancel the project,” it said. “To all who have supported this project and looked forward to this endeavor, we sincerely appreciate it and apologize for this outcome.”

The statement did not give further details on the cause of the cancellation.

https://asia.nikkei.com/Business/Aerospace-Defense-Industries/Japanese-billionaire-Maezawa-dearMoon-mission-cancels-moon-flyby